New Delhi: Automotive industry is not just undergoing a technological shift but also a dynamic shift in thinking. Customers have become very discerning. This shift in priority compels the original equipment manufacturers (OEMs) to develop new ways to deliver the overall experience to the customers.

The role of the carmakers has gone beyond the “design, build, sell” business. They have to manage the entire lifecycle of the modern connected car, including IT security and data privacy.

Similarly, technological giants like IBM that have been working in tandem with the automotive industry for years have to revamp their engagement models and partnerships with the auto companies to stay competitive and keep pace with the changing priority.

“In the last couple of years, the focus of auto companies has shifted from process efficiency to managing client expectations. We at IBM, have transformed from building a monolithic IT landscape for auto companies to building agile systems to meet client demand much better,” Venu Juvvala, director – industrial and distribution business, IBM India, told ETAuto.

During 2000-07, most of the auto companies invested heavily on building strong ERP (Enterprise Resource Planning) systems process controls as there was a lot of backend push. The second wave of the evolving IT landscape focused on the dealer and subsequently on the customer.

It required OEMs to invest in robust CRM (Customer Relationship Management) and dealer management systems. “Many automotive companies have been investing in technology that will help them discover customer satisfaction. IBM’s largest future revenues will flow from there,” Juvvala said.

IBM has been building capabilities to provide tailored solutions that give real-time insights to understand which part of the car is functioning well and which is not even before the customer reaches the service centres and help companies come up with anticipatory remedial strategies, he said.

Juvvala claimed that IBM manages roughly 60% of the IT backend for automotive companies in India, including Maruti Suzuki and Honda Cars. “IBM manages the IT backend of every two out of three vehicles manufactured in India,” he said.

At Maruti, IBM began as their core IT service provider for about a decade but in the last four to five years, they have been closely partnering with the engineering and R&D teams of Maruti to build their first connected car solution, Suzuki Connect, which got launched last year.

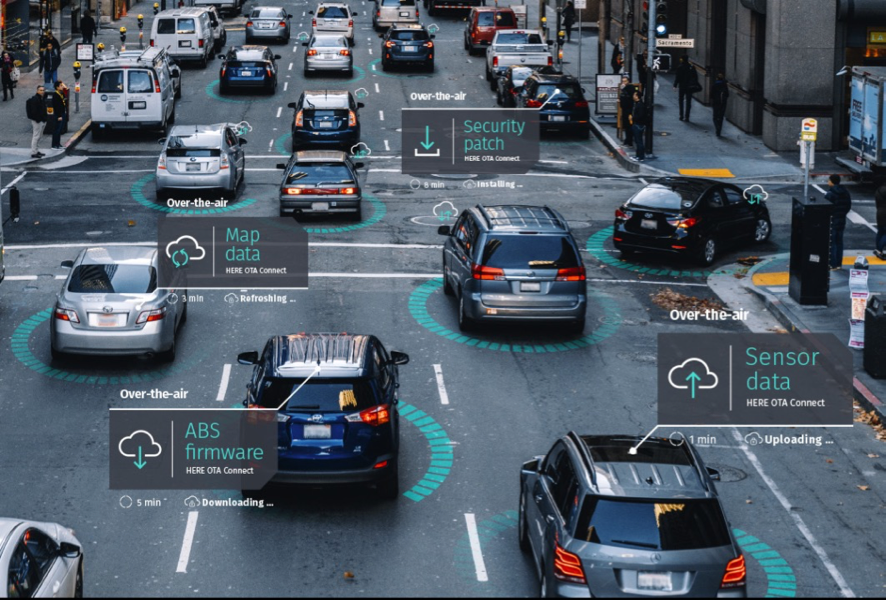

With connected cars come a humongous amount of data generated every day. Today’s connected cars churn out around 1TB, which will increase to 4TB in future vehicles.

During 2000-07, most of the auto companies invested heavily on building strong ERP systems process controls as there was a lot of backend push. The second wave of the evolving IT landscape in the automotive industry focused on the dealer and subsequently on the customer.~

IBM has been working with auto companies to build data platforms to derive actionable AI insights that can help monetise and improve customer satisfaction. But one of the biggest concerns has been the ownership and security of the data generated.

Juvvala explained, “When data flows into this platform at an aggregate level, we help auto companies to create robust data platforms. The data generated is always the property of the OEM, which uses the platform, not IBM. Individual data is always protected. All our platforms comply with the General Data Protection Regulation (GDPR).”

There is a multitude of laws worldwide that regulate personal information and privacy. IBM maintains more than 60 Cloud data centres globally, including 16 across Europe, and can tailor data management practices in each region to meet the compliance demands of a particular market.

Hybrid Cloud is the future

Cloud technology is at the forefront of the digital transformation of enterprises. But with digitalisation comes the challenge of securing and protecting sensitive data. This struggle is especially true in regulated industries as these regulations make it difficult for many of these companies to move all data assets to the Cloud.

According to Prativa Mohapatra, vice president – sales, IBM India, South Asia, only about 20% of the available workload of the companies is stored in the public Cloud. The other 80% is a mission-critical workload that is difficult to move. It is here that the hybrid Cloud platform finds significance.

IBM that has been working in tandem with the automotive industry for years had to revamp its engagement models and partnerships with the auto companies to keep pace with the changing priorities.~

“Hybrid Cloud is the future. Enterprises see about 2.5 times more value in hybrid Cloud strategy than public Cloud. A lot of it has been accelerated by the current COVID-19-related travel restrictions as enterprises are spread across different regions of the world”, Mohapatra said.

Hybrid Cloud is a dominant driving force in the Cloud industry, and IBM has been witnessing accelerated Cloud revenue growth globally quarter-on-quarter and year-on-year. The segment generated more than USD24 billion of revenue over the past 12 months globally.

One of the major investments in this area has been the acquisition of RedHat, a leading open-source solution provider, in 2018. The acquisition provided IBM with the technology base to build a hybrid Cloud platform based on open-source.

Overall since 2012, IBM invested more than $120 billion to transform their strategy, portfolio and workforce.

The company’s long-term and short-term investments are aligned with the hybrid Cloud and AI space. “IBM invested nearly $30 billion in capital expenditures, building cloud and cognitive offerings and bolstering security and services capabilities,” Mohapatra said.

The tech major also invested $45 billion in research and development, forging the futures of cloud, AI, blockchain and quantum computing.