Leasing is adding to the momentum in electric vehicle sales, even as vehicle price remains a dampener in EV adoption, industry executives and experts said.

The EV leasing business has grown substantially over the past 8-12 months, they said. With the base still remaining low, this segment is expected to continue its quick growth.

More than a dozen companies are involved in the EV leasing business. These include Mahindra Finance-promoted Quiklyz, Ayvens (a part of the merged entity of ALD Automotive and Leaseplan), Yamaha Motor subsidiary Moto Business Service, Alt Mobility and Lithium Urban Technologies.

Fleet operators as well as logistics and employee transportation companies are increasingly taking the leasing route to deploy electric vehicles, instead of purchasing them due to the high upfront cost.

Leasing is more economical. For instance, a Tata Nexon EV is priced at INR 14.49 lakh. For a tenure of 48 months, the outflow on an outright purchase, including interest on loan, works out to INR 12.2 lakh after accounting for the resale value. Leasing is cheaper at INR 10.94 lakh, because the cost of maintenance, repairs and insurance are borne by the leasing company, according to estimates by Ayvens. Also, no down payment is required in leasing.

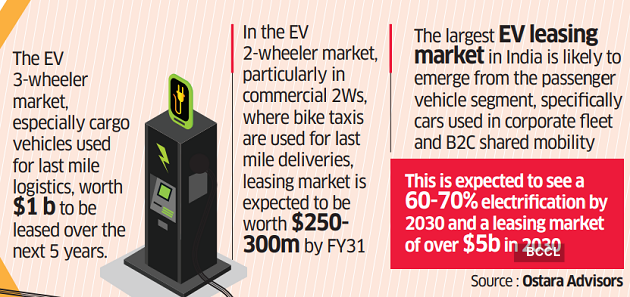

As the “total cost of ownership remains compelling, leasing will form an important way to make EV adoption friction-less”, said Vasudha Madhavan, founder and chief executive of Ostara Advisors, an EV-focused investment bank.

According to Sanjay Krishnan, founder and CEO of Lithium Urban Technologies, “Leasing companies are more malleable than a bank.”

Leasing allows fleet operators to be asset light and channel the capital to other parts of their business, instead of spending on acquiring vehicles. Often, they get an option to also buy the vehicles after the lease period.

As bank financing for electric vehicles is still not easily available, the leasing model is seeing strong demand.

While leasing gives flexibility of ownership, it also absolves the user from technology risk, as the EV industry is evolving quickly, said Dev Arora, cofounder and CEO of ALT Mobility, an EV leasing platform which has deployed more than 7,500 electric 3/4 wheelers (cargo) in the last 24 months.

Many companies are also using the EV leasing option as an employee retention tool. “For the employee, it’s tax efficient,” said Suvajit Karmakar, country MD India at Ayvens.

In India, Ayvens is the largest automotive leasing company with a fleet of 45,000 vehicles, including those running on fossil fuels. Most of these are leased through corporates to their employees. It expects to add 1,500 EVs to the fleet this year, which will be 8% of its annual fleet addition.

“We see employee transportation moving very rapidly to 100% EV fleets. Our business in 2023 saw five times growth and we expect a further five times growth in 2024,” said Nakao Hiroshi, managing director of Moto Business Service India.

Operating cost for an EV is 15-20% lower than a vehicle running on conventional fuels, Hiroshi said.

Quiklyz, the vehicle leasing business of Mahindra Finance, offers customised leasing solutions for electric three- and four-wheelers. “We expect 20% of the leasing business to come from zero emission products like EVs in the next 2-3 years,” said Raul Rebello, MD designate of Mahindra Finance.

The company aims to broaden its EV portfolio in the logistics and last-mile mobility space.

Even though the EV market in India is still in an early stage, the leasing industry is looking to capitalise on the potential growth.

For leasing companies, individual consumers present unique hurdles, like stringent vehicle registration policies, uncertainty around residual values and a lack of robust charging infrastructure, said Ravi Bhatia, president of automobile consultancy firm Jato Dynamics. Additionally, the risk of customer defaults is heightened, as missed payments do not impact credit scores in the same way as traditional loans, Bhatia added.

As the overall Indian EV market continues to evolve, the leasing industry is addressing issues like residual value, battery health standards and expansion of charging networks, said experts.