It’s a phenomenon fraught with many risks. A bubble similar to that in other industries in the past seems to be shaping up in the electric two-wheeler segment. The business case of many companies is built on the promise of scale of such magnitude that is unheard of for any new player in an industry as complex as automotive. Two names stand out–Bhavish Aggarwal’s Ola Electric and Suhas Rajkumar’s Simple Energy. Ola is backed by SoftBank and Temasek among others. It is setting up a 10-million-unit futurefactory in Tamil Nadu. Simple Energy, backed by UiPath and Sattva Group, wants to set up an even bigger facility, also in Tamil Nadu.

Then there are the others including the current market leader Hero Electric, Okinawa, Ather Energy, Revolt, Bounce Infinity, BGAUSS and Bajaj Auto that have all stepped up their game in the past few months proposing bigger investments and expansion plans.

The expected cumulative capacity for electric two wheelers by 2026 is set to exceed 30 million units a year (see chart). It is a staggering number, almost 50% more than the peak sale of 21.2 million two-wheelers in fiscal 2018-19 in India.

Would India need that much capacity even by 2030? Unlikely, even in the most optimistic scenario of all new two-wheelers going electric.

“The announcements do add up to a lot more than the anticipated demand and therefore, it is expected that many would not see an on-ground implementation to that extent,” says Ashim Sharma, Partner and group head, Nomura Research Institute. “Assembly plant capacity alone cannot solve the issues because not everything gets built in-house. There needs to be an entire multi-tiered supply chain built to cater to that capacity.”

In a game of trying to garner crazy valuations, the propensity to exaggerate the potential over a squeezed timeline is obvious. The startup ecosystem does not necessarily look at the long term and investors are only eyeing a shorter timeframe for an exit. Hype is a necessity.

“Capacity is really a combination of a manufacturer’s ability to deliver a certain number of vehicles backed by both demand and a strong supply chain. In the absence of any one of these, it’s hollow,” says Ravneet Phokela, chief business officer, Ather Energy. “You would always want your capacity to be slightly ahead of both demand as well as supply chain but only slightly. If we just mathematically add all the capacities that have been announced it does seem to suggest that the number is higher than at least what we see the demand to be in the next four to five years.”

“There is an incentive for EV entrants to paint a rosy picture of new tech uptake. However, the assumption that growth will be friction free is wrong,” adds Ravi Bhatia, President and Director, JATO Dynamics India. “In India in every category two players dominate. There are a lot of new players entering as cost of entry is low (simpler, cheaper, faster) but the ROCE (return on capital employed) requires volumes. There will ultimately be a time when inefficient players will be weeded out.”

The narrative of hype

The narrative itself is pretty straightforward. As one of the largest two-wheeler markets in the world, India offers a tremendous opportunity for any new electric vehicle company. Including the share of exports, which itself is also growing, around two million new two-wheelers are being produced in the country today. In the future, they will all be electric but for now their penetration is still low. This suggests that the pie will keep growing.

“India is a huge two-wheeler market – there are over 200 million on roads today. There is enormous potential for electric 2Ws and the surrounding ecosystem in India,” says Arjun Seth, an angel investor who has helped found three EV startups in India. “Electrification of transport is here and happening right now. It is only this kind of capacity that will bring affordability and viability. The demand is definitely there and will only pick up in the next few years.”

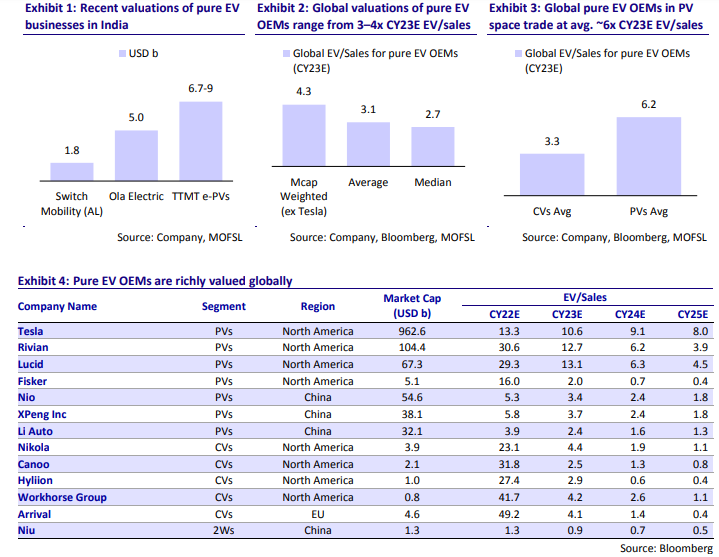

It is this kind of potential that is driving up valuations of companies in this segment. This is luring more entrepreneurs to join the fray. According to a recent report by Motilal Oswal, EV firms in India are currently valued at 3-4 times the estimated revenue four years down the line in fiscal 2027.

“While the advent of EVs is causing disruption for incumbents, it is creating big opportunities for smaller players, new entrants, and startups alike,” said the December 19 report. “Globally, and in India, this has created substantial interest among financial investors in this emerging ecosystem. In India, recent fundraises in the EV segment have been at very rich valuations for businesses that are at the very nascent stage of evolution.”

“The market is large–nearly 2 crore (20 million) two wheelers are sold in the country which within 3-4 years will become 4 crore (40 million) and the EV penetration is still very small,” says Vivekananda Hallekere, CEO and co-founder, Bounce. “I think millions of consumers will shift to electric scooters in the next few years and our product will do a lot of the talking for us. Over the next 5 years, I expect 90%-95% of this 40-million market to be electric.”

The market is large- nearly 2 crore (20 million) two wheelers are sold in the country which within 3-4 years will become 4 crore (40 million) and the EV penetration is still very smallVivekananda Hallekere, CEO & Co-founder, Bounce

Suhas Rajkumar of Simple Energy, who took everybody by surprise last November when he upstaged even Bhavish Aggarwal’s Ola Electric with the claim that he would build a 12.5-million unit factory in Tamil Nadu, says the target is to completely displace the existing internal combustion engine industry as soon as possible.

What has further fuelled the ambition and added to the lustre of the opportunity is the relative absence of the big legacy players in the game.

“The biggest challenge and fear for legacy companies is that when they eventually move to EVs, they may not be market leaders. The industry is transforming itself, new players are coming in, technology is changing and innovative platforms and business models are emerging. Who knows what the future will look like,” says Puneet Gupta, Director–automotive, IHS India. “Two things are certain. One, the current market at around 20 million per annum will grow. Two, ICE is not the future and will change to EV. We are getting close to achieving price parity between EVs and petrol two-wheelers and while most believe the changeover will be gradual, it can also happen very aggressively,” he said.

Where are the motorcycles?

The two main roadblocks in the path of electrification of transport–range anxiety and infrastructure– may not be very relevant to two-wheelers, but they have their own set of challenges. One of the peculiar aspects of the electric vehicle story in two wheelers so far is the dominance of scooters and the negligible presence of motorcycles. Barring Rattan India’s Revolt Motorcycles and a few smaller regional players, the major players in the market today have only scooters in their portfolio. This is in contrast to the traditional two-wheeler market where motorcycles command over 65% share while scooters account for only 30%.

“Motorcycles command 60-65% of two-wheeler sales in the country today and scooters account for the rest. I am sure in future it will be the same in the electric segment as well,” says Rahul Sharma, CEO, Revolt Motors. “We will essentially cater to the same set of customers who are buying motorcycles today. That is 65% of the market. For me, this is the segment where the bulk of the demand will be. Even the shared mobility or delivery segment today mostly uses motorcycles and they will continue to prefer them to scooters.”

Nomura’s Ashim Sharma also flags this as one of the five issues the industry needs to overcome for electrification to take off in a big way.

“I would not discount companies that may have given conservative estimates but are looking at managing some of the key issues including that of the lack of electric motorcycles in the market,” he said.

Not everybody agrees and the lack of consensus is widespread. Both Gupta of IHS and Phokela of Ather Energy believe scooters will command the lion’s share of the market in the electric era overshadowing the motorcycles.

“In urban centres, scooters are growing faster than motorcycles and the trend is likely to continue. Early indications are that the utilitarian segment of the motorcycle market will migrate to scooters while mobikes will become more leisure, premium and performance oriented,” Phokela said. “The mobike user is different and he wants higher range and more performance which means bigger battery, faster charging and all of that means more price. So my sense is that scooters will account for 50-60 percent of the market in EVs and the balance will be motorcycles.”

In urban centres, scooters are growing faster than motorcycles and the trend is likely to continueRavneet S. Phokela, Chief Business Officer, Ather Energy

Even then, there aren’t as many motorcycles on the horizon to support 40% in a 30-million-unit market. The only companies that have ventured into this category–Tork, Ultraviolette and Revolt– have capacities that are a fraction of the scooter makers. At the same time, there is a big question mark whether the supply chain is adequately gearing itself up to the projected steep rise in sales. Unlike the OEMs, not many ancillary units have announced expansion to match them. Further, for a high level of penetration in the market, companies would also need a very wide sales and service network, which is lacking and will take time to build.

“In the automotive space, building a few prototypes is easy but production is hell. This is compounded by the massive chip and electronic component shortage that the entire world is facing. I do think investors will want to look more into the production capabilities of new age companies before buying into their story,” said investor Seth who is also associated with India Angel Network (IAN).

“The bigger challenge is on the supply chain side. The other bit about network expansion is relatively easier to manage. But capacity in the supply chain, be it domestic or through imports, looks like the real challenge,” Phokela added.

Bullish investors

Despite the red herrings, the investor community continues to be bullish and scoffs at the suggestion of a bubble. The main argument is that EVs herald a turning point for the global transport industry where not only the vehicles will change from hardware to a more software dependent orientation but also business models. As such, the required scale would be of a different kind.

“We are at the beginning of the transition and witnessing large amounts of money being invested into electrification around the world. I do not think there is a bubble,” says Seth of IAN. “The use case for electric is clear and it is now a matter of affordability. The governments are doing their bit with subsidies and the players in the ecosystem are working in collaboration. There are plenty of opportunities in the areas like charging infra, battery swapping, etc which are needed to get these vehicles on roads.”

Avaana Capital founder Anjali Bansal believes the momentum would only grow in the years to come. She sees no reason for any anxiety.

“The EV industry is at an inflection point in India, with transition to EV making economic sense instead of just being environmentally beneficial. Improvements in overall product quality, battery technology along with ongoing investments in charging infrastructure being built out by public and private players alike, we expect this transition to gain momentum,” she says.

“We expect EV adoption in India to be dominated by two-wheelers, not very different from the case with ICE vehicles, and in line with the trends in similar emerging economies. There has been an influx of better-quality supply, for both commercial and consumer use cases. A rampant increase in the demand for E2Ws is also witnessed and for all these reasons we believe this trend will certainly continue. Any short-term market consolidation that occurs will be solely on the basis of quality and range, but overall market growth remains highly promising,” she added.

Gupta of IHS says it is easy to understand the high investor interest in EV companies in India as the policymakers have clearly indicated that decarbonization is at the core of the economy in future across sectors including automotive.

“There has been a sea change in the thought process even among people who were earlier a bit skeptical and it is clear that money will only flow into green companies now,” Gupta adds. “The world is moving to EVs and unlike in the past India cannot be a laggard or left isolated. And there is a high probability that the market leader of tomorrow will be a new player,” he added.

The road ahead: consolidate or perish

There is complete unanimity that the market, however big, will not be able to accommodate the over two dozen companies that have mushroomed over the past 18 months. What will follow is a period of intense consolidation where either some companies will get bought over or die. Only about a dozen odd companies will be left standing.

“There’ll be more people who will come and time will tell who will be able to sustain,” says Hallekere of Bounce Infinity. “Investments are required in this. The mobile phone and e-commerce industries also saw something similar–there were a lot of players but finally it converged between three or four players.”

“Wherever there is any good opportunity a lot of interest comes in but only the top group will survive. We will see how much each of us holds in this market,” he added.

Venture capital funds that are backing new age companies today to become tomorrow’s disruptors and champions would also look at cashing in on their investments over the next few years and the window of opportunity may already be closing.

“Investments will dry up eventually and not everybody will remain a startup forever,” says Rajkumar of Simple Energy. “The ideation window is already closed because from ideation to production it is a 28-month journey. We spent 3 years doing that ourselves. So, if somebody ideates today, he will come to the market only by 2025 and it would be too late by then.”

“The top five startups will do well and the rest will either be acquired or they will die because of lack of funds. The VCs will only look at the top 5,” he added.

A lot will depend on the subsidies that the government has doled out which is a major tailwind for demand. A steep reduction in the latter half of the decade could cause a momentary slowdown. In China–the world’s largest electric vehicle market, around 200 startups went bankrupt after the government tightened norms for subsidies with a view to usher consolidation in the market. A highly fragmented market may be good for consumers but is bad for the industry’s profitability.

“In China there were thousands of electric 2-wheeler manufacturers at one point of time across the country. The numbers have come down drastically but the market is different from ours as many of them were low speed vehicles,” says Hemal Thakkar, Director, CRISIL Ltd. “Of course (in India) the ones with volumes in a few hundred may not be able to survive given the fixed costs and technological investments. So, the larger companies may cherry pick the good ones at the right time and we will definitely see closures of a few companies in the bargain.”

The comparisons with China are unending but what led to the swift transition from fossil to EVs was the total ban on petrol two- wheelers in major cities. That is highly unlikely to happen in India so the shift is bound to be slower.

“The industry seems to be working on cost parity scenarios supported by subsidies. In China (which has 50% electric penetration in 2-wheelers) it took a lot more than subsidies as consumer behaviour modification takes a lot longer,” says Bhatia of JATO. “Also infra is easier said than done. China had to ban ICE 2W from big cities to remove competition. It’s difficult to imagine this in India.”

What keeps the investors still interested? The chance of a couple of startups doing a Tesla and disrupting the traditional two-wheeler industry to emerge as segment leaders in future. Even if that means a dozen other companies falling by the wayside, the pay-off promises to be big for those that back the right horse.

“As with any burgeoning industry (like EVs in India) there will be eventual winners and losers,” says Seth of IAN. “Scaling of EV hardware for a startup is very hard and without scale, they will remain uncompetitive. Eventually some would lose out. However, given the size of the domestic market, the winners can win big.”

2030: How big will the market be?

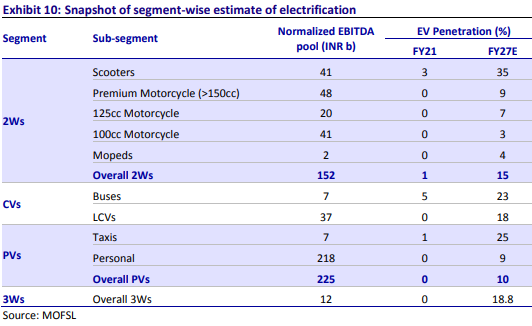

It all boils down to a game of stargazing on how big the market for electric two wheelers will be at the turn of the decade. And there is an absolute lack of consensus on that with varying estimates. The most conservative is Motilal Oswal that expects only 15% of the market to be electric by fiscal 2027. Thakkar of Crisil, Bhatia of JATO and Sharma of Nomura peg it at around a third of the overall market by 2030.

The manufacturers and investors have more optimistic projections. For the same timeline, Phokela of Ather thinks half the scooter market would be electrified while Hallekere of Bounce Infinity believes it would be as high as 90-95% of the scooter segment. Simple Energy’s Suhas Rajkumar says at least 70% of the overall market would be electric by 2030. IAN’s Seth has the most aggressive projection of 65% by 2030 when sales would top 15 million units a year.

“If there is 100% electrification of two-wheelers by 2025 then the 30 million capacity sounds logical. That is the goal as eventually everybody is fighting to replace ICE vehicles entirely. Definitely there is optimism and growth but how much we will eventually grow, that we will know in the next 2 years,” says Rajkumar of Simple Energy. “When you plan a factory, you plan it big to future proof yourself. So that you don’t have to scale it up and expand again and again. That is what we are doing.”

If there is 100% electrification of two-wheelers by 2025 then the 30 million capacity sounds logical. That is the goal as eventually everybody is fighting to replace ICE vehicles entirelySuhas Rajkumar, Founder & CEO, Simple Energy

This disparity in projections is at the heart of the bubble. As the calculations show, even in the most optimistic scenario, utilization would still be half the installed capacity. That capacity itself would see further additions to include the entry of the legacy players–Hero MotoCorp, Honda, TVS, Yamaha, Suzuki and Royal Enfield, over the course of the decade. Some of this additional capacity will be offset by any export potential but the bulk of the production will be for the domestic market. The overall narrative doesnt change and the size of the bubble depends on which set of projections is off the mark.

“Announcements are made by several companies and then they are altered. Alteration seldom gets reported in the media. It’s generally the initial statement that gets picked and is carried through. For any manufacturer to make money or stay in business capacity will be a function of demand and competition and there will be a gradual ramp-up,” says Thakkar of CRISIL.

“Currently, the ecosystem is largely driven by startups or unconventional companies. There is a lot of money that is flowing into the EV ecosystem which is creating more of a demand push than pull,” he added.

The projections notwithstanding, growth can never be taken for granted in India’s automotive industry. The luxury car segment that has stagnated since 2015 or the domestic two wheeler sector itself which is at a decade low right now are prime examples. The electric bandwagon would do well to adopt a measured tone. A decade is a long time.

Also Read: