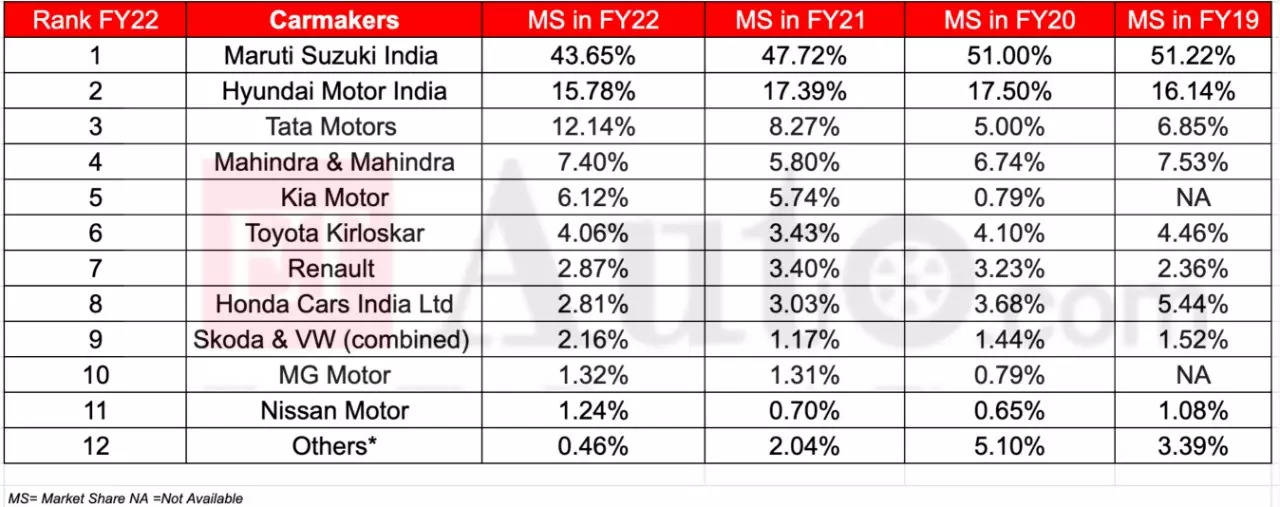

MSIL had been maintaining a market share of about 50% in the Indian passenger vehicle space for a long time and kept the crown of 51% until FY20. So, why did MSIL lose the game?

The onset of a new decade, in a true sense, threw a completely unseen and unprecedented world for all of us. The Indian passenger vehicle industry went through disruptions too. At the centre of it were supply chain crises and volatility in the most part of the business.

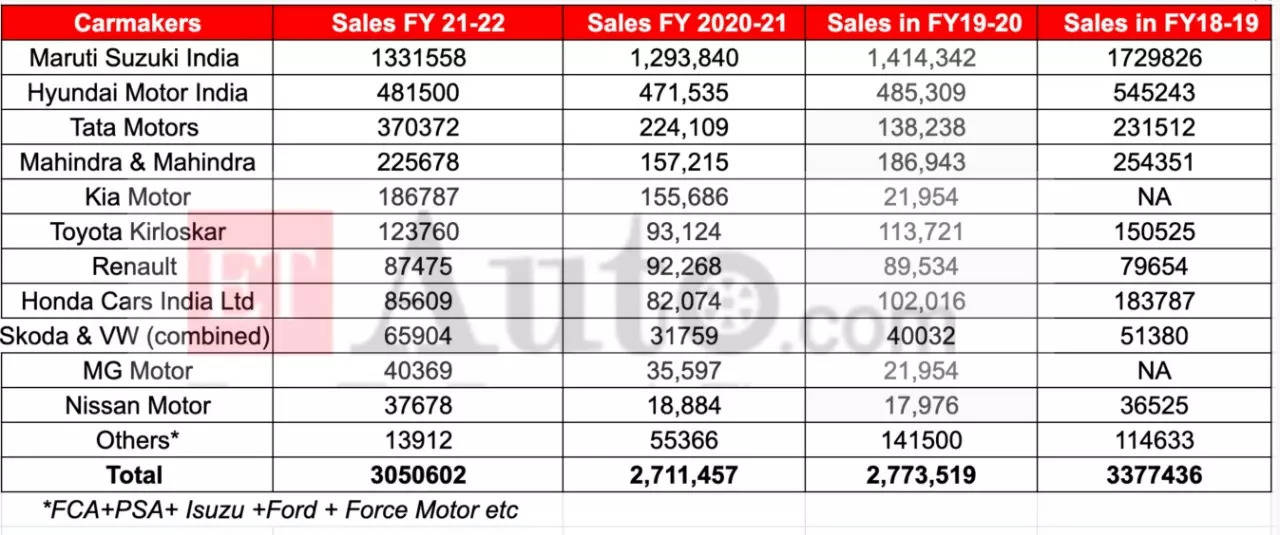

It is noteworthy that this was succeeded by Indian auto inc braving the rude shock of demonetisation and slowing the economy. Withstanding this, the passenger vehicle makers crawled to their peak in FY18-19 with a total volume of 3.37 million units. Even then MSIL kept an unshaken 51% market share.

In due course demand feebled, uncertainties gripped the industry, and eventually overall sales came down. The passenger vehicle industry crashed to 2.7 million units in FY20 and in the recently concluded fiscal it wiggled up to 3.05 million units.

Like most of its counterparts, MSIL also could not escape unscathed. Other ingredients that resulted in the market leader shedding the most are supply chain disruptions, uneven demand curve, and entry of new players like Kia India and MG Motor India. Tata Motors also took away the largest share of the pie. The homegrown automaker doubled its market share to over 12% in FY2022 compared to 6.8% in FY 2018-19.

Factors like increasing demand for utility vehicles (UVs) has also played a key factor in bringing down Maruti Suzuki’s market share. UVs’ share in the total passenger vehicles sales in FY2022 (April-Feb) stood at 45.5%. Even though the crown bearer of the Indian car market is catching up fast in the UV segment, there is still good ground to cover.

Exit from diesel and increasing demand for SUV contributed to the drop in market shareShashank Srivastava

“This year we have seen supply side constraints as well so it may be misleading to arrive at demand side conclusions in what is essentially a supply constrained market. Some manufacturers are obviously affected more than the others depending on suppliers of semiconductor components or the vehicle specs or the exports share in the overall volumes or the base volumes of the OEM . The true demand share pattern will emerge when the supplies become normal,“ Shashank Srivastava, Senior Executive Director — marketing & sales, MSIL argued. He further pointed out that Maruti Suzuki exited the diesel space which is still about 20% of the market. “In fact one third of the competition sales are in Diesel . We have made up for this loss somewhat by increased CNG sales which is now 9% of the industry ,“ Srivastava added.

Country’s second largest car maker Hyundai Motor India maintained its position but slipped closest to the nearest contender for the number 2 slot- Tata Motors.

Hyundai’s market share in FY2022 stood at 15.78% while Tata Motors inched up to its highest market share since 2008-9 to 12.1%. Sibling Kia India also seemed to have gained.

The sister concern of the Korean car major Kia India on the back of massive demand for SUVs secured 6.12% of the passenger vehicle market share to become India’s 5th largest carmaker. Achieving over 5% market share has remained a distant dream for many global leaders like Volkswagen, Toyota, Nissan, Renault FCA, despite being in India for over a decade.

Hyundai Motor India also had a similarly stellar debut in the Indian market. It started operations in 1998 and achieved over 10% market share by 2000.

What lifted Tata Motors’ market share is mainly improvement of its products in terms of quality, design and presence in the right segments. The home grown carmaker has a range of new SUVs starting with the compact segment Punch, Nexon, to mid segment SUVs Safari and Harrier. Exceptionally well designed Tata Altroz has also performed decently in the last few months.

Japanese carmaker Honda Cars India experienced the biggest loss, a drop from being the 5th largest carmaker in the country, to 8th position. Another Japanese auto major, Toyota Kirloskar Motor, did not gain or lose market share in the last financial year. Its share has remained more or less the same four the past 4 years despite inclusion of Suzuki’s re-badged products like Glanza and Urban Cruiser.

Also Read: