Leading the pack is the notoriously high-valued Tesla Inc, which crashed by over USD 519 billion since April 2022. It is more than the combined market cap of Reliance Industries (USD 215 billion) and Adani Group (~USD 260 billion). Though the tumble impacted traditional automakers, its intensity was less than that of these new-age EV manufacturers. The disruptions from Covid-19 and the Ukraine-Russia war crisis had their role to play in this catastrophe for both sides of the industry.

Delusive market cap

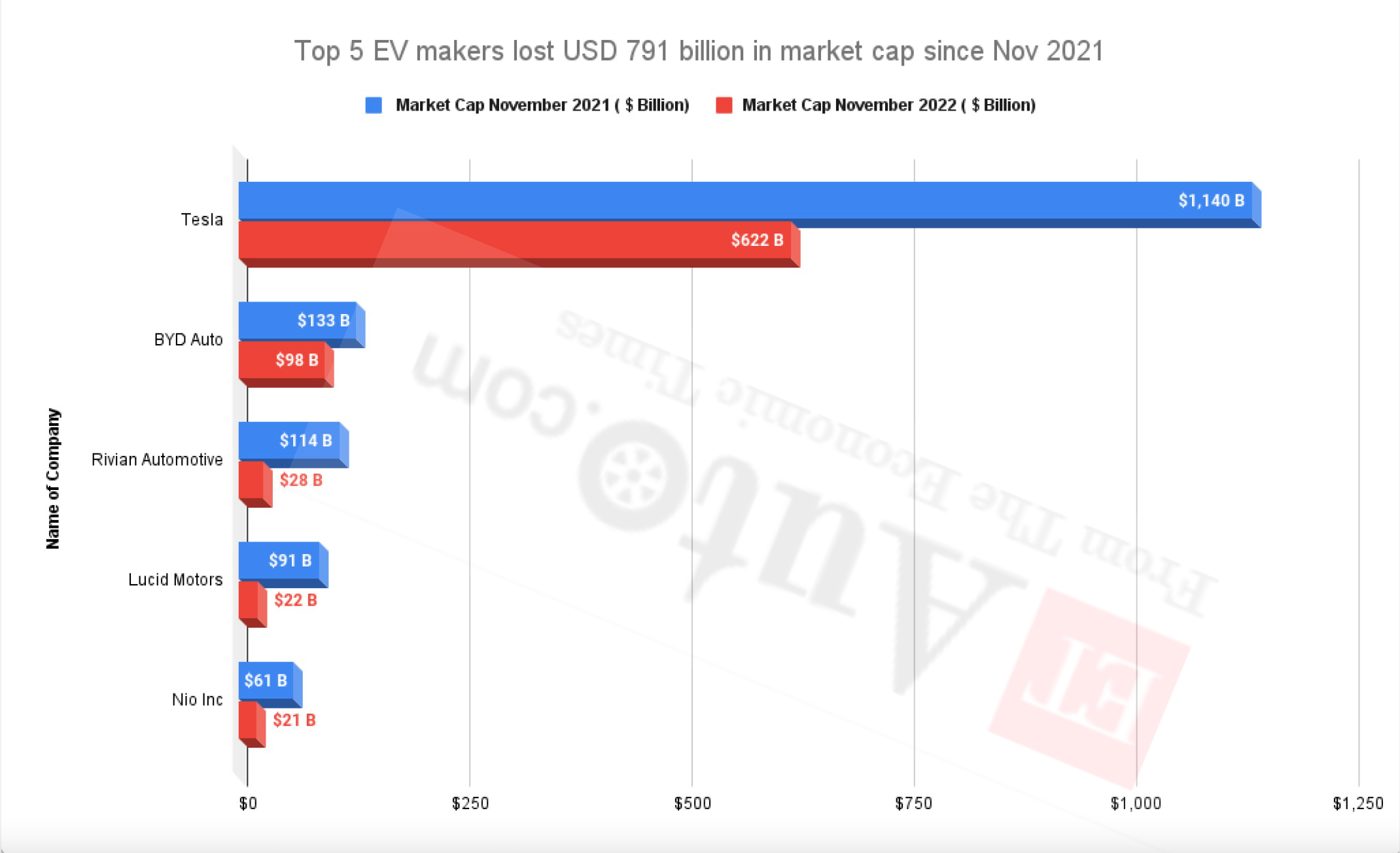

Between November 20, 2021 and November 7, 2022, these new-age mobility companies witnessed a uniform bloodbath in terms of market capital. At the time of filing this report, Rivian Automotive fell from USD 113 billion to USD 28.26 billion, BYD Auto from USD 133 billion to USD 97.69 billion, Lucid Motors from USD 90.9 billion to USD 23.3 billion, and Nio Inc from USD 61 billion to USD 20.9 billion. The fall is common across all other smaller companies also. We chose the above companies as representatives.

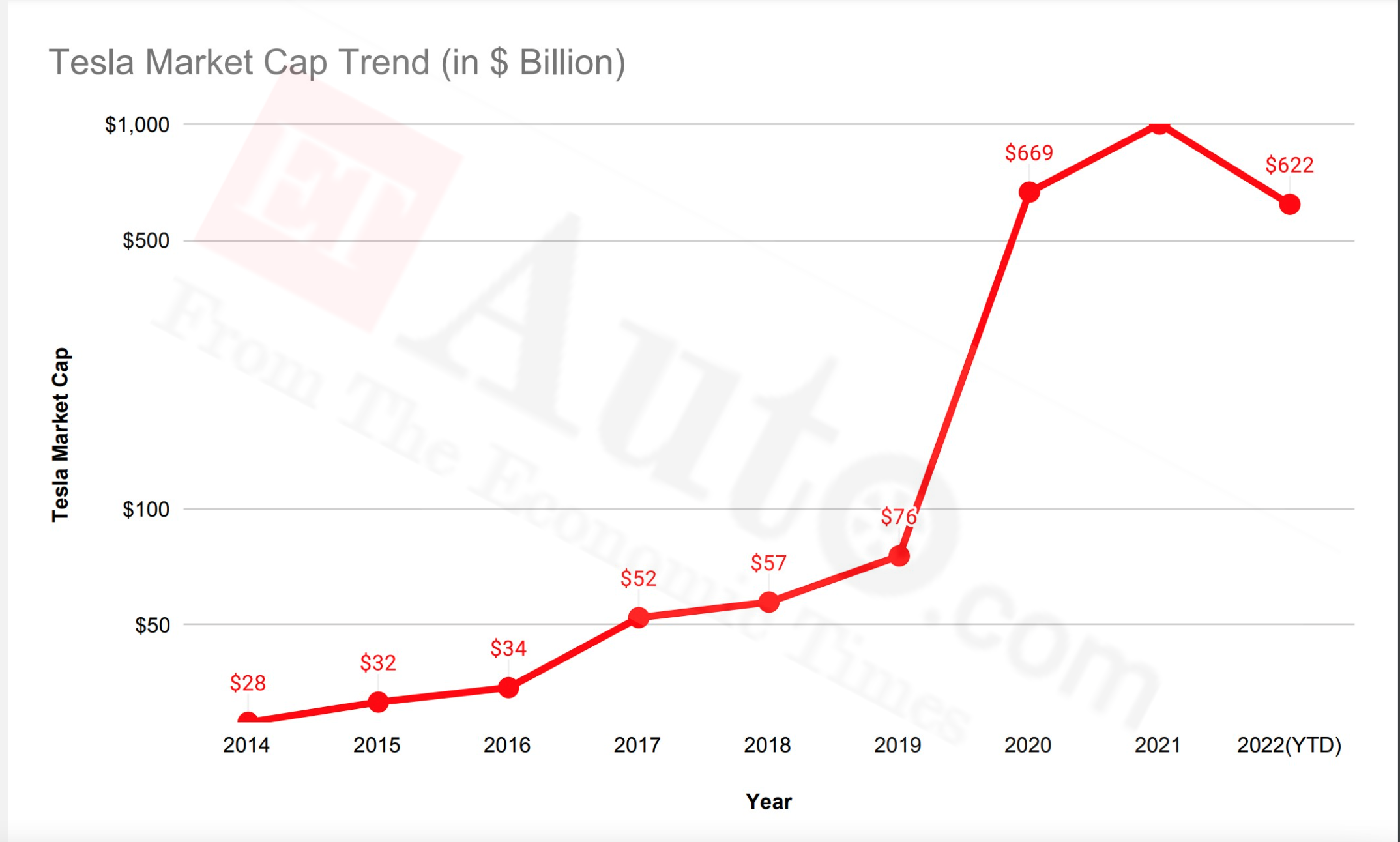

Undoubtedly, Tesla had the most delusive market cap which hit USD1 trillion for the first time in October, 202, and went beyond. After a few ups and downs it recovered to ~USD 1.18 trillion in April 2022. Since then its slide down began with no end in sight.

As on November 7, 2022, it tanked to USD 622 billion losing USD 519 billion since April 2022. This loss in market cap is higher than that of India’s biggest conglomerates like the Tata Group, Ambani and Adani. Each of these Indian Inc. has its market cap hovering around ~USD 300 billion. There is no surprise as Tesla’s market cap was soaring without any strong fundamentals and the crash was impending. The impact on the other four EV makers, most likely, stems from the fall of the mammoth.

Tesla Inc crashed by over USD 519 billion since April 2022. It is more than the combined market cap of Reliance Industries (USD 215 billion) and Adani Group (~USD 260 billion).~

The anomaly continues, Rivian, ranked 14th in market capitalization is placed 4th in terms of business.

“The market cap of companies like Tesla, Rivian etc (I exclude BYD) has been over-priced and due for correction. I don’t think the race to EV will abate. I exclude BYD because it’s a traditional player and it’s pivoted effectively to a very good EV offer,” says Andy Palmer, British auto industry magnate, and often referred to as “Godfather of EV” for launching one of the most successful electric car, Nissan Leaf, in 2010. He is also former CEO of Aston Martin and former Deputy Chairman of Switch Mobility.

The crash saga

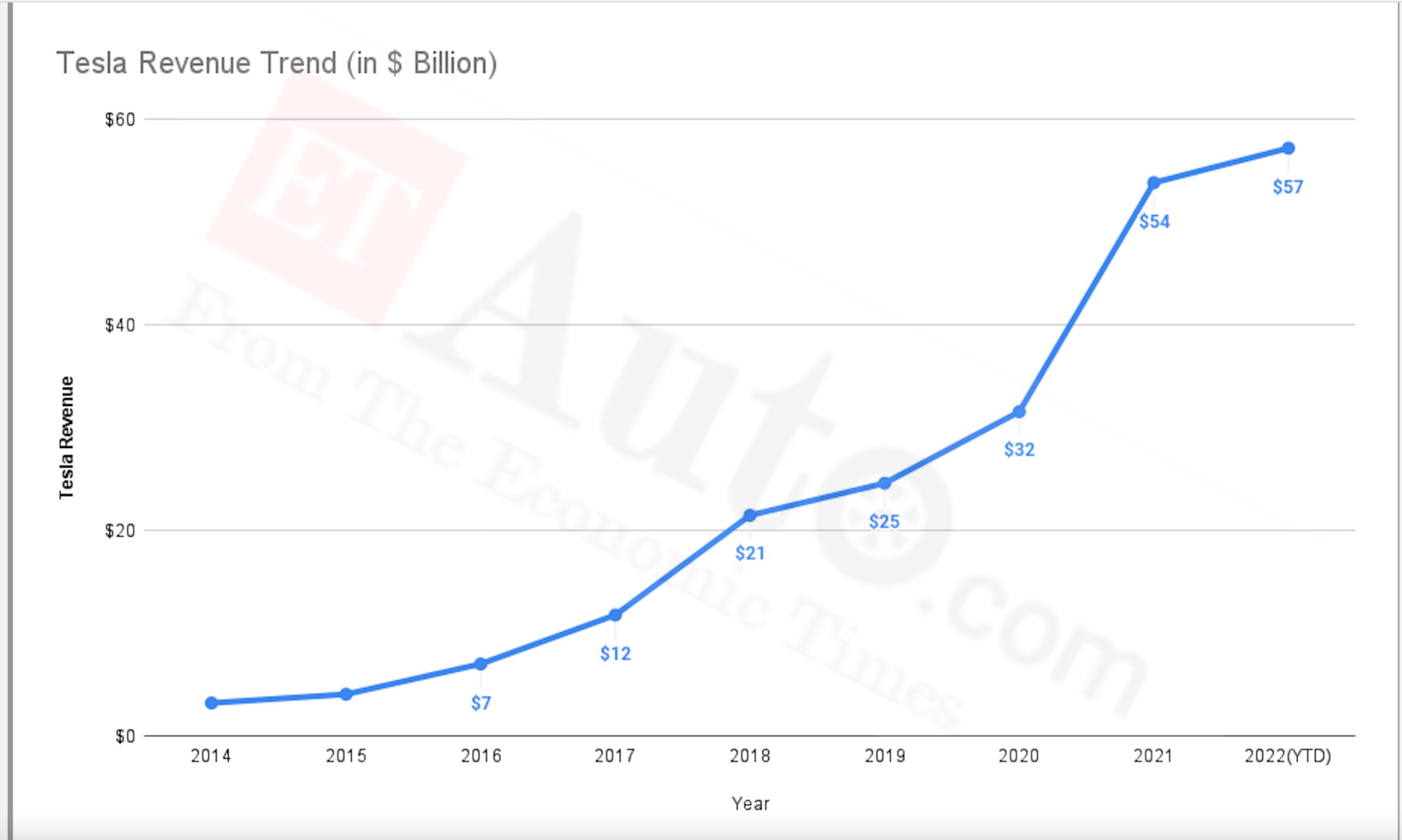

Ironically, by revenue, Tesla doesn’t feature even among the top 10 automobile companies in the world. The German carmaker Volkswagen AG with ~USD 284 billion revenue holds the pole position in revenue terms but by market cap ranks 5th with USD 81 billion. Even the world’s largest automobile company after Tesla, Toyota Motor Corporation, looks like a pygmy with a market cap of USD 187 billion.

Evidently, Tesla’s market cap has been continuously spiralling down despite stellar performance in terms of demand and production. Tesla produced over 930,400 vehicles in 2021, an 82.5% increase over 2020. In 2022 (YTD) Tesla produced 929,910 units with an increase of 42% over the previous year in the same period.

The crash was most likely anticipated by Musk that led to selling of stock worth USD 6.9 billion in August this year. So, what was the magic that worked for Tesla so far and what has gone wrong?

Among the many things that went in favour is the history that manifests Elon Musk as essentially a shrewd businessman and investor. When the story is about Elon Musk, nothing can be simple, it has to be topsy-turvy and multidimensional.

The recent hostile takeover of Twitter and upheavals thereafter display Elon Musk’s signature antics of snubbing and crushing all that comes on his way to profitability. The event strictly is an effort to de-risk the business as the Tesla bubble leaks and eventually fizzles out. He had no option but to monetise and find a new and safer alternative.

Tesla had the most delusive market cap which hit USD1 trillion for the first time in October, 2021, and went beyond. After a few ups and downs it recovered to ~USD 1.18 trillion in April 2022. Since then its slide down began with no end in sight~

Going forward, it looks very difficult for Tesla to regain such a tall market cap as competition mounts from the traditional automakers and new-age startups like Nio Inc, Lucid Motors etc.

What played the magic for Tesla was its excellent design and quality product at the right time, but more than that the reluctance of the traditional automobile giants to accept the transition to electric mobility.

The traditional giants did not want to let go off the huge investments they made in tooling, machinery and R&D. They tried to delay the electrification drive. As electrification gathered speed in the market led by the new-age companies, the traditional automakers also made the plunge. This challenged most of the new-age companies, and opened up multiple options for the investors and customers. The traditional players have the reliability, legacy and trust to attract both the customers and the investors.

“You can now see that the traditional car companies, at much lower market caps, demonstrate their EVs in the market and in some cases they are better than that of the startups,” Andy Palmer pointed out.

Also Read: