New Delhi: Lightweighting has been an essential part of product design and development across the automotive manufacturing industry for the last few decades. With the latest transitions in the industry, the future of mobility will be defined by autonomous and electric vehicles. In the process, there is a pressing need for advanced lightweight materials to play a bigger role of ensuring driving dynamics, vehicle range, fuel efficiency and reducing tailpipe emissions in building the vehicles. While most vehicles are steel intensive, metals such as high strength steel, aluminum, magnesium and titanium, sandwich solutions (with a few of these metals), composites which are made of high performance fibre including carbon-fibre, and lightweight plastics are potential alternatives. However, everything comes at a cost. Several factors including part complexity, part size, capital investment, additional labour, factory location, and reengineering effort influence the real-world lightweighting cost.

Experts suggest that the type of powertrain, production volumes, system integration, sustainability and the vehicle price will determine the OEMs’ choice of lightweighting material. Since each part has different requirements regarding formability, strength, temperature resistance, and the cost of each material is different, a part-specific strategy could be a go-to option.

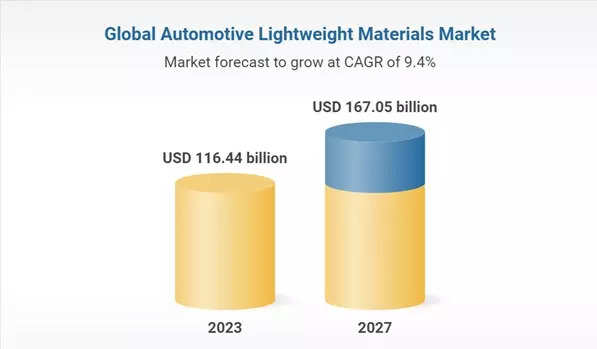

Globally, the automotive lightweight materials market is expected to grow at a CAGR of 9.4% from USD 116 bn in 2023 to USD 167 bn in 2027.

Electric Vehicles

When compared to the traditional internal combustion engine (ICE) vehicles, electric vehicles (EVs) are substantially heavier owing to its battery size.

N Saravanan, CTO, Ashok Leyland, says that lightweighting makes tremendous sense in EVs from the perspective of paybacks. Since 60% of the cost of an electric commercial vehicle (CV) is a battery, lightweighting can enable improved battery capacity and cost.

“Unlike diesel vehicles, where it is difficult to get a payback for lightweighting in CVs, in EVs, you can save USD 1200 on each kWh of battery saved. However, getting there is a different challenge as CVs come with a payload. So it has to be a multi-pronged approach of determining a combination of materials, depending upon different applications. In the process, reliability of the vehicle should not be compromised and it should make sense from a business perspective,” he said.

Ramesh Rajagopal, EVP, VECV, says lightweighting targets are increasing every year. It has to be a trade-off among reliability, durability, weight and fuel efficiency.

In 2021, researchers at Chalmers University of Technology in Sweden came up with an innovative concept of ‘structural battery’ using carbon fiber. Also known as massless energy storage, a structural battery aims to significantly reduce the weight of EVs by incorporating batteries into the structure of the object. With this, the need for separate batteries is reduced or potentially even eliminated.

Global EV maker Tesla developed structural battery packs for use in the Texas-built Model Y, aiming to increase the vehicle’s range and reduce overall weight, resulting in improved acceleration and handling. However, reports suggest that it has its own set of challenges.

Challenges

According to a research by the Centre of Automotive Research (CAR), automakers often need to add weight to improve vehicles’ safety, performance, and customer expectations. Mass for safety is required for crashworthiness and electronic devices such as cameras, sensors, computers, etc. Mass for performance might be added for attributes such as improvements in stiffness, the quietness of the ride, lowering the center of gravity, equalizing the load distribution, unsprung mass reduction, etc. Automakers also add mass to satisfy customer demand for better comfort.

There are several real-world constraints and manufacturing challenges that automakers face when looking to include a new material into production. Every OEM designs vehicles using internal design standards and best practices. The time and development process to qualify new materials and derive appropriate product specifications can take as long as 3 to 4 years. The assembly and handling processes for each material technology is also different in a few cases.

EVs will need noise, vibration and harshness (NVH) for sound deadening. Thin sheets of lightweight materials reduce mass but aggravate NVH. Solutions to counter the effect typically mean a mass increase, where automakers struggle to balance lightweighting versus NVH requirements.

Each material also has its own set of challenges. For instance, McKinsey & Company notes how maintenance of carbon fiber parts, which has significant potential in weight reduction, is difficult since damage can often not be seen through a visual inspection. While development of smart concepts can make detection technologies affordable, it otherwise requires acoustic emission detection or thermal, ultrasonic, or x-ray imaging. All of these technologies impose potential investment cost on dealerships and workshops.

A few studies also suggest that there is a lot more to vehicle lightweighting than just production of materials used to reduce the vehicle mass.

“The production of most materials used to reduce vehicle mass tend to be more energy intensive than the steel that they replace. In some cases, the emissions created in production can outweigh the CO2 benefits of reducing mass,” Russ Balzer, Technical Director, WorldAutoSteel, and an Environmental Consultant, The Phoenix Group says.

Moving ahead, several innovations are in works in the area of vehicle lightweighting which offers several opportunities for technology giants.