New Delhi:

The first quarter of FY22 was lost to the Covid-19 lockdowns and plant shutdowns. June was the first month of the last fiscal to have sustained production for most of the automakers. One year later, Q1 FY23 was more productive and promising. The threat of the COVID pandemic dissipated, the economy opened up and the auto industry saw growth, though not in all segments.High prices of commodities like steel, copper, aluminium, zinc, nickel, and of precious metals along with semiconductor shortage were the major challenges during the quarter. In spite of these, some passenger vehicle (PV) and two-wheeler (2W) manufacturers increased their market share while a few others lost their ground.

The following is a market share report of the OEMs during the April-June 2022 period, the Q1 of FY23.

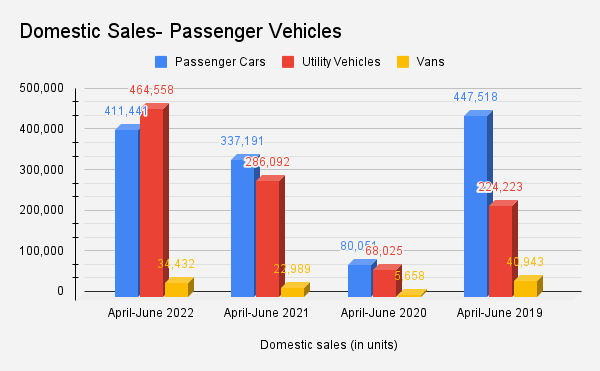

Passenger Vehicles

On a year-on-year basis, the passenger vehicle makers saw improved performance in the first quarter of the current fiscal year. With several new launches, easing of supply chains, softening of commodity prices, increasing interest for SUV style vehicles, and the upcoming festive season, the PV segment is expected to sustain this demand in the next quarter also.

However, within the segment, the major stress has been on the entry-level mini cars category for over three years now. Since its peak in Q1 FY19, the sale of mini passenger cars has dropped 59% from 1.35 lakh units to just 55,000 units in Q1 FY23. Experts suggest this may be attributed to the increase in ownership costs of these vehicles, new regulatory policies, multiple price hikes by OEMs and the decrease in gap of the average price range of entry-level SUV style vehicles.

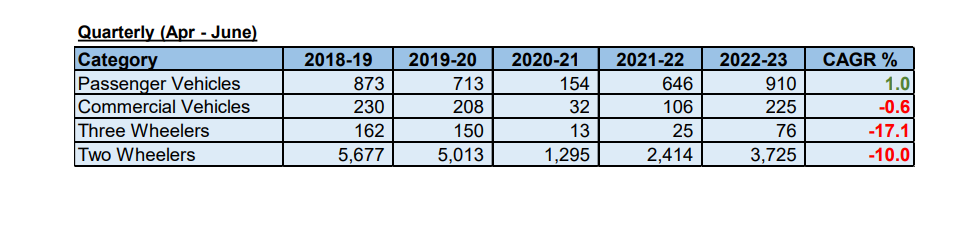

Auto industry body Society of Indian Automobile Manufacturers (SIAM) reported that for Q1 (April-June) of the last five fiscal years, the compounded annual growth rate (CAGR) in the PV segment has been only 1%.

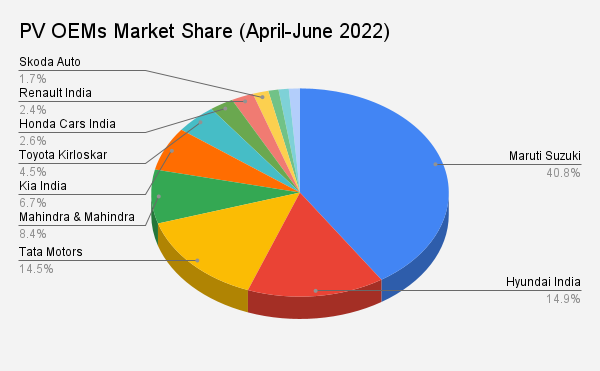

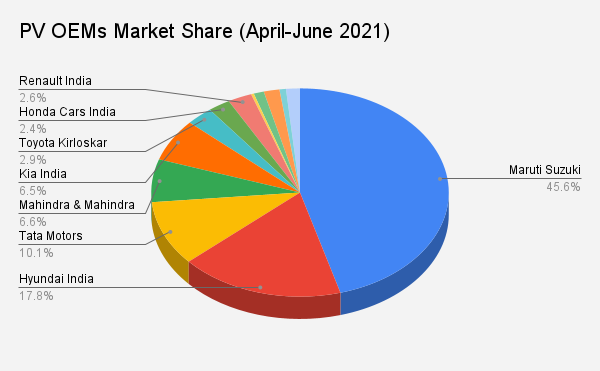

Maruti, Hyundai lose out; Tata turns out the biggest gainer

In Q1 FY23, while some PV makers lost market share to their rivals, others gained by riding on customer traction over fresh product launches, new technology features and better management of chip supplies.

The undisputed market leader Maruti Suzuki India Limited (MSIL) dispatched 3, 69,154 units in Q1 FY23 as against 2, 93,062 units in Q1 last fiscal. It reported about 5 percentage point decline in market share, majorly due to its subdued presence in the SUV segment. However the maker of Swift and WagonR has a lineup of new launches in the coming quarters.

Hyundai India followed by reporting a drop of 3 percentage point in its Q1 market share. The maker of Creta sold 1,35,295 units during April-June 2022 compared to 1,14,499 units in the corresponding quarter of last year.

Among the major gainers were Tata Motors, Mahindra & Mahindra (M&M), Toyota Kirloskar and Skoda Auto with the excitement of their new launches.

Shailesh Chandra, Managing Director, Tata Motors PV and Tata Passenger Electric Mobility, said that the company’s SUV portfolio contributed 68% of Q1FY23 sales. Electric vehicle sales during the quarter stood at 9,283 units. “Nexon EV Max launched in May 2022 has witnessed strong demand. Going forward, we expect the supply side, including that of critical electronic components, to progressively improve.”

The maker of Nexon dispatched 1,31,940 units in the quarter under review, as against just 64,961 units in the first quarter of last fiscal.

Mahindra, the fourth largest PV maker in the country, also reported an uptick in sales to 76,310 units in Q1 FY23, compared to 43,202 units in Q1 FY22. Its market share during this period also grew to 8.4% from 6.6%.

Kia India which entered the Indian market in August 2019 has managed to maintain its position among the Top 5 and sustained its market share of over 6%, leaving behind established players like Toyota Kirloskar and Honda Cars.

SAIC-owned MG Motor, which entered the market during the same time as Kia, has managed to stay in the Top 10, clocking 1% share in the market. It sold 10,519 units in the April-June 2022 period, compared to 7,139 units in the corresponding period of last year.

During the course of the coming quarters, some auto firms are expected to get back to the game by regaining portions of their lost pie, owing to new product line ups in the second half of 2022.

Two wheelers

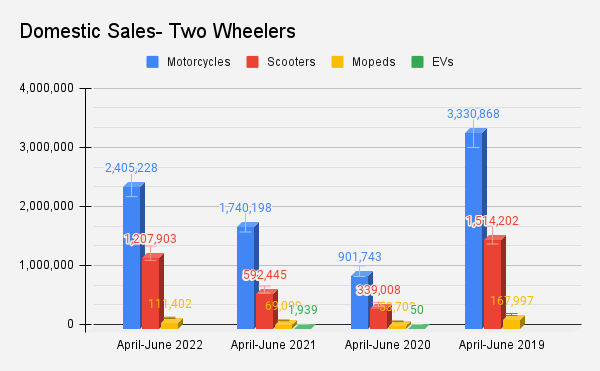

During the April-June 2022 period, the two-wheeler segment dispatched 37.24 lakh units in the domestic market, marking a year-on-year growth of about 54% owing to the demand from the marriage season. The segment reported sales of 24.13 lakh units in the first quarter of last fiscal year.

However, the sector is far from reaching normal volumes and is still below the peak volumes of FY19 when it clocked sales of 56.77 lakh units in Q1 and FY20 when it reported 50.13 lakh units in the same period.

It may be noted that during Q1 FY22, the two-wheeler segment was severely impacted owing to the penetration of the COVID-19 pandemic into the hinterland which reduced rural incomes, led to the temporary closure of dealerships and to higher channel inventory.

Going forward, just like the PVs, the major hurdle is in the entry-level category of two-wheelers. According to SIAM, the sales of scooters of up to 125cc saw a drop of 36% in Q1 FY23 as against the corresponding quarter of FY19. Even the sales of mass segment motorcycles of up to 110cc dropped 42% in Q1 FY23 compared to the peak of Q1 FY19. This was majorly due to a significant increase in input cost, multiple price hike by OEMs and high fuel prices.

Hero, Bajaj lose a big time; Honda, TVS emerge as gainers

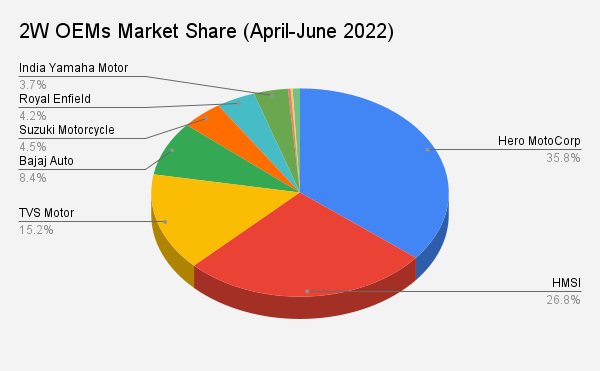

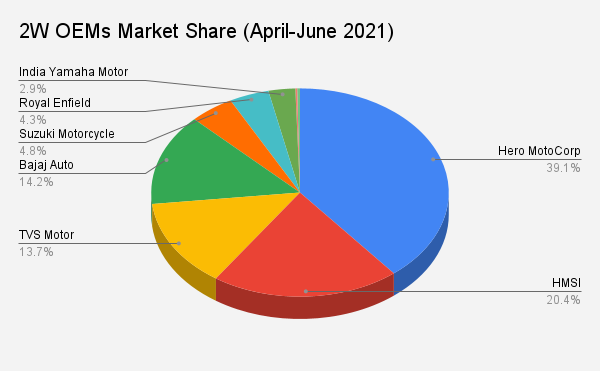

During the April-June 2022 period, country’s largest two wheeler maker Hero MotoCorp reported a market share of about 36%, marking a decline compared to the corresponding quarter of the previous fiscal when it grabbed a pie of 39% which was very close to its peak of 40% mark.

The Pawan Munjal-led company dispatched 13.28 lakh units in April-June 2022 quarter, compared to 9.40 lakh units in the corresponding quarter of last fiscal.

A company spokesperson said that Hero MotoCorp has sequentially registered 3.1 percentage point growth in market share in Q1 FY23 (36.2%) over Q4 FY22 (33.1%), and this is the highest-ever market share gain in the past two decades outside of the Covid-19 impacted years, indicating significant momentum and growth.

Honda Motorcycle & Scooters India (HMSI) and TVS Motor turned out to be the major gainers during the April-June 2022 quarter. Honda’s share grew to 27% with volumes of 9.95 lakh in Q1 FY23 from just 20% when it clocked sales of 4.91 lakh units in the corresponding quarter of last fiscal. TVS marked a year-on-year growth of almost 2 percentage point, growing its volumes to 5.65 lakh from 3.28 lakh.

Bajaj Auto however lost market share owing to the decline in sales of its motorcycles. The share stood at 8% with sales of 3.14 lakh motorcycles in Q1 FY23, vs 14% in Q1 FY22 when it sold 3.42 lakh units.

Suzuki Motorcycle and premium bike maker Royal Enfield (RE) maintained their positions in the market, with 5% and 4% share in the market respectively. Suzuki domestic sales grew year-on-year to 1.67 lakh units in Q1 FY23 from 1.16 lakh, while RE sold 1.57 lakh units, up from 1.04 lakh sold in the same period of last fiscal.

Piaggio Vehicles reported a negligible share of 0.3% in the quarter under review, clocking 13,706 unit sales as against 7,205 units in the same quarter of last fiscal.

With a rapid adoption of electric vehicles in the two-wheeler segment, EV startups also grabbed a tiny pie of the market in the first quarter of this fiscal, as against the corresponding quarter of FY22 when their volumes were hardly making a difference.

During Q1 FY23, companies like Ather Energy and Okinawa Autotech grabbed a marginal 0.2% and 0.8% share respectively in the domestic two wheeler market. Ather clocked 10,551 unit sales, up from 2,052 units in the first quarter of last fiscal, while Okinawa increased its volumes to 29,982 units in Q1 FY23, as against 7,855 units in Q1 FY22.

Also Read: