By Dharmesh Shah

Equity benchmarks extended losses tracking weak global cues post US FOMC meet outcome last week. The NSE Nifty 50 index ended the week at 15294 down 5.6%. The broader market indices extended weakness as Nifty midcap, small cap indices lost ~6% and 8%, respectively. Sectorally, all major indices ended in red weighed by IT, metal and financials.

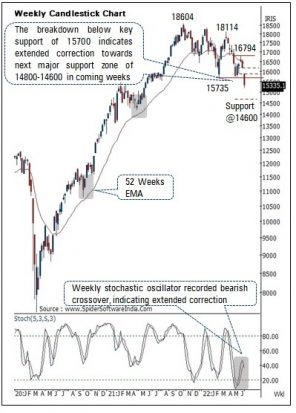

Nifty 50 Technical Outlook

The index witnessed a gap down opening (16202-15877) and drifted southward as the week progressed. The selling pressure accelerated on the breach of key support of 15700 which was held over the past three months. The weekly price action formed a sizable bear candle carrying lower high-low, indicating acceleration of downward momentum. As a result, the daily stochastic oscillator approached oversold territory with a reading of 8. Meanwhile, India VIX regained upward momentum after four weeks’ decline.

The breakdown below key support of 15700 along with across sector sell-off indicates extended corrective phase towards next major support zone of 14800-14600 in coming weeks as it is confluence of:

a) 80% retracement of CY-21 rally (13596-18604), at 14600

b) implicated target of recent consolidation breakdown 16800-15700, is placed at 14600

However, bearish extreme readings on momentum and sentiment indicators suggest that going aggressive short at lower levels should be avoided as technical pullbacks could not be ruled out. Going ahead, for a meaningful pullback to materialise, index needs to form higher high-low on a weekly time frame along with improvement in market breadth. In the process, 15800 will act as key resistance on the up side.

Structurally, the sentiment indicators are approaching their bearish extremes. Historically, such bearish extreme conditions possess the distinctive nature of a technical pullback in subsequent weeks. The key observations on sentiment indicators are as follows:

a) Historically, reading of percentage of stock above 200 DMA below 15 signifies extreme pessimism in the markets. From a behavioural perspective such levels are produced when sentiments are bearish and participation turns low thereby leading to a durable bottom formation from medium term perspective. Therefore, current reading of 14 (which is lowest since March 2020) signifies impending pullback in following weeks

b) Empirically, net advance – decline below -450 signifies market sentiment at its bearish extreme. Current week we observed a reading of -459 indicating extreme oversold market conditions and impending pullback

From a medium term perspective this is an opportune time to construct a portfolio in a staggered manner with focus on Large caps. We prefer Reliance Industries Ltd (RIL), Infosys, Axis Bank, State Bank of India (SBI), Tata Motors, ITC, L&T, ABB from medium term perspective.

Historically, in three instances over the past decade, maximum bull market correction in the Nifty Midcap, Small cap indices have been to the tune of 28% and 38%, respectively. In the current scenario both indices have corrected 22% and 32%, respectively. Therefore, 4-5% correction from hereon cannot be ruled out. However, such correction amid oversold territory would set the stage for a technical pullback in coming weeks.

Nifty Chart

Bank Nifty Outlook

The Bank Nifty extended losses for the third consecutive week and closed sharply lower by 5% at 32743 levels amid weak global cues as the US Federal Reserve raised the rate by 75 basis points (bps) , the biggest increase since 1994, to tame inflation. The weekly price action formed a sizable bear candle with a lower high-low and a bearish gap above its head (34346-33774) signaling extension of the corrective decline. The index, contrary to our expectations, closed below the support area of 33000 levels during the previous week.

Daily stochastic has approached oversold territory with a reading of 13, however, the index needs to start forming higher high-low in the daily chart on a sustained basis for any technical pullback to materialize in the coming sessions. Failure to do so will keep the bias negative and will lead to extension of decline towards the 31000 levels.

Index has immediate hurdle around 33800 levels being the confluence of the lower band of the last Monday’s gap down area (33774-34345) and the 38.2% retracement of the last three week’s decline (36083-32291).

The index has support around 30500-31000 levels being the confluence of the following technical observations:

(a) 80 % retracement of the previous major rally of December 2020 -October 2021 (28976 -41829)

(b) previous major low of April 2021 is also placed at 30405

(Dharmesh Shah is the Head – Technical at ICICI Direct. Please consult your financial advisor before investing.)

ICICI Securities Limited is a SEBI registered Research Analyst having registration no. INH000000990. It is confirmed that the Research Analyst or his relatives or I-Sec do not have actual/beneficial ownership of 1% or more securities of the subject company, at the end of 17/06/2022 or have no other financial interest and do not have any material conflict of interest. I-Sec or its associates might have received any compensation towards merchant banking/ broking services from the subject companies mentioned as clients in preceding 12 months.