New Delhi:

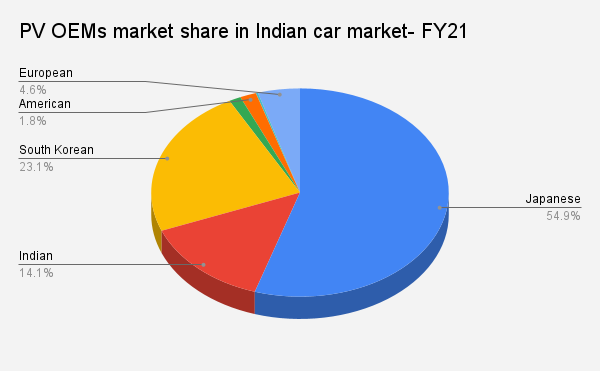

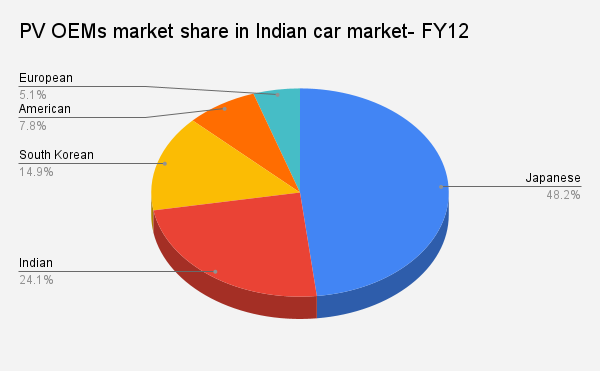

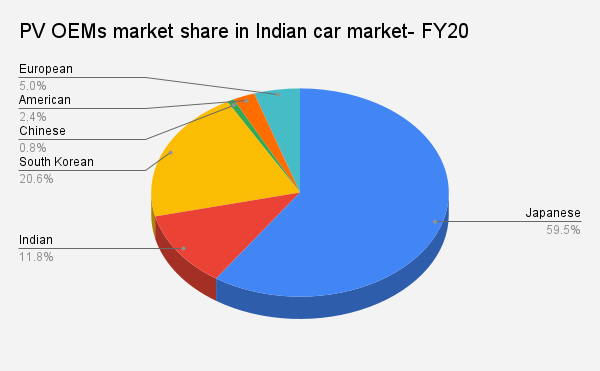

In the Indian car market dominated by the multinational brands the two Indian companies, Mahindra & Mahindra and Tata Motors have together increased their market share by about 5% from the pre-COVID times while many of the foreign brands lost their ground.The Indian OEMs had clocked 14.45% market share in FY19. It dropped to 11.8% in FY20 and rose to 14% in FY21. In the just concluded FY22 the market share jumped to about 19.5%. However, it is way behind the 24% of FY12.

| Country of Origin | OEMs | Market Share FY22 |

| Japanese | Maruti Suzuki, Toyota, Honda, Nissan | 51.75 |

| Indian | Tata Motors, M&M, Force Motors | 19.54 |

| South Korean | Hyundai, Kia | 21.91 |

| European | Volkswagen, Skoda Auto, Stellantis | 3.54 |

| American | General Motors, Ford | NA |

| Chinese | MG Motor | 1.32 |

| Others | 1.94 |

The number of Indian carmakers, which used to be five in FY12, including Force Motors, Hindustan Motors, Ashok Leyland, Tata Motors and Mahindra & Mahindra, has now shrunk to just two primary Indian companies- Tata and Mahindra.

Both the players have been very strong in the commercial vehicle segment. Their entry to the passenger car segment has been gradual and growth has been steady. Tata Motors made significant gains in FY22 by grabbing 12.14% market share from 8.27% in FY21. This is Tata’s highest share since FY09. In the pre-COVID FY19 times, it was only 6.85%. Tata Motors, the highest selling Indian carmaker, is also bullish on its EV game along with the ICE volumes.

Indian PV OEMs have significantly focused on their design and development while improving the quality of their products in the last few years. Tata Motors is emphasizing on safety and Mahindra has a good rural connect with the consumers, said an industry veteran.

Besides the two Indian carmakers now, Force Motors, another Indian OEM, sells a few units of Trax-Gama and Gurkha in the domestic market.

Together, the two Indian OEMs have overtaken the global giants like Toyota, Honda, Volkswagen, and others. Ashok Leyland, a major commercial vehicle player, also contributed a little in the PV market with its Stile MPV. Launched in 2013, it was based on the Nissan Evalia but failed to make a mark with the Indian consumers. The model clocked 776 units in its first year, followed by 346 units in 2014 and just 1 unit in 2015, after which it was discontinued in 2015.

The Japanese carmakers, represented by Suzuki-owned Maruti Suzuki, Toyota Kirloskar Motor, Nissan India and Honda Cars India, overall lost a portion of their share from 62.25% in FY19 to 51.8% in FY22. Interestingly, about a decade ago in FY12, they had only 48.2% market share. The growth was aided by the domination of Maruti Suzuki in the Indian car market which has been here for the longest time and is adept with the Indian consumer’s mindset.

Honda Cars India on the other hand lost the market share which declined from 5.44% in FY19 to 2.81% in FY22. But Nissan India gained some volumes after the launch of its Magnite SUV. Toyota Kirloskar has not moved above 4% in the Indian market since long.

The South Korean Hyundai, the second largest car maker in India, has levelled up its game from a decade ago. The carmaker is now teamed with the sibling Kia which marked its entry into the Indian market in 2019. Kia’s entry and Hyundai’s new product offerings have created a buzz and increased their share by 7% from 14.9% in FY12 to 21.9% in FY22. In the Pre-COVID FY19, it was at 16.19%, which later followed a growth trajectory to 20.6% in FY20 and 23.1% in FY21. However, in FY22, it was down to 21.9%.

Korean carmakers have their strength in technology and innovation. Since their focus on R&D is relatively better, they may come up with better model lineup, the industry veteran said.

European car makers comprising Volkswagen, Skoda and the newly formed Stellantis – a merger between FCA and PSA in January last 2021 – grew from 3.88% in FY19, to about 5.18% in FY20. In FY21, their market share was down to 4.76% and then to 3.545 in FY22. It was at 5.1% in FY12.

Chinese however have been a troubled lot. Back in 2019, there was a buzz surrounding the leading Chinese carmakers, ready to enter the Indian market. Automakers like Great Wall Motors, Changan Automobiles, Geely Automobile, BYD were all set to foray into the cost effective and brimming SUV market. However, only the SAIC-owned MG Motor crossed the border in 2019.

Great Wall Motors, China’s largest SUV maker, has seen its plans facing regulatory hurdles. The maker of Haval SUV had committed close to USD 1 billion for the Indian market.

Meanwhile, the American OEMs were completely washed out. By the end of 2017, General Motors stopped selling cars in India after 21 years of operations in the country. In last September, the other American carmaker, Ford Motor Company, also stopped its Indian manufacturing operations.

Together they grabbed a pie of about 7.8% in FY12 and it got down to 2.75% in FY19. Then only Ford was in the Indian market. Thereafter, it was reduced to nil.

Also Read: