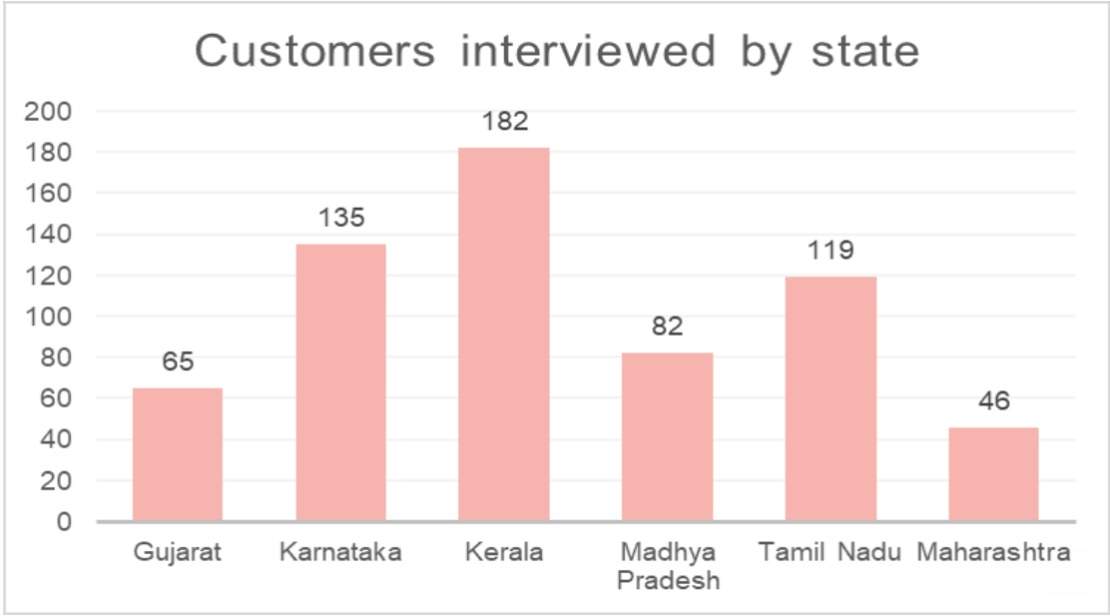

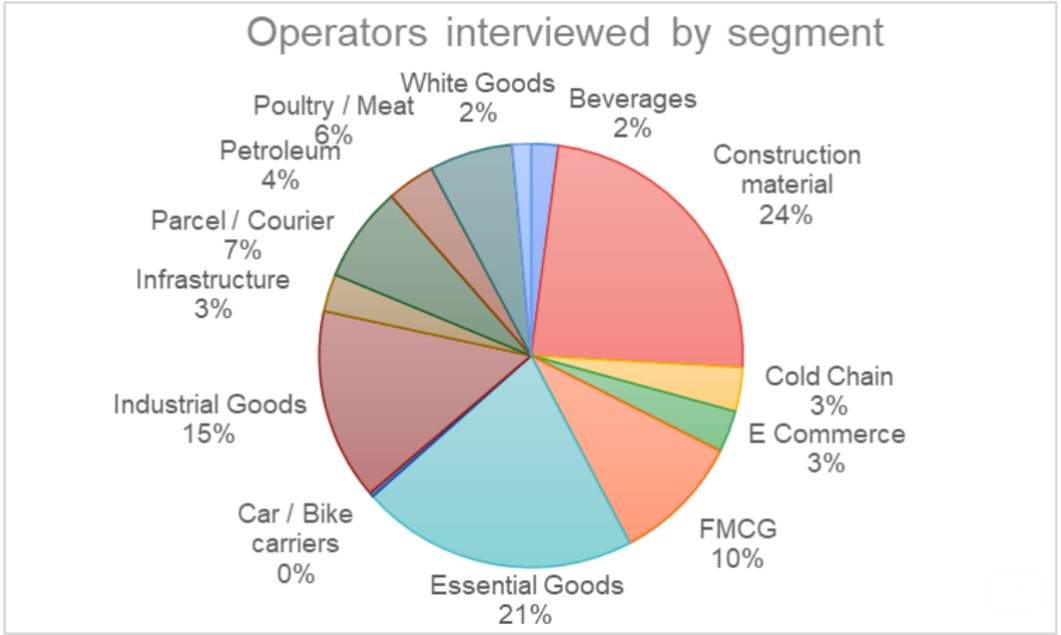

New Delhi: The second Leaptrucks Credit Suisse truck operator survey covered the states of Maharashtra, Karnataka, Kerala, Tamil Nadu, Madhya Pradesh and Gujarat. Over 600 fleet operators were interviewed from multiple segments (shown in Chart 1), across rural and urban areas in May and early June 2021 as part of the survey.

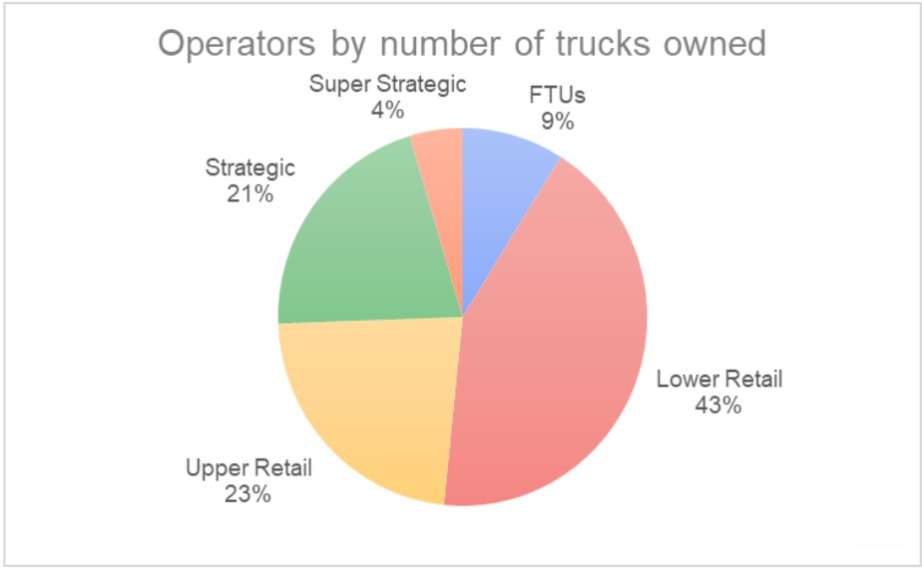

Operators interviewed included First Time Users (FTUs owing 1 truck), Lower Retail Operators (owning 2-5 trucks), Upper Retail Operators (owning 6 to 10 trucks), Strategic Operators (owning 11 to 50 trucks) and Super Strategic Operators (owning over 51 trucks).

Impact of the lockdown on truck demand

A majority of operators across the country (over 51%) indicated a substantial (over 25%) drop in market demand in April vs. March. The drop in demand affected most segments that were polled. However, the construction material, E-commerce, infrastructure and petroleum segments appear to be the least affected since they were allowed to operate during the lockdown. It was also interesting to note that the essential goods segment (fruits, vegetables, milk and agriculture) was negatively impacted in Lockdown 2.0.

Construction material, E-commerce, infrastructure and petroleum segments appear to be the least affected since they were allowed to operate during the lockdown.~

Across states, over 67% of operators in Madhya Pradesh and Tamil Nadu reported a substantial drop in demand. At the same time, 48% of operators in Maharashtra and Karnataka and 37% of operators in Kerala and Gujarat also reported the same.

Mohit Mittal, Partner at Southern Cargo, said, “Lockdown 2.0 has impacted our operations significantly more than lockdown 1.0. This year, we have seen the demand for even goods like packed atta, which is a consumer staple, fall by more than 30% from the previous year”.

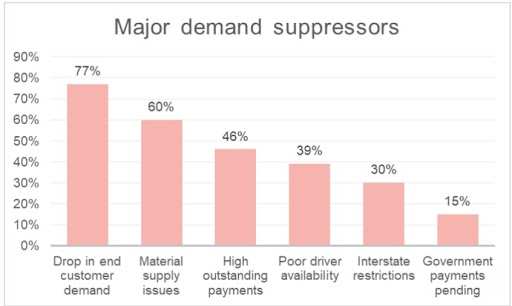

A majority of operators cited that a drop in consumer demand was the primary cause of the fall in the market. This was followed by challenges in material supply due to the closure of factories and stores. Large outstanding payments for both operators and suppliers also contributed to a slowdown in demand. Interstate restrictions, which had a major impact on operators in Lockdown 1.0, appear to have significantly eased with states providing ease of transportation to goods vehicles in Lockdown 2.0.

Over 21% of operators indicate that despite the challenges in Lockdown 2.0, the overall business environment was better than Lockdown 1.0. Across states, operators from Maharashtra and Tamil Nadu indicated higher stress than the operators in other states. Across fleet sizes, FTUs indicated that they were more impacted than others.

Across operator sizes, FTU operators were most negative with only 6% of them indicating that the situation was the same or worse than Lockdown 1.0. Lockdown 2.0 also appears to have impacted rural areas significantly with fewer rural operators indicating that the situation was better than that for the Urban operators.

Over 21% of operators indicated that despite the challenges in Lockdown 2.0, the overall business environment was better than Lockdown 1.0.~

The impact on demand in Lockdown 2.0 has been significant. While the lockdown has not been national, the impact has been felt by operators across the country. Operators in Maharashtra and Tamil Nadu have indicated higher stress than others due to extended or local restrictions. The impact has also been felt in rural India unlike Lockdown 1.0. Across fleet sizes, FTUs appear to be facing a significant amount of stress compared to other operators. We also continue to see optimism across operators. Over 21% of them indicated that the overall situation was better than Lockdown 1.0.

Impact on operator profitability

The drop in demand has impacted truck utilisation. Over 53% of operators indicated that utilisation of trucks dropped significantly (running of 10 days or less in the 30 days prior to the interview). Operators of trucks carrying beverages, car and bike carriers, and the carriers of industrial goods, parcels/courier, white goods and essential goods indicated a drastic drop in utilisation. It is interesting to note that while trucks moving essential goods were one of the best performing segments in Lockdown 1.0 (based on our survey from August 2020), a combination of challenges in the operating markets for extended periods, changing distribution patterns and drop in consumption has led to lower utilisation this year.

Among the states, operators in MP, Tamil Nadu and Maharashtra indicated a significant drop in truck utilisation. Operators in rural locations were affected the same way as their counterparts in the urban areas in Lockdown 2.0. Across truck owners by size, FTUs were the most hit while the super strategic operators were the least impacted. Diversified operations and long-term contracts helped the latter weather the Lockdown 2.0 storm.

At the same time, operators continue to face an environment of soft freight rates which have been exacerbated by low demand and excess capacity in the market with Lockdown 2.0.

Over 67% of operators interviewed indicated that their freight rates were stagnant (had not changed or decreased since September 2020). Operators in Gujarat and Maharashtra were the most impacted followed by Kerala and Tamil Nadu. Similarly, operators in the urban areas were more impacted than those in the rural areas.

Across fleet sizes, FTUs, lower and upper retail and strategic operators were affected by stagnant rates. However, only a few of the super strategic operators faced the same issues. Super strategic operators were in a better position to work closely with their end customers on freight rate increases since they formed a much larger percentage of their customers’ transportation needs. They also had long term contracts in place with a few of them having price escalation clauses for rising input costs.

Stagnant freight rates continue to be a major issue facing operators across the country. Many operators that were interviewed indicated that freight rates had not been revised over the past 2 years. A few even indicated that they were still operating at freight rates which were agreed upon as early as in 2015.

The simultaneous drop in demand and stagnant freight rates has negatively impacted operator profitability. Across segments, the carriers of industrial goods, parcels/courier, white goods and the cold chain segments were most impacted (with a drop of over 20% in April 2021 vs. March 2021).

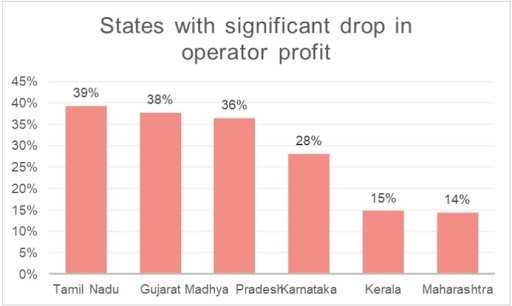

Operators from Tamil Nadu, Gujarat and MP were impacted the most with over 36% of them seeing a significant drop in profitability. Operators in Karnataka, Kerala and Maharashtra were less impacted by the same. The impact was the same among rural and urban operators indicating challenges across the rural economy.

The drop in demand has reduced the utilisation of trucks and also impacted freight rates. At the same time, operators have also been facing rising input costs. Since September 2020, prices of diesel shot up by over 20%, and of tyres by over 10%. Driver salaries increased by 10% to 15% because of low availability due to lockdown. All these have significantly impacted operator profitability.

Operators in the west and central India along with Tamil Nadu in the south were the most impacted by lower utilisation, low freight rates and profitability. Across fleet sizes, FTUs had the largest impact on utilisation and profitability during the pandemic. Softer freight rates appear to be a longer-term challenge than demand which may pick up after Lockdown 2.0.

Operators across west and central India along with Tamil Nadu in the south were most impacted by lower utilisation, low freight rates and profitability.~

EMI payment challenges

A combination of lower utilisation, soft freight rates and lower profitability has impacted the cash flow of operators. At the same time, they are faced with multiple challenges in meeting all their financial commitments.

Over 45% of operators indicated that in addition to their truck loans, they were also accessing an additional loan like a tyre loan, fuel loan, insurance loan or personal loan for access to incremental working capital. FTUs were more likely to have an additional loan than the super strategic operators.

In addition to this, over 15% of the operators interviewed indicated that they had also used a top-up loan since September 2020. More operators in Maharashtra and MP had accessed these loans than those in other states. The use of top-up loans and the burden of other related loans for working capital have added incremental pressure on operators in paying their EMIs.

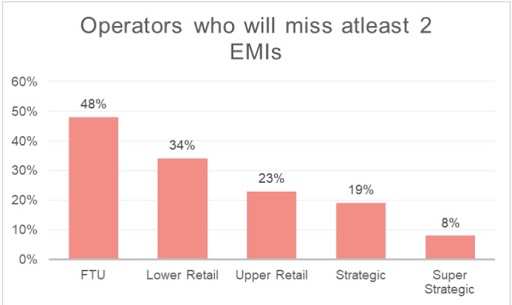

Around 30% of operators interviewed indicated that they would miss at least 2 EMIs in the April -June quarter. The drop in cash flow due to poor utilisation and setting aside funds for emergencies related to Covid were the most common reasons cited by them. The white goods and parcel/courier segments were the most impacted segments.

A majority of operators interviewed in Maharashtra and Tamil Nadu indicated that they would miss at least 2 EMIs indicating that they were under high stress. Across fleet ownership, FTUs were clearly under significant stress and the Super Strategic operators were the least stressed.

“Delinquencies (30+ days past due) for CV loans have risen by more than 100 bps MoM in April, and with collection efficiency of only 50%-80% in May (though improving in June), it might have risen further. With 30% of respondents in our survey indicating their inability to pay more than one EMI in the April-June quarter, we expect lenders to see higher slippages in Q1FY22. We expect banks having exposure to Large Fleet Operators (LFOs) and NBFCs lending to the owner-driver segment to see lower addition to stressed loans vs. lenders to Small Fleet Operators (SFOs).” said Rikin Shah, NBFC Analyst at Credit Suisse.

Operators in Maharashtra and Tamil Nadu appear to be under significant stress in comparison to other locations. Similarly, FTUs appear to be more likely to miss EMIs than other segments. This will create a short-term collection challenge for NBFCs and banks as operators get back to repaying on schedule as the economy picks up.

Outlook on business recovery

Over 35% of operators also believe that the business would recover by September 2021. This compared favorably with our survey last year where only 24% of operators had expectations of a quicker recovery. Across segments, it was interesting to note that the essential goods segments, one of the most optimistic in the survey last year, turned pessimistic about a quicker recovery this year.

Across states, operators in Tamil Nadu, Karnataka and Kerala were more optimistic about a quick recovery than those in Gujarat, MP and Maharashtra. Rural operators were more optimistic about a quicker recovery than their urban counterparts.

Many operators also backed the optimism with the expectation of expanding their fleet sizes over the next 3 months. Segments where operators indicated plans to expand included cold chain, petroleum, E-commerce, infrastructure, poultry & meat, and FMCG. Across states, operators in Karnataka and Kerala were more likely to add to their fleet than those other states. Across fleet sizes, super strategic operators were more likely to add to their fleet than others.

Conclusions of the study and outlook for 2021-22

Truck operators have had a challenging Lockdown 2.0. Many segments including white goods, beverages, car and bike carriers, essential goods and the parcel and courier segment have indicated a fall in demand, freight rates and profitability. Similarly, operators in Maharashtra and Tamil Nadu in the FTU segment have indicated a high degree of stress in their operations.

A majority of operators interviewed in Maharashtra and Tamil Nadu said that they would miss at least 2 EMI payments indicating that they were under high stress.~

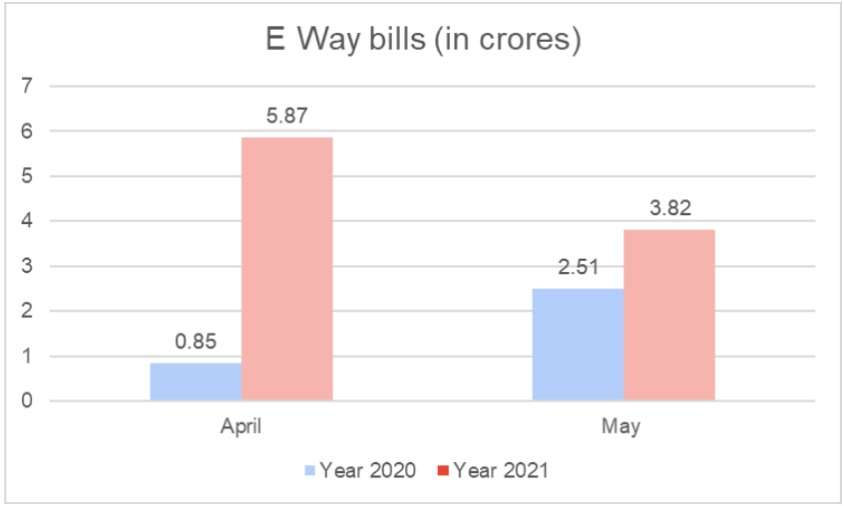

However, the E-way bills data from April and May 2021 offer us the reason for optimism. While E-way bills have fallen sequentially in the first 2 months of the year, we have seen a growth of over 188% vs. the same period last year. This clearly indicates that the overall demand in Lockdown 2.0 continued to be significantly higher than in Lockdown 1.0 despite the challenges faced across the country.

The market recovery is likely to be led by operators in the E-commerce, FMCG, infrastructure, petroleum and poultry/meat segments. Super strategic operators will lead the recovery along with operators in rural areas. Karnataka, Kerala and Tamil Nadu are likely to lead the recovery followed by MP, Gujarat and Maharashtra.

(The author is the CEO of Leaptrucks. The article is from a joint study conducted by ETAuto, Credit Suisse and Leaptrucks.)