The industry body said that the commercial vehicle segment has started showing better demand and the market trend for the coming months seems to be positive.

Commercial Vehicles

Pushan Sharma, Director, CRISIL Research expects CV domestic wholesale volumes to grow by 22-24% in fiscal 2022-23 driven by improving transporter profitability, higher fleet utilization levels, materialization of deferred replacement demand and healthy demand from construction and infrastructure sectors.

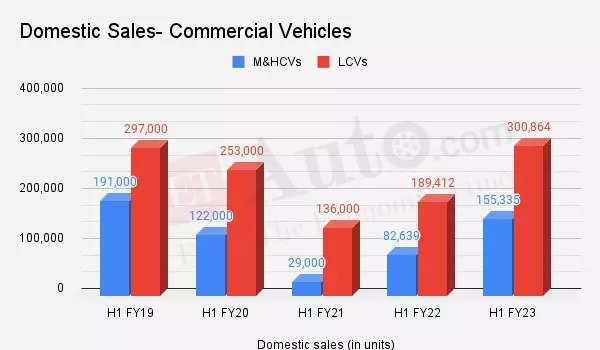

CV players witnessed strong growth of about 67% in H1 fiscal 2023 on a low base of H1 fiscal 2022 exceeding fiscal 2020 levels by 21.5%. Sales in the second half of a fiscal are historically higher than those in the first half attributable to year-end sales push by OEMs and improving construction activities. A similar trend is expected to play out in FY23 as well, however rising interest rates, rise in fuel prices and ambiguity regarding BS-VI Phase-2 can restrict growth in H2, he said.

CV domestic wholesale volumes to grow by 22-24% in fiscal 2022-23Pushan Sharma, Director, CRISIL Research

During April-September 2022, M&HCV sales increased to 1.55 lakh units as against 82,639 units in the year-ago period. Domestic sales volumes of passenger carriers were up 5X to 15,358 units and that of goods carriers almost doubled to 1.40 lakh units.LCVs recorded 3 lakh dispatches up from the 1.89 lakh units in H1 FY22. Here, passenger carriers grew by over 2X and goods carriers increased by 55%.

Sharing a similar view, Kinjal Shah, Vice President and Co-Group Head – Corporate Ratings, ICRA Limited said, “The domestic CV industry is expected to report healthy volume growth over the near- to- medium term as the underlying demand drivers remain positive. Pickup in infrastructure and construction activity, especially in the road segment, which also boosts volumes in the cement and steel sector, is expected to drive growth in the heavier truck segments.”

“On the other hand, the light CV segment would continue to derive support from the positivity in the e-commerce and agricultural segments besides pickup in general trade. Replacement demand would also be a major growth driver, especially for the M&HCV truck segment, given that this has been deferred for over 2-3 years. Accordingly, the average age of the M&HCV fleet in the country is at the highest levels of the past two decades, signifying good replacement potential,” she said.

For the M&HCV (truck) segment, supported by the uptick in construction and mining activity, besides healthy demand in sectors such as cement, steel, the segment is expected to grow in healthy double digits in FY2023. The LCV truck segment, in FY2023, would also continue on its positive growth trajectory, with increased requirements for last-mile transport, especially in e-commerce, supporting growth prospects. Growth in the passenger carrier/bus segment would be high optically, supported by the low base, while other factors such as the reopening of educational institutes and offices, the comeback of tourism, reducing risk aversion towards public transport, would support volumes in the sector, said Shah of ICRA.

According to Motilal Oswal, the CV demand momentum is quite stable and demand has been improving post monsoons, but OEMs are still offering discounts to gain market share. Inventory in the channel is at its optimal level of 20-30 days.

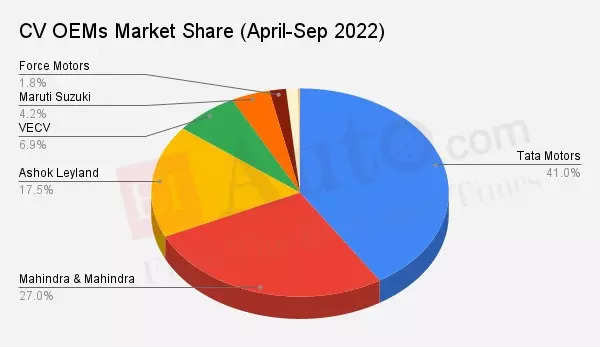

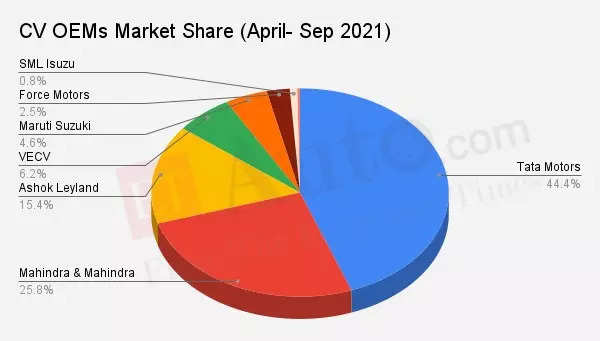

Market leader Tata Motors clocked 1.86 lakh unit sales in the domestic market during H1 FY23, marketing a growth over a year-ago period when it clocked 1.20 lakh units. However, the company now contributes only 41% in the segment sales, reporting over 3 percentage point drop in its market share compared to last year.

Girish Wagh, Executive Director, Tata Motors said that the commercial vehicles industry witnessed a consistent demand in Q2FY23. Tata’s growth in sales volumes was led by sales of MHCVs and a recovery in passenger carrier demand. Improving fleet utilizations, pick up in road construction projects and increase in cement consumption catalysed the demand recovery for MHCVs.

“The recent exciting launches of the new range of smart trucks in MHCV and ILCV, and best‐in‐class pickups will help us serve our customers better. Going forward, while we expect strong sales in the festive season we will maintain a close watch on the evolving geopolitical, inflation and interest rate risks on both the supply and demand,” he said.

Mahindra & Mahindra, Ashok Leyland emerged as gainers during the first half of this fiscal, jumping up about 1 and 2 percentage points respectively. Mahindra dispatched 1.23 lakh units and the latter reported sales volumes at 79,639 units during the April-September 2022 period.

Sanjeev Kumar, Head-MHCV, Ashok Leyland said, “The commercial vehicle market has recovered and is returning to its pre-COVID levels. The macroeconomic environment has improved, and there is strong demand from end-user sectors. Volumes in the M&HCV market have increased due to development initiatives in key industries like construction and mining, higher capital expenditure for infrastructure projects, increased expenditure for road transport & roads, multimodal connectivity, and pent-up replacement demand.”

Launching new products and adding touchpoints has contributed to our growth story. Going into the next half of the year, we plan to further increase our touch points in North & East, he said.

Three-wheelers

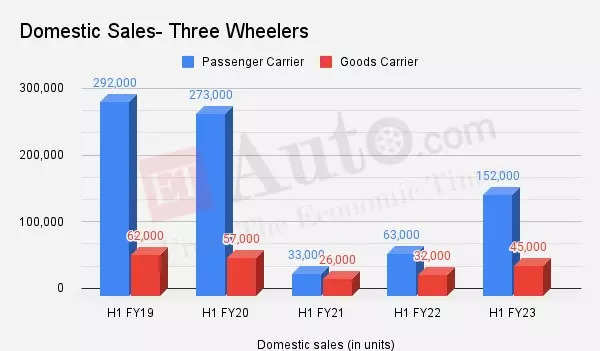

The three-wheeler segment has also seen growth over the last two fiscal years. During April-September 2022 period, the segment reported domestic sales at 1.97 lakh units, still below H1 2009-10 levels, when it was at 2.08 lakh units. The segment hit its peak during the first half of FY 2018-19 when the factory dispatches touched 3.54 lakh units.

3W volumes doubled during H1 YoY, due to growth led by a revival in the passenger carrier segment as well as increased penetration of EVs in the segmentKinjal Shah, Vice President and Co-Group Head – Corporate Ratings, ICRA Limited

CRISIL Research expects three wheeler (goods carrier) volumes to grow by 32-34% in FY23 as demand recovers on a low pandemic impacted base.

“Sales were impacted in fiscal year 2020 to 2022 attributable to the general economic slowdown, Covid-19 outbreak mobility restrictions and impacted incomes of driver owners. Three wheeler (goods) sales have seen an optical growth of about 39% in H1 fiscal 2023 however volumes are still below pre-covid levels, growth momentum is expected to sustain in H2 fiscal 2023 as well but overall sales for the fiscal would still be below pre-Covid levels,” Sharma said.

Kinjal Shah of ICRA said that the segment volumes doubled during H1 FY2023 compared to a year-ago period, due to growth led by a revival in the passenger carrier segment as well as increased penetration of electric vehicles in the segment.

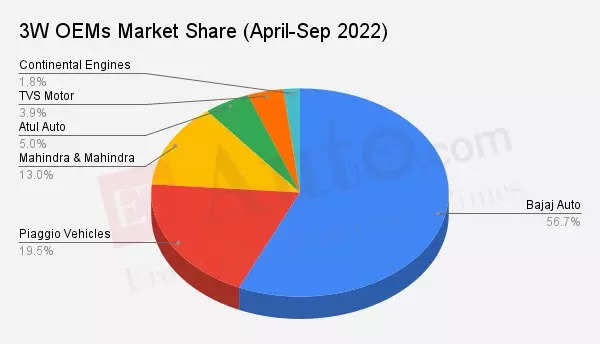

Among the three-wheeler makers, Bajaj Auto lost a significant pie of about 5 percentage points. Its market share currently stands at 57% compared to 62% in the year-ago period. Its sales volumes in the domestic market increased to over 1.11 lakh units in H1 FY23 from just 58,647 units in H1 FY22.

Piaggio Vehicles, on the other hand, gained over 2 percentage points, reporting sales at 38,341 units this year, compared to 16,188 units in the corresponding period of last fiscal.

Going forward, CRISIL sees deferred replacement demand from fiscal years 2020 to 2022, rising e-commerce penetration leading to rising demand for last-mile delivery and increased model availability of electric three wheelers as some of the tailwinds for growth of three wheeler goods carriers.

Transition to sub-tonne LCV for last mile as they are able to carry a higher payload allowing flexibility and the rising interest rates may pose challenges, it said.

Also Read: