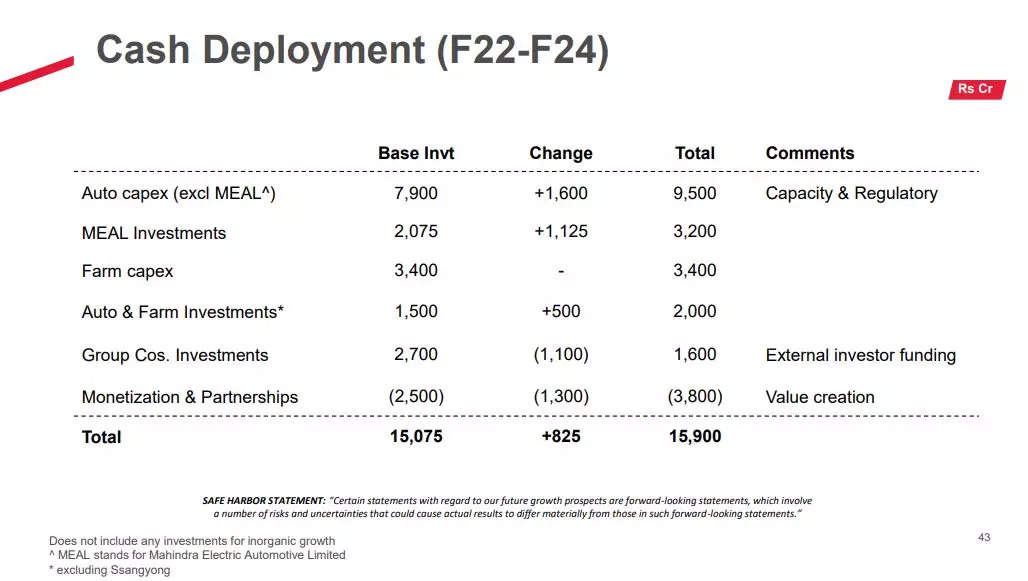

New Delhi: Auto major Mahindra & Mahindra (M&M) on Friday said it has revised the capital expenditure (capex) outlay for the three years investment cycle of FY22-FY24 to INR 15,900 crore. Previously, this stood at INR 15,075 crore. This includes investments into the company’s auto, farm, EV businesses, along with Group company investments and partnerships.

The automotive ICE business investments has been increased 20% to INR 9,500 crore from INR 7,900 crore earlier. The capex for its EV arm, Mahindra Electric Automobile Limited (MEAL) has been revised 54% to INR 3,200 crore as against INR 2,075 crore.

Rajesh Jejuriker, Executive Director & CEO (Auto and Farm Sector), M&M said, “For auto capex, the investments have been revised owing to the anticipated regulatory changes and the capacity expansion. For EVs, it is about making sure that we are changing our requirements in line with what is happening in the market. For auto and farm investments of INR 500 crore, it reflects the investment made in BMTC as part of the deal which we just closed.”

“About two years back when we put out those investment numbers, we were just beginning to draw the blueprint of our EV plans. So it was a very tentative estimate of what we needed to spend. From there on we have evolved to say we will invest in the Inglo platform, there will be about five top hats, and now we are putting out very specific investments. At that time, it was like a broad stroke thinking that this is the kind of money we need to put in for EVs. But the plans have evolved since then,” he explained.

Mahindra’s Group company investments were revised downwards to INR 1600 crore from INR 2700 crore. “…because of the external funding, we think that we don’t need to invest so much in the other group companies,” he said.

Mahindra reported growth of 18% in its consolidated profit after tax (PAT) at INR 2,637 crore for the January- March 2023 quarter. It had posted a PAT of INR 2,237 crore in the year-ago period.

Revenue increased to INR 32,366 crore for the fourth quarter ended March 2023, as compared to INR 25,934 crore in the corresponding quarter of the previous fiscal.

Anish Shah, Managing Director & CEO, M&M said, “It has been a blockbuster year for the group. Auto led the way with record-breaking launches, as we regained the #1 position for SUV revenue market share.”

In March this year, the company stated it had completed the expansion of its production capacity to produce 39,000 units per month. However, it noted that the semiconductor shortages impacted the company due to which it could not meet the monthly SUV production target.

Going forward, it plans to further scale up its capacity to 49,000 units per month from 39,000 units now. Jejurikar said that basis this the waiting period for the company’s XUV700, Scorpio-N, Thar models is expected to reduce substantially by the next six months.

The auto major has no plans to launch any new product this year. It is focused on consolidating the product range, and will launch the 5-door Thar in the CY 2024. The new Thar will compete with Maruti Suzuki’s 5-door Jimny, which was unveiled early this year and will launch next month.

Jejuriker said the company is looking at scaling its farm machinery business to 10X and grow its exports by 1.6X by FY26.

Owing to good reservoir levels, good rabi crop, decent mandi prices, normal monsoon forecast and government spending on agriculture, the auto major is positive about tractor sentiments. “Our estimate for tractor demand for FY24 is low single digits.”

Growth in the international markets will happen in three phases. Phase-I is to cut down the waiting periods and leverage the growth opportunity in the existing market. Phase-II will focus on introducing EV products in the Western region starting with the UK, which is a right-hand drive market. Phase-III which is planned to come in action by 2030 will see the introduction of EVs in left-hand drive mainstream markets like Western Europe.

As the company prepares to unveil its new Mahindra Oja platform in August this year, it looks to expand in ASEAN market as well.

Mahindra also said that it is expanding the Zahirabad facility and setting up a new battery assembly line over there. Currently, its gets batteries from a Korean supplier. It has no immediate plans of making cells for its EV batteries on its own and “is on-track” to evaluate production via Volkswagen tie-up.

In August last year, Volkswagen and Mahindra signed a term sheet to supply the former’s MEB architecture components to the Indian carmaker for use in its Inglo platform-based EVs. The term sheet was signed at an event where Mahindra unveiled its new electric platform and XUV.e and BE series of EVs.