Lockdown and unlocking in the second wave of the Covid pandemic in the country were implemented in phases unlike during the first wave. The impact is completely different from the previous one as the second wave has far-reaching consequences on the hinterland.

Pent-up demand

The lockdown in the country has been stretching this time, starting from mid-April (Chhattisgarh, Maharashtra, etc) and it is still continuing at least in the three states (West Bengal, Kerala, Punjab). The shortage of chips and semiconductors and the interrupted supply chain due to it has delayed the production of high selling models in the country. This has increased the waiting period up to eight-nine months.

This resulted in the delay and creation of pent-up demand and thus the dispatch numbers in June look good in terms of wholesales of the passenger vehicles.

Overall the consumer sentiment is losing strength. Consumer confidence for urban markets has shown only a feeble month-on-month recovery in June 2021 with a slight uptick of 1.4 percentage points, according to the monthly Refinitiv-Ipsos Primary Consumer Sentiment Index (PCSI).Nabeel A Khan

According to the various automobile dealers, ETAuto contacted, and FADA president Vinkesh Gulati, normal time average cancellation of booking remains at about 10% which has now gone up to 30%.

However, it is still slightly lower than the normal average monthly volume of 2.65 lakh units in the post-Covid world while the gap is wider than the average peak volume of 2.8 lakh units a month in the pre-covid times.

Bumpy road ahead

What appears to be one of the biggest hindrances is the fragility of the rural market as it has been hit the hardest due to the pandemic and the post-pandemic economic complications. The fear of a third wave looms large in the rural areas as the inoculation of vaccines is lower because of lack of awareness and misinformation.

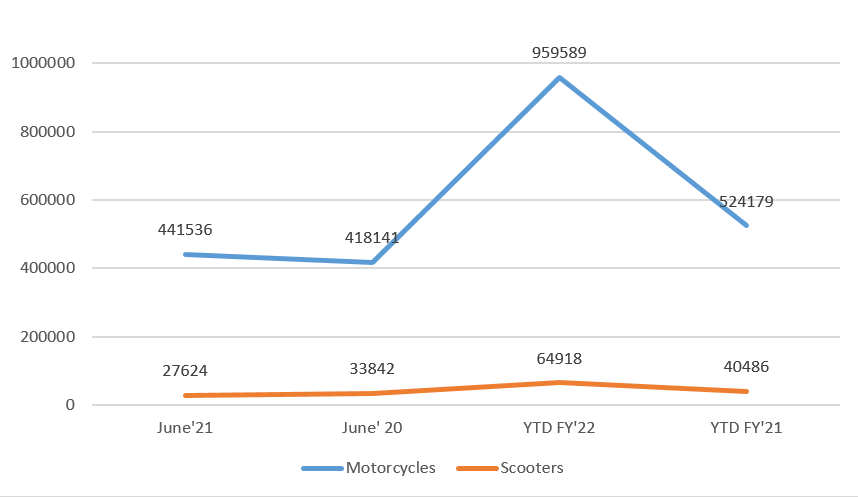

The economic activities in the rural areas are picking up but very meekly. Two-wheeler sales, a major indicator of the mass economic sentiment, have been trailing. Dispatch of the rural market’s favorite, the economy or entry-level motorcycle, in May 2021 has come down to 1.6 lakh from the January 2021 volume of 4.5 lakh units reaching a peak of 5.4 lakh units in March 2021.

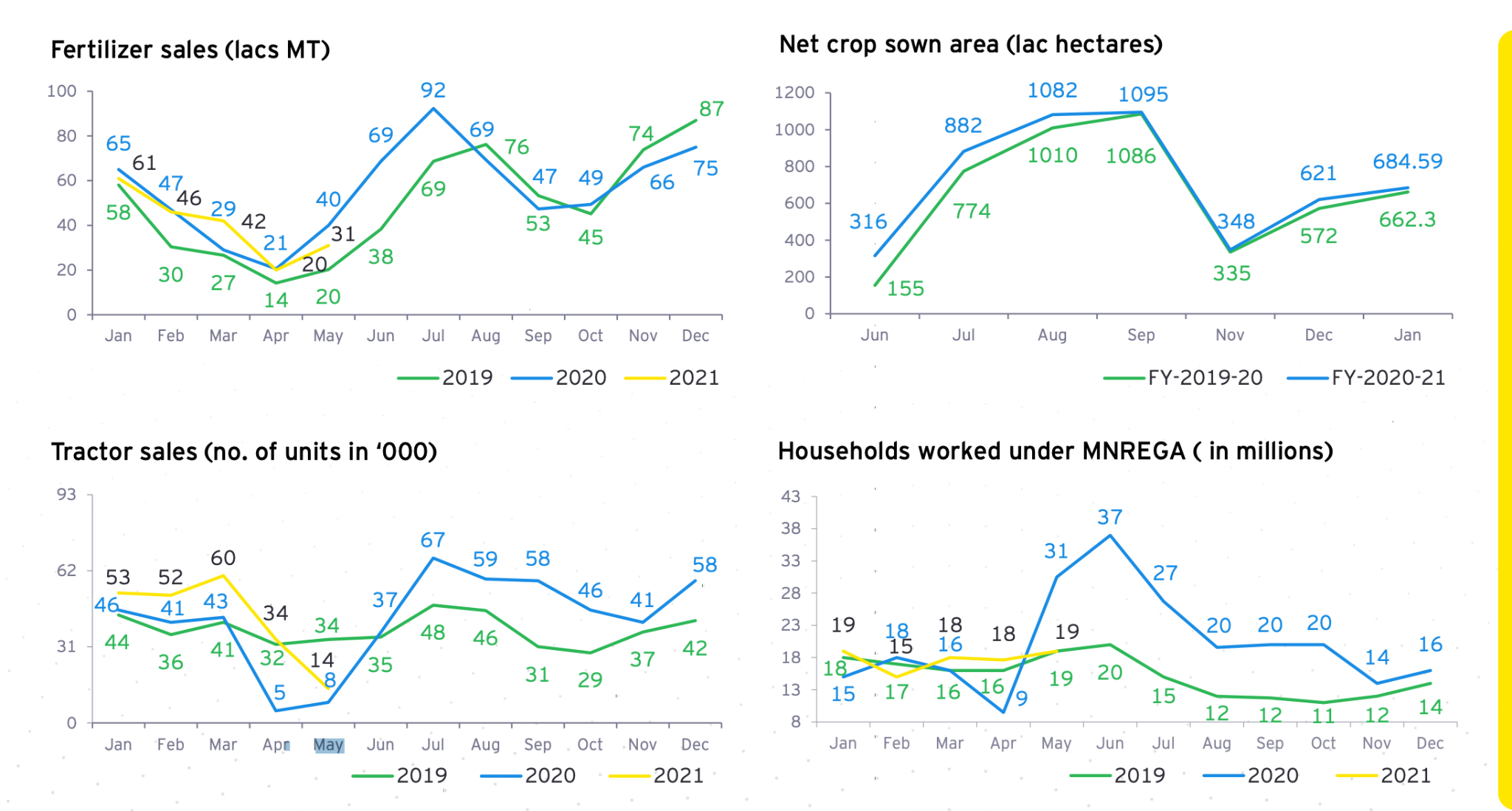

While other factors like MNREGA works and dipping tractor sales are raising the concern about the rural economy. The tractor wholesales have been dipping since early this year and it intensified post-March 2021. From 60,000 units in March 2021 it dipped to 32,000 in April and further came down to 8,000 in May. In fiscal year 2020-21, about 9 lakh tractors were sold with an average of 75000 units a month.

What appears to be one of the biggest hindrances is the fragility of the rural market as it has been hit the hardest due to the pandemic and the post-pandemic economic complications. The fear of a third wave looms large in the rural areas as the inoculation of vaccines is lower because of lack of awareness and misinformation.Nabeel A Khan

However, retail numbers of tractors give some hope, though it showed a sequential month-on-month decline: March – 69,000, April – 38000, May- 16000, and in June 2021 it revived to 52000. It is to note that traditionally, the rainy season, which starts in June-July, is the best for tractor sales.

The delay in the arrival of monsoon in northern states like Punjab, Haryana, Rajasthan, Delhi, and Western Uttar Pradesh remains a concern area. However, parts of Bihar, West Bengal, and eastern UP had a flood-like situation which may also have a negative impact.

For the farmers growing mangoes and litchi, the year was not so great as transportation became difficult and they had to sell at a lower cost even as the retail market had decent selling prices.

Source: EY Economy Watch

Overall the consumer sentiment is losing strength. Consumer confidence for urban markets has shown only a feeble month-on-month recovery in June 2021 with a slight uptick of 1.4 percentage points, according to the monthly Refinitiv-Ipsos Primary Consumer Sentiment Index (PCSI).

It is already on a low base as of May, which saw a sharp plunge of 6.3 percentage points in consumer sentiment. The demand for essentials and the FMCG segment has also seen a weak recovery. Neither a major revival in Job was witnessed.

The urban scooter, an urban phenomenon, has wholesales of about 10% in May 2021, of the normal volume of 4.48 lakh units in January 2021. The increasing price of petrol and diesel hovering around INR 100/litre will continue to mar the buying sentiments for automobile products.

The increasing price of petrol and diesel hovering around INR 100/litre will continue to mar the buying sentiments for automobile products.Nabeel A Khan

Rentals on trucks plying on the main cargo moving routes across the country zoomed by 9%-14% during June 1-15, 2021 with the increase in the prices of diesel and tyres by 6%-8%. These two together accounts for 90% of the variable cost component of the trucking business, says the Indian Foundation of Transport Research and Training (IFTRT).

Rentals on the main truck routes like Delhi-Mumbai-Delhi rose by 11% and Delhi-Hyderabad-Delhi by 10%. On other routes like Delhi-Kolkata-Delhi and Delhi-Chennai-Delhi the increase was by 14% and 12% respectively. This may further trigger inflation.

The silver lining is the remaining few states. Once they open up completely they will add to the numbers. While the upcoming festive season may help sustain the volume, looking at the response of the past festive seasons, it is unlikely to see a major jump.

However, robust demand for the premium segment and SUVs and new launches will help the revival.

Read sales data of Hyundai, Hero MotoCorp, Mahindra Tractor, Maruti Suzuki.