By Avik Chattopadhyay

Now, this is a tricky question.

Why would I be indulging in the reader’s time on a subject where numbers can do the talking? As per the Invest India website, the automobile industry contributes 7.1% to India’s GDP, generates employment for 35 million people [direct and indirect], and accounts for 40% of global R&D and 4.3% of the nation’s exports.

It is one of the “pillars” of the economy. Yet, the treatment meted out to the automobile industry is not in line with the stature it should have in the eyes of the policy makers, regulators, and judiciary. Minister after minister takes pot-shots at it, pulling it up and dragging it down for reasons not all within its control or responsibility. It is often accused of being cartelised, profiteering and polluting.

A recent McKinsey report states that one of the six key levers or value chains that can generate $320 billion gross value added within the next seven years is “automotive components and vehicles”.~

The industry has wished for crucial interventions on taxes, scrappage, and infra spending where no progressive action has been forthcoming for years. Can we ever remember such instances in the Indian software industry? Or oil and gas? Or power generation? Not really. Individual companies definitely get singled out but the industry as a body…never.So, what makes the Indian automobile industry a convenient punching bag while others are not?

The category and clout, or lack of it

One can do nothing about the category because it is as it is. But one can certainly work on establishing clout so that people do not use you as a temple bell!

How to build clout? Given the nature of our business and the context of our country, we can do this only by becoming much bigger.

Manufacturing, as a sector is underpowered as being only 14% of India’s GDP. As per 2019 World Bank data, the share of manufacturing has dropped from 15% in 2014 to 14%. In contrast, in China, it is 27%, Bangladesh 19%, Indonesia 20%, Vietnam 16%, Malaysia 21% and Thailand 25%. Even in a developed economy like Germany, it is 20%.

Being at 7% of national GDP and directly employing around 300,000 people in the manufacturing process, the automobile industry does not reach any of the “clout” thresholds of either contribution to GDP or direct employment. The retail sector is 10% of the national GDP, while the IT sector directly employs four million. Hence, they are never messed around.

A recent McKinsey report states that one of the six key levers or value chains that can generate $320 billion gross value added within the next seven years is “automobile components and vehicles”.

So, the automobile industry has to build its own threshold of contribution to GDP to go up to a minimum of 10% by 2025 and reach up to 15% by 2035. Given the nature of the business and with growing automation and robotics getting into mainstream manufacturing, direct employment cannot be a target threshold. So, more will have to be produced and sold. There is no other alternative.

To reach 10% of GDP in the next five years, it needs to plan and execute on three critical fronts.

Produce more 2-wheelers, 3-wheelers, buses and LCVs

These three product segments are what will lead to change. At a market penetration level of 126 two-wheelers per 1,000 and just 1.3 buses per 1,000 [as per SIAM data], the industry has a long way to go. Penetration of cars can take a back seat for the next five years as it is directly proportionate to the number of people upgrading from two-wheelers.

Two-wheelers and three-wheelers are the backbone of our economic growth, both as a business tool and a symbol of sustainable employment. There needs to be a concerted effort by the government and industry to work on increasing affordability by lowering GST and providing massive incentives to fleets and e-commerce platforms. They are also the quickest adopters of electric technology and so will provide the foundation for greater adoption of clean energy.

As more of the “developed” economies start closing trade borders, even for components, the Indian automobile industry needs to play the role of a value-packed solution to the developing and emerging economies.~

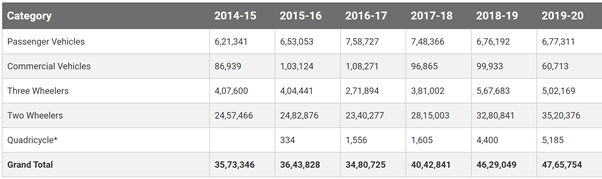

SIAM data shows that with an installed capacity of 27.56 million in 2016-17, the industry produced 25.70 million in 2018-19, before the economic contraction started, well before the COVID-19 crisis. This was a terrific 93% capacity utilisation, in contrast to the 55% for four-wheelers. Though FY21 will be a terrible one, as per ICRA Ratings, with domestic sales contracting by 16%-18% to 17 million units due to macro-economic factors, the very revival of the economy will also be riding on a revival of this product segment. There obviously needs to be a capacity enhancement in the immediate future to spearhead this growth.

Buses have been neglected for long as being the end of the value chain. At a penetration of merely 1.3 per 1,000, this sector has a long way to go. In fact, being high ticket items, with the right GST and incentive structure public transport can truly be democratically public after more than 70 years of independence.

LCVs have always remained as the poor cousins of the big and brawny trucks. It is time they took centre-stage, being along with the two-wheeler, one of the key engines of growth through engagement and employment. As infra projects will always be dependent on budget releases and allocations, MCVs and HCVs will be tied to unstable external factors. The LCV as a tool of individual enterprise will be crucial to sustainable growth, across sectors and applications.

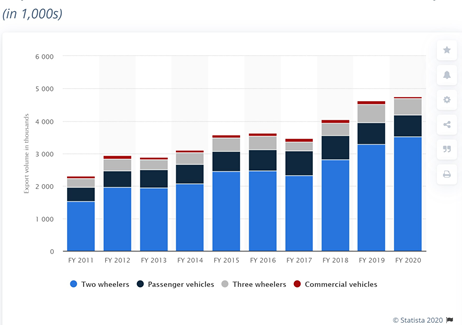

Export, export, export

The industry has regularly underperformed in the export of vehicles. Two-wheelers are the only positive news here in numbers, but exports have never gone beyond 25% of domestic sales in any segment. And this is where the potential lies.

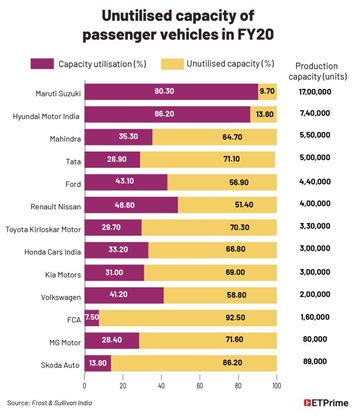

The entire RHD (right-hand drive) market in Africa can be easily catered to by automakers here. The continent is going through its biggest phase of growth, and mobility is key to it. Working at below 50% of installed capacity, car and UV makers should go out and capture these markets while a larger part of the car manufacturing world focuses more on protecting domestic markets and keeping the Chinese out.

The price points offered by Indian automakers cannot be matched in two-wheelers, three-wheelers and LCVs even by the Chinese brands. Africa is still not on the electric bandwagon so ICE vehicles will still power their growth for the next decade. SIAM and other industry bodies have to go out and lobby hard in these markets through roadshows and market-specific agreements.

If the automobile industry is to really ‘build the nation responsibly’, as it states on its website, it has to think, plan and execute its own growth to a level previously never imagined.~

Is the Indian auto industry big enough?

Buses of all lengths will be another big export item from India in all markets looking for increasing public transport networks. Here automakers can also offer electric solutions. The smaller length buses will be a key differentiator for last-mile and rural connectivity.

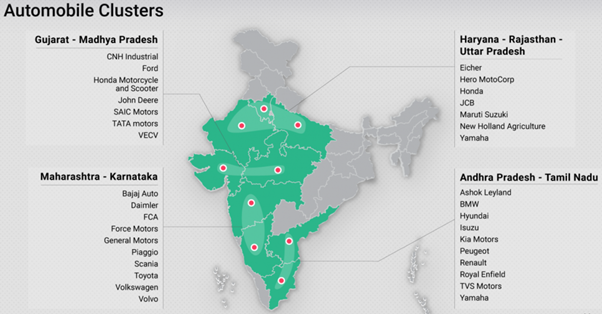

Create new manufacturing hubs

The Make in India website mentions five manufacturing hubs – Chakan, Oragadam, NCR, Sanand, and Pithampur. That was three years ago. The Invest India site is more recent and shows nine hubs.

This will reduce the migration of educated and employable people leading to better ecosystem development in all parts of the country.

Sources say that close to 200 million jobs have been lost due to the COVID-19 crisis, though CMIE puts the number at 120 million. Most of these are in the unorganised sector. Close to six crore unorganised setups have folded up over the last seven months! The famed “pakoda” maker has run out of a sustainable profession as well as earnings.

If the automobile industry is to really ‘build the nation responsibly’ as it states on its website, it has to think, plan and execute its own growth at a level previously never imagined. This is not the 6%-8% normal growth it has been used to. Manufacturing is the only way out for this country. Manufacturing alone offers a sustainable job and salary, ensures workers’ rights and reforms, provides skills and constant upgradation and a symbiotic ecosystem that lives on and feeds into this core activity.

The Indian automobile industry has to take the call to build itself to size and impact that will give it the clout and stature to command respect, not demand it!

(The author is co-creator of Expereal India. Also, he is former head of marketing, product planning and PR at Volkswagen India.)

(DISCLAIMER: The views expressed are solely of the authors and ETAuto.com does not necessarily subscribe to it. ETAuto.com shall not be responsible for any damage caused to any person/organisation directly or indirectly.)