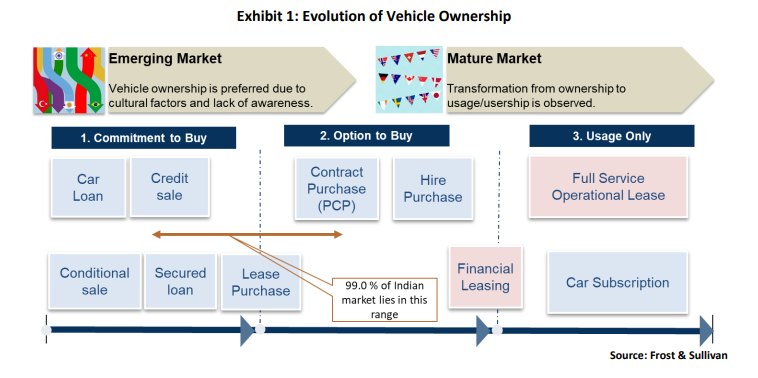

Vehicle ownership has come a long way. Frost & Sullivan classifies it into three categories: Commitment to buy, where the customer buys the vehicle, Option to buy, the customer is provided with a lower monthly payment compared to a traditional loan and is given an option to buy the asset at the end of the contract, and Usage only, the latest category; the customer can only possess the vehicle during the contract and has to return it when the contract ends..

Customers in emerging markets still prefer owning a car due to factors such as it being a status symbol, lack of company car as a concept, and mainly, a lack of awareness. While customers of the mature markets lean more on usership, they have crossed the first wave of the ownership evolution—which is vehicle leasing—and are now at the cusp of the second wave that includes private leasing, vehicle subscription, etc. As per Frost & Sullivan’s analysis, about 99% of total vehicle sales in India are bought outright, while the rest can be accounted for under leasing and subscription.

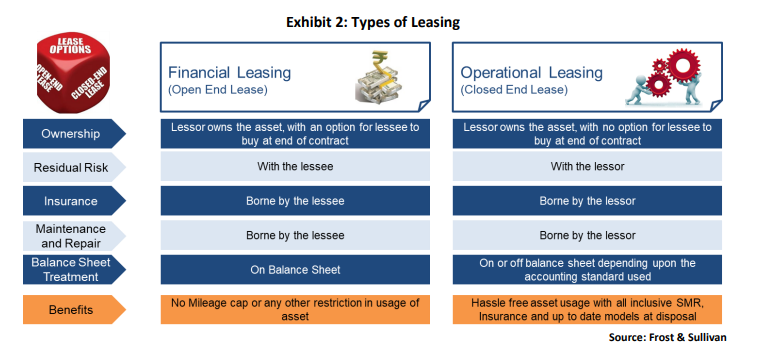

The types of leasing

Financial leasing is a contract also known as an open-end lease (TRAC in the US), where the lease contract holder (lessee) accepts the risk related to depreciation (referred to as residual value) and the leasing vehicle provider (lessor) bears the financing risk. The lessee decides when and how to dispose of the vehicle at the end of the lease contract.

Operational Leasing, also known as a full-service lease or closed-end lease, is a contract whereby the lessor accepts both the financing and residual value risk. The lessor is responsible for selling the operated vehicle once the lease contract ends or when the lease contract holder (lessee) no longer requires the vehicle. The lessor is also responsible for the asset’s maintenance, insurance, etc., which is not the case with financial leasing.

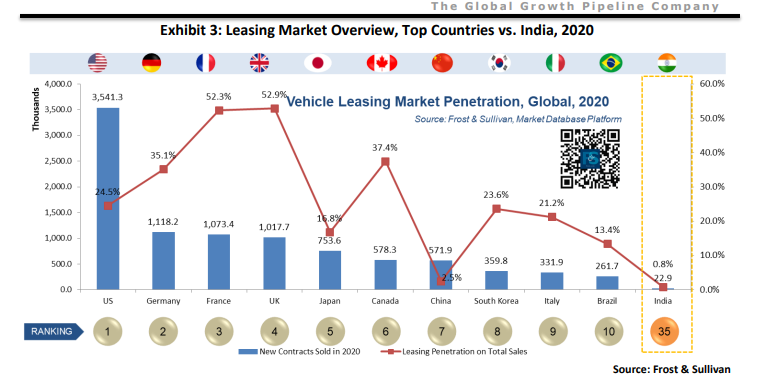

India Ranks 35th Globally in New Contracts Sold with 0.8% Penetration

The Indian leasing market sold only 22,000 new contracts in 2020, which is 35th globally and the last amongst the BRICS countries. Looking at global markets, we have some interesting dynamics and structure, e.g., in North America, leasing emerged as a strategic move by OEMs to push off their surplus from the inventory. The OEMs target retail customers who come in to purchase a vehicle and give them an option of leasing at a lower monthly payment than a regular loan EMI and upgrade every three to four years. Currently, the US has a staggering 3.5 million new vehicles leased; out of those, 86.9% constitutes a private lease.

In Europe, leasing started as a strategic financing alternative for corporates to fund their fleet of vehicles that were offered as company cars to employees. With leasing, they became asset-light overnight. Operational leasing was expensed and not put on their balance sheet; however, with the IFRS16 implementation in 2019, things have changed. Unlike the US market, leasing is dominated by the company car segment in Europe. It is currently facing a huge surge in demand for private operational leasing, especially in the Netherlands, UK, Sweden, France, etc.

In the BRICS, it gets a little mixed in the sense that all other markets are dominated by corporate customers with more than 80% business; the only exception is China, which is dominated by private leasing.

If we look at the penetration in India, only 0.8% of the total light vehicles sold in 2020 were leased. So leasing in India has a huge potential. All of this comes from the corporate business segment, while there is little to no penetration in the retail market. But what are the transformations shaping the market, and where are the opportunities?

Factors that shape Indian leasing industry

Leasing is still an emerging market in India because companies still believe in owning the asset so that they have total control over the asset rather than a leasing company dictating the terms of usage.

Moreover, there is low awareness about leasing solutions. The concept of the company car is not widely known. This has to be addressed by the lease companies via marketing, advertisement campaigns, roadshows, etc.

On the competition front, the market is highly concentrated, with the top five players accounting for about 62%. This is dominated by international players such as ALD, LeasePlan, Avis, Orix, etc. Only a few homegrown players are seen in the market, including Sundaram Finance, TranzLease, Magma, etc.

Consumers are now looking for alternative options and newage mobility solutions including car subscription, ride-hailing, P2P car sharing, etc., are growing in demand, and this is one more factor impacting the demand for leasing products.

In 2018, the Indian automotive industry started slowing down, and in 2020 faced its worst decline of about 19%. Buyers are looking for alternative ways to acquire cars at better rates. Leasing is a flexible solution (in this case, lease companies bear high residual value, making monthly payments cheaper) and can be a savior with attractive pricing driving growth.

While the used car market is 1.3 times the size of the new car market in India, demand for well-maintained vehicles in SME business segments can be met by leasing off-lease vehicles (vehicles that are coming out of an expired leasing contract) at attractive prices~

Big corporates are the foremost customer segment for the leasing companies. This is because doing business with big corporates, especially for new solutions, will serve as a benchmark for such solutions creating credibility in the market. This will attract the SMEs and retail customers who feel assured of the benefits of such a solution and migrate to them. Private leasing, which is prominent in the US and a growing segment in Europe, is negligent in India. However, there are indications that private leasing may be emerging as a promising business. Maruti is offering private car leasing to SMEs and the self-employed in India, but it is not properly regulated or structured yet.

Used car leasing is preferred by young companies and individuals who want access to quality vehicles, albeit at a lower price. While the used car market is 1.3 times the size of the new car market in India, demand for well-maintained vehicles in SME business segments can be met by leasing off-lease vehicles (vehicles that are coming out of an expired leasing contract) at attractive prices.

The electric vehicle market in India is small, with only a few thousand units sold in 2020. High growth potential exists for EVs; however, it comes with uncertainty in residual estimation, making leasing the best option to get an EV.

Digitalization can be used as a tool to gear up for growth in the leasing market. Robust digital platforms will also reduce the friction with customers (in terms of the various procedures associated with leasing a vehicle). Soon, this value addition will become a necessity.

Vehicle subscription is slowly gaining popularity. Almost every OEM offering subscriptions for new cars is pushing it as an alternate channel for car ownership. Leasing companies are at the forefront of making this initiative a success with their knowledge in residual management and pricing such solutions.

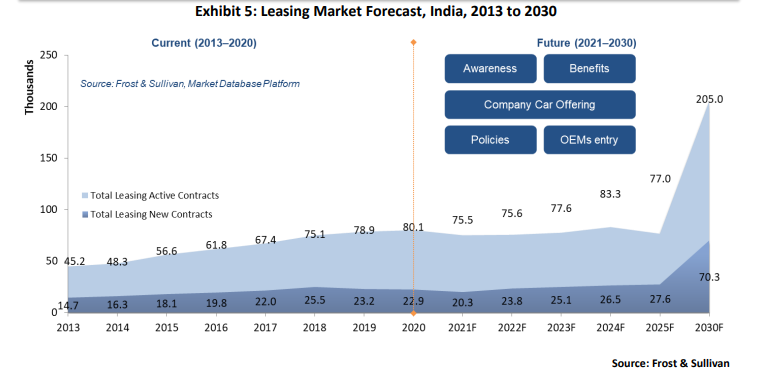

Indian leasing market to cross 200K units by 2030

With the existing players and dynamics, the market is expected to cross 200K active contracts by 2030, which is a conservative estimate. However, with the additional attributes such as product awareness, its benefits, growth in company car offerings, policies supporting the leasing products, and entry of OEMs that can get the retail segment into leasing, this market is expected to have more than half a million active leasing contracts by 2030, in an optimistic scenario.

A high market concentration of about 62% of total active contracts is managed by international leasing players. Since 2018, the OEMs have entered the market, which is encouraging. Additionally, they have partnered successfully with leasing companies, most of which are international players. While the former gets in more prospective customers, the latter helps the business with the know-how and years of expertise from the EU and American markets. For instance, we have ORIX partnering with VW, FCA, Honda, M&M, Nissan, TATA Motors, and Maruti, offering leasing and subscription solutions. Similarly, ALD Automotive partnered with Hyundai, Citroen, and Maruti to offer leasing solutions.

Big 3 predictions for 2030

Core Business: At Frost & Sullivan We expect the total leasing market in India to hit 87,500 new contract sales by 2030.

Growth opportunities: Full-service operational leasing will drive market growth. Customer segments include corporates, startups, and individuals such as entrepreneurs, first-car buyers, etc.

Future business segments: The emergence of new leasing businesses is expected in electric vehicles, used car leasing, and vehicle subscriptions. In addition, business opportunities will emerge from digital platforms, data monetization, auto insurance, and the fleet aftermarket.

(This article is the first part of the two-part article on Vehicle Leasing by Frost & Sullivan.)

(Abishek Narayanan is Research Manager, Mobility Practice, Frost & Sullivan. Views are personal.)