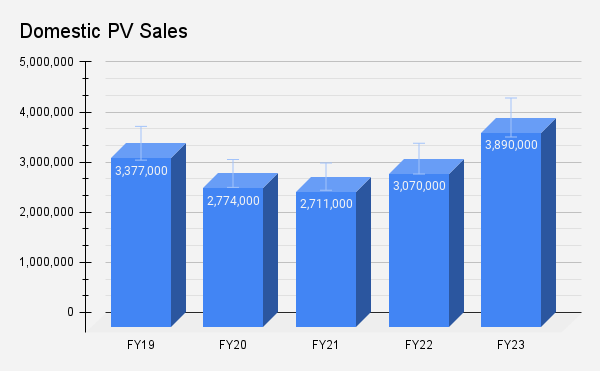

New Delhi: Owing to post-COVID pent up demand, easing of supply chain shortages, rise in demand for SUV-style vehicles and the new product launches, passenger vehicles (PV) posted their highest ever domestic sales during 2022-23 at 38.9 lakh units, growing at a CAGR of 3.6% and surpassing the previous peak of 33.7 lakh in 2018-19.

Now, SUV-styled vehicles make up 43% of the total PV market in India.

According to Vinod Aggarwal, President, Society of Indian Automobile Manufacturers (SIAM), “2022-23 has been a year of consolidation, post Covid. The year started again with supply chain disruptions from the Ukraine conflict. However with efficient management of supply chains and better availability of commodities especially for the electronics items, prices have moderated over the year, though it remains a concern.”

Rohan Kanwar Gupta, Vice President & Sector Head – Corporate Ratings, ICRA Limited says, “Retail sales in the industry have remained steady aided by healthy underlying demand. Post some moderation in February 2023, steady demand coupled with an extent of pre-buying prior to the implementation of second phase of BS-VI emission norms from April 1, 2023, acted as tailwinds to demand in March 2023. Aided by these factors, the industry volumes reached an all time high of about 3.9 nn units in FY2023.”

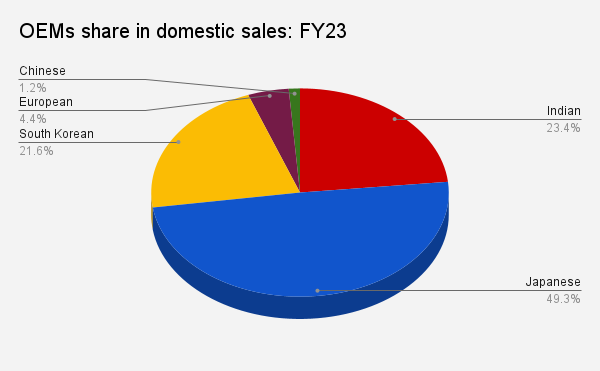

Share of Indian OEMs inches closer to 25%, Japanese dips below 50%

According to the latest data by SIAM, the top three carmakers Maruti Suzuki, Hyundai, Tata Motors reported their best ever sales performance during the fiscal year ended March 2023. Interestingly, the share of Indian carmakers (Tata Motors, Mahindra & Mahindra) inched closer to occupy about a quarter of the industry’s sales while the Japanese OEMs (Maruti Suzuki, Toyota, Honda, Nissan) dipped blow 50%.

During the fiscal year 2021-22, the Indian OEMs grabbed about 20% of the market share as against the Japanese at 52%.

South Korean OEMs (Hyundai, Kia) continued to maintain their share at a little over 21%.

Market leaders Maruti, Hyundai lose out; Tata, Mahindra, Kia gain

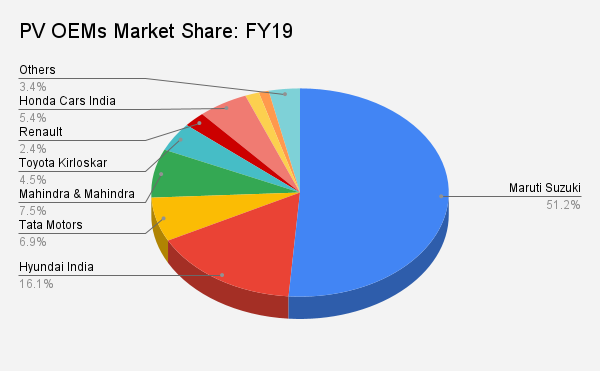

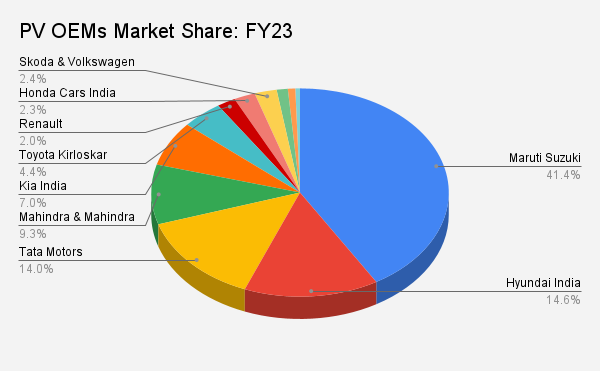

The country’s largest carmaker Maruti Suzuki, which used to grab over half of the domestic Indian car market has seen its share slimming by 10% in just three years. The company, which managed to maintain its 51% share until 2019-20, dropped to 48% the next year, followed by 44% in 2021-22 and finally 41% during the year ended March 2023. It may be noted that new players like Kia and MG entered the Indian market in 2019-20.

However, the Japanese carmaker has recently entered the mid-size SUV segment with its Grand Vitara and also unveiled the new Fronx and Jimny. With this, it aims to be the top seller in the SUV segment and expects to grow its overall market share to 45% in 2023-24.

Hyundai, which maintained its number two position during the fiscal, slipped closer to Tata Motors. The maker of Creta was ahead of the latter by just about 30,000 units. Its share in the market reached the lowest in the past 5 years to 14.5%. In 2020-21, this stood at 17.4%. However, the company is banking on new products with technology rich features for 2023-24.

On the other hand, the maker of Nexon has more than doubled its share from 6.8% in 2018-19 to 13.9% during the year ended March 2023. This comes on the back of its EV portfolio and the rise in SUV-styled vehicles.

Mahindra & Mahindra is also revving up its market share game with demand for its new models including the Scorpio, XUV700 and Thar. Its share in the domestic market hovered around 7% during the last four years and has now gone up over 9% during 2022-23.

South Korean automaker Kia, which marked its foray in the Indian market in 2019 occupies about 7% share in the domestic car industry. Back in 1998, when sibling Hyundai entered the India market it also managed to become a household name by grabbing 10% share in the first two years of its operations.

Honda, which used to grab over 5% share of the Indian market in 2018-19 has shrunk to about 2% by 2022-23. However, the company is set to enter the hot selling SUV market in India this year. Last year, it also introduced the hybrid version of its flagship City sedan.

Nissan, which occupies less than 1% of the market, discontinued production and sales of its Datsun brand vehicles in India during April 2022, after reviving it in the country in 2013.

Existing challenges

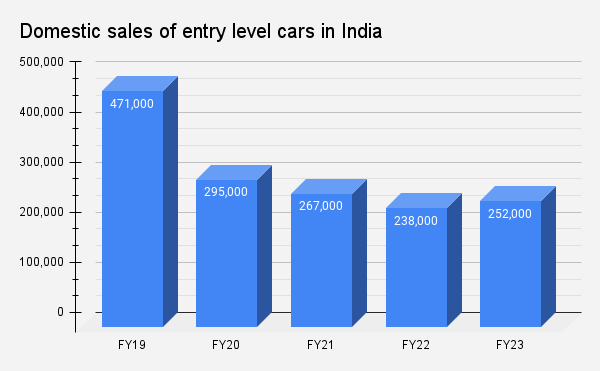

Owing to change in consumer demand trends, new regulatory norms and the increasing cost of vehicle acquisition, the sales of the entry level category continue to decline. Compared to 2016-17, when the sales in this segment stood at 5.83 lakh units, the mini car sales have dropped 57% to clock 2.52 lakh unit sales.

Maruti, which has been a leader in small car sales, stopped the production of Alto 800 hatchback this year.

Earlier, Hyundai also realigned its business strategy to focus on SUVs and sedans as it pulled the plug on the once popular Santro.

Even though the supply chain disruptions have improved, shortage of semiconductors has not waned out completely. Automakers expect it to continue for some more time.

Exports

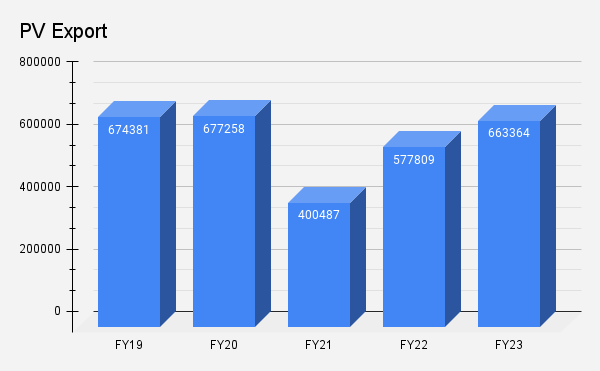

Passenger vehicle exports in the country grew in 2022-23 to cross the 65-lakh units mark after three years. Market leader in the domestic segment Maruti Suzuki also grabbed the numero uno position in exporting cars from India. The company which exported 2.55 lakh vehicles in 2022-23 ships to nearly 100 countries. Africa, Latin America, Asia, and the Middle East are its important markets.

Among the other top PV exporters from the country are Hyundai which shipped 1.53 lakh units, Kia at 85,000 units and Nissan over 60,000 units.

However, the industry’s exports during the year 2022-23 were still lower than 2016-17 when it stood at 7.59 lakh units.

Outlook

Keeping up with the high base of last year, experts project a single digit healthy growth for 2023-24.

Rohan Kanwar Gupta, Vice President & Sector Head – Corporate Ratings, ICRA Limited says, “Going forward, healthy replacement demand, new model launches and adequate financing availability are likely to help the industry volumes grow by 6-9% in FY2024. However, an increase in cost of ownership (led by hike in vehicle prices and repo rates) remains a major headwind for the industry.”

“Additionally, the performance of South-west monsoon amid concerns regarding occurrence of El Nino phenomenon, and its impact on rural demand, remain monitorable. The availability of semiconductor chips to support the desired production levels of the OEMs would also remain key, with new capacities likely only towards the end of CY2023,” he said.