New Delhi:

After braving two years of difficult times, the Indian automobile industry finally seems to be coming out of the woods in the first half of the current fiscal year 2022-23.According to the latest data by SIAM (Society of Indian Automobile Manufacturers), the industry has seen year-on-year domestic sales in green across the segments aided by gradual improvement in semiconductor supplies, festive season demand and a low base of last year.

Vinod Aggarwal, President, SIAM said that there is an improvement seen across the segments compared to the previous year and the industry is expected to do well in the month of October, which has two major festivals of Dussehra and Diwali.

However, the recent increase in the prices of CNG fuel, higher repo rates and the Russia-Ukraine conflict are of concern and could impact the market in the coming months, he said.

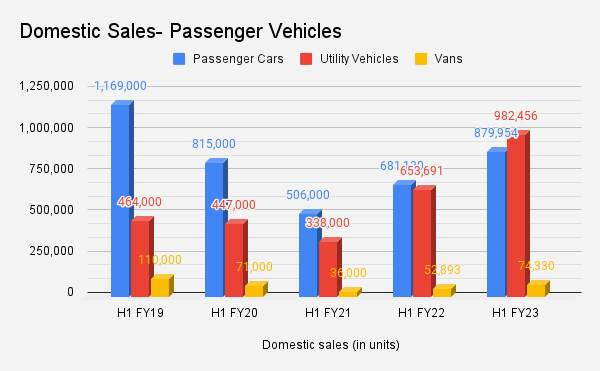

During H1 FY23, the passenger vehicle segment reported its highest ever sales and Q2 FY23 became the first-ever quarter to cross the 1-million mark in domestic PV sales.

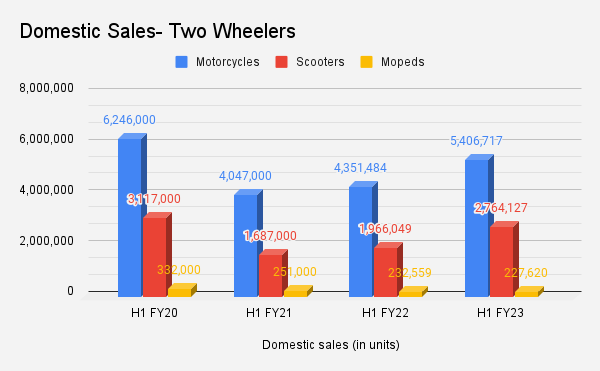

The two wheeler segment saw an year-on-year increase in domestic sales during H1 compared to the last two years. It grew to 8.39 million units in April-September 2022 period as against 6.55 million units in the corresponding period of last year. But the sales are still below the pre-Covid levels of 2019-20.

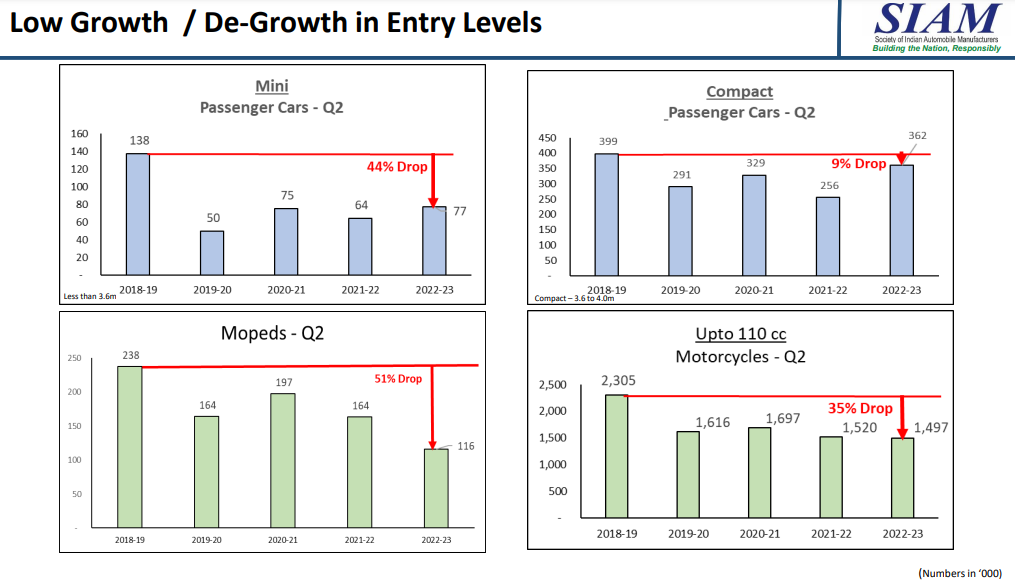

Within the segment, the major stress has been on the entry-level mini and compact cars category for over three years now. Since its peak in Q2 FY19, the sale of mini passenger cars has dropped 44% from 1.38 lakh units to just 77,000 units in Q2 FY23. Sales of compact cars is also below its peak of FY19.

Experts suggest this may be attributed to the increase in ownership costs of these vehicles, new regulatory policies, multiple price hikes by OEMs and the decrease in gap of the average price range of entry-level SUV style vehicles.

A similar trend has been observed for the entry-level motorcycles (upto 110cc) category where sales have dropped from its peak of 2.30 million units in Q2 FY19 to almost half at 1.49 million units in Q2 FY23.

Rajesh Menon, Director General, SIAM said, “September has been generally good for industry, as the passenger vehicle segment has recorded the highest ever sales in H1 and the commercial vehicle segment has started showing trends of better market demand. Off-take of entry level two-wheelers and entry level passenger vehicles have been of concern especially as the rural demand has not picked up.”

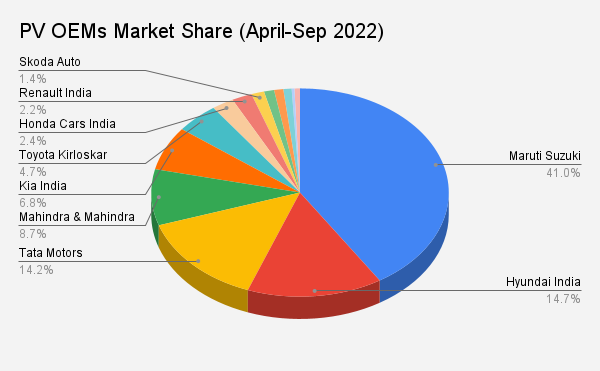

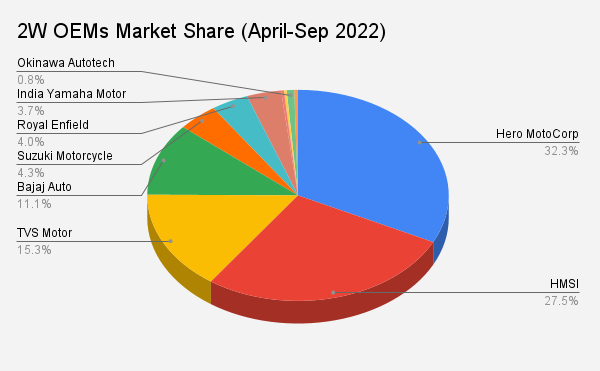

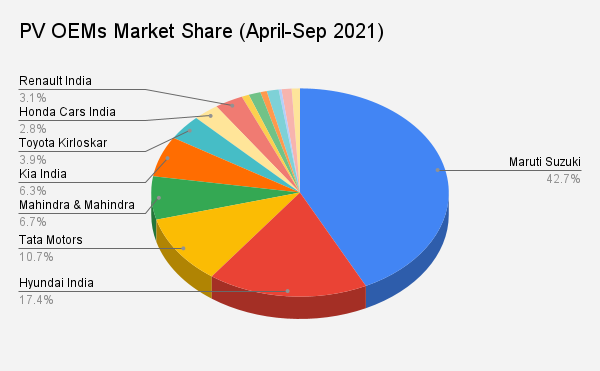

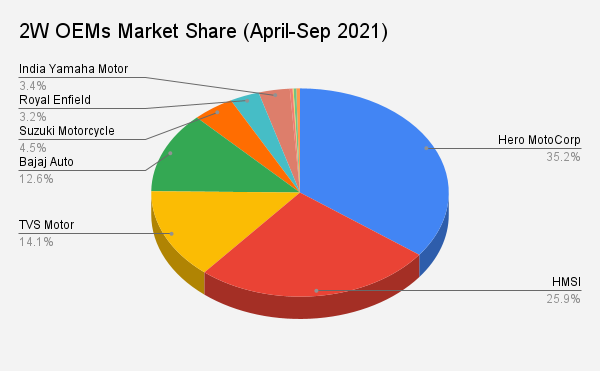

The following is a market share report of the OEMs during the April-September 2022 period, the H1 of FY23.

Passenger Vehicles

On a year-on-year basis, the OEMs saw improved performance owing to the easing of chip supplies, reduced waiting periods, softening of commodity prices, new launches, and a Covid-free festive season after two years. Interestingly, the utility vehicles (UVs) segment now contributes over 50% share in the PVs, riding on robust demand for countless options of sports utility vehicles (SUVs).

Shashank Srivastava, Sr Executive Officer- Marketing & Sales, Maruti Suzuki said that domestic sales of passenger vehicles during three consecutive quarters in 2022 was over 9 lakh units, which is also a first for the industry.

In January-March 2022 period, the PV segment clocked sales of 9.20 lakh units, in April-June quarter it stood at 9.10 lakh units and July-September period crossed the 1-million mark.

Tata, Mahindra turn up as biggest gainers, Hyundai loses out

While some OEMs lost a pie to their rivals, others gained on the back of new product launches and better management of chip supplies.

Market leader Maruti Suzuki dispatched 794,550 units in the first half of this fiscal year, compared to 593,092 units in H1 FY22. However, it reported a 1.7 percentage point decline in the market share.

The maker of Grand Vitara marked its entry into the popular midsize SUV segment in September and expects to gain its share in the segment going forward. Currently, it is sitting on a booking backlog of over 4 lakh units.

Hyundai India reported the highest drop among the PV OEMs ranging to almost 3 percentage point year-on-year. The maker of Creta sold 285,005 units during April-September 2022 period, as against 242,494 units in the year-ago period.

Among the major gainers were Tata Motors and Mahindra & Mahindra, gaining over 3 and 2 percentage points respectively.

Shailesh Chandra, Managing Director, Tata Motors said that the PV industry witnessed strong demand fuelled by the festive season and new launches. Led by sales of Nexon and Punch, its SUV sales contributed about 66% of the PV sales during Q2 FY23.

In H1, the auto major sold 275,785 units, marking a growth of 84% over 149,525 units sold in H1 FY22. With the recent launch of the Tiago EV hatchback and improving supply of vehicles, the company said it is expecting to witness strong retails during the festive season.

Kia India, within 3 years of entering the Indian market, has sustained its position in the Top 5 OEMs and managed to maintain its market share of over 6%. It sells five models in the country.

Toyota Kirloskar Motor which launched its Hyryder midsize SUV recently, observed about a percentage point increase in its market share compared to last year. Its sales volumes grew to 91,429 units in H1 this fiscal as compared to 54,282 units in H1 of last fiscal year.

Czech carmaker Skoda Auto India also increased its sales volumes to 27,991 units during April-September 2022 period, as against just 12,347 units sold in the corresponding period of last year. Globally, India now stands as Skoda’s third largest market after Germany and home market, Czech Republic.

Petr Solc, Brand Director, Skoda Auto India, said that the Kushaq and Slavia models drove the sales impetus. “Our D-Segment products like the Octavia and Superb are leading their respective categories,” he added.

The only Chinese automaker to find its place in the Indian automobile market, MG Motor has managed to maintain its 1% share in the country. The SAIC-owned carmaker entered the Indian market in 2019.

Volkswagen, gaining traction for its Virtus sedan and Taigun SUV, dispatched 19,379 units during H1 this year, up from 10,747 units in H1 last year.

Two Wheelers

According to Motilal Oswal, the two wheeler segment, which has remained sluggish for a while, is expected to see a good uptick this festive season. Inquiries and bookings have picked up in the month of September 2022. OEMs announced attractive offers for Navratras.

“Quite a few OEMs have planned some product refreshes for this festive season. Hero MotoCorp took a price hike of up to INR 1000 in September. The supply chain issues in the entry and executive level portfolio for Hero has started to ease out. Royal Enfield (RE) Hunter has been able to attract some new customers, while the other models remain fairly stable. Inventory for the festival season is around 50-60 days,” it said.

The two wheeler sales have been better than last two years, however it still sits below 2019-20 levels.

Honda, TVS, RE gain market share, Hero loses a portion of its pie

During April-September 2022 period, the country’s largest two wheeler maker dispatched 2.71 million units compared to 2.30 million units in the corresponding period of last fiscal. Its market share stands at 32.3%, making a decline against 35.2% in H1 last year and thus moving away from its quarterly peak of 40% share.

The Pawan Munjal-led company recently entered the electric two wheeler market with its Vida V1 premium scooter.

Honda Motorcycle & Scooter India (HMSI) gained 2 percentage points and grabbed a pie of 27.5% in the market. It sold 2.31 million units in H1 FY23 as against 1.69 million units when its share was at 25.9%.

TVS and Royal Enfield gained about a percentage point each, grabbing 15.3% and 4% market share in H1 FY23. Bajaj however lost a percentage point and contributed with 11.1% motorcycle share.

Suzuki and India Yamaha sustained their share on a year-on-year basis. Suzuki dispatched 365,332 units in the April-September 2022 period while India Yamaha sold 311,238 units.

During the first half, EV makers also grabbed a tiny pie of the market, as against the last year when their volumes did not make much difference. Together they grabbed just over 1% share in the Indian two wheeler market. However, their volumes have increased significantly as against the previous year. Ather Energy sold 28,568 units in the first six months of the fiscal year as compared to 8,792 units in the corresponding period of last year. Okinawa reported a growth by selling 71,062 units in H1 FY23 as compared to 23,684 units in H1 FY22.

Going forward, the passenger vehicle segment is set to record new highs for fiscal year 2022-23 while festivities during the month of October remain critical for the recovery of two wheeler segment.

Also Read: