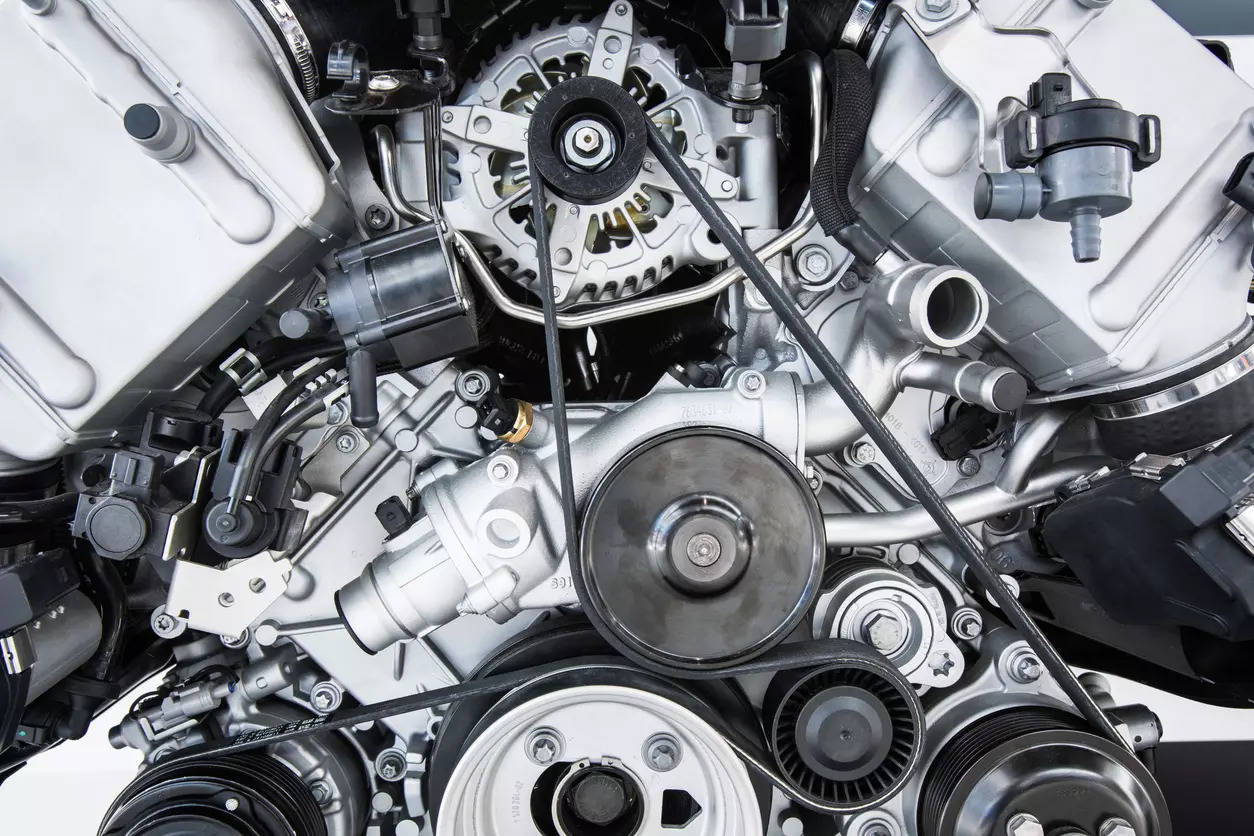

New Delhi: Creating jobs for over 5 million Indians, and contributing 25% to manufacturing GDP, the auto component industry puts India on the global manufacturing map. It could become one of the largest in the world by 2030, exceeding a USD 200 billion market size. India’s auto component exports alone could be worth USD 100 billion by 2030, a more than five-fold growth from USD 21 billion in 2024.

What would it take to make this potential a reality? Can India tap into global supply chain disruptions as a reliable, high-quality supplier of auto components?

We believe this is entirely possible. After all, India has an expanding role as a global manufacturing hub, offers competitive manufacturing costs, and can tap the growing international demand for high-quality auto components. Indian auto component exports to North America could soar from USD 6 billion today to USD 40 billion by 2030. A similar growth is likely in Europe, while exports to Latin America could grow from USD 2 billion today to around USD 13 billion by 2030.

We propose two priorities for India’s auto component manufacturers to capture this opportunity: Further penetrating key export markets (North America, Europe, and Latin America) as buyers there diversify supply sources, and leading the charge on alternative powertrains to meet the growing demand for sustainable mobility.

The US, with its thrust on nearshoring EV component production, offers an opportunity for India to establish itself as a strong trade partner. Indian auto component suppliers can target segments where local demand exceeds local supply, and where they have a manufacturing advantage (such as chassis components, interior components, etc.) with a demand–supply gap as high as 30%.

India’s world-class facilities and cost competitiveness could be a draw for Europe, where over 43% of European component suppliers admit to worrying about rising production costs. Germany, for example, one of the largest European markets, could double imports from India, from USD 2 billion today to USD 4 billion by 2030.

In Latin America, Brazil could see import volumes double from India. Two-wheelers comprise around 75% of Brazil’s auto parc. Some major Indian manufacturers already have local operations Brazil, especially in the two-wheeler market. Indian auto-component players can build on this presence to access the market and possibly grow the share of exports from 4% in 2023 to 9% by 2030.

Reimagining the go-to-market approach for these different markets could be the key for Indian component manufacturers trying to boost exports. For example, some level of nearshoring may be a more effective GTM model to penetrate the EU, where OEMs are increasingly turning to regional suppliers over global ones. On the other hand, a hub-and-spoke model, such as by focusing on Brazil as a hub to serve the Latin America region, may prove more effective in expanding export operations for Mexico, Guatemala, Chile and other nearby countries.

Export growth will require the Indian auto-component industry to innovate at scale for sustainable mobility, which calls for greater investment in R&D. At an industry level, establishing centers of excellence that equip component manufacturers to develop alternative materials through access to training, technical assistance, contacts, and best practices could add a sustainability tag to the “designed in India” brand. Supportive subsidies, tariffs, and streamlined compliance mechanisms could make sustainable manufacturing more profitable and feasible. These efforts could help ensure full compliance with global, tightening sustainability standards, such as the EU’s Carbon Border Adjustment Mechanism and local market regulations on the use of clean energy and recyclable materials.

The contemporary vehicle is no longer just a means of transportation; it has become a highly advanced computing system, replete with sensors, cameras, and software that power cutting-edge functionalities such as infotainment, navigation, and driver assistance. This technological fusion opens vast prospects for innovation and expansion within the auto component industry.

With the backing of a supportive government, proactive industry collaboration, and an unwavering focus on innovation, auto component companies could shape a dynamic industry that brings the world to India and takes India to the world.

(Disclaimer: Shivanshu Gupta is a Senior Partner in McKinsey’s Bengaluru office and Brajesh Chhibber is a Partner in the Gurugram office. Views are personal.)