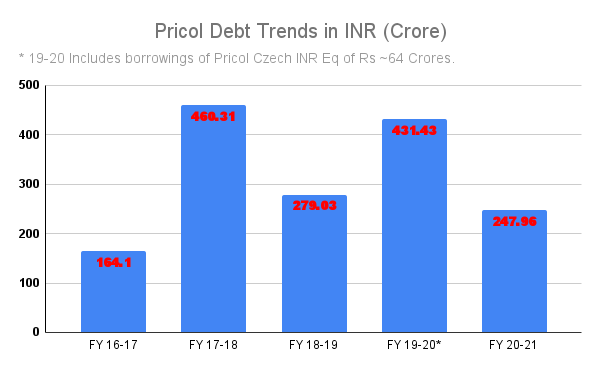

The company’s total debt stood at INR 247 crore in FY21 which came down from INR 431 crore in FY20.

When Vikram took over the reins in 2011 from his father as the Managing Director, the company was going through one of its worst phases. Over the past 5 years, he has completely restructured the company and put it on a recovery path.

However, Vikram said though the company’s capacity utilization is still low, it is generating a good amount of free cash and “our goal in the next 12 months is to become debt-free even at this lower levels of production and demand from the market”. The company remained off the targeted revenue mark of INR 2000 crore from the auto business in 2021.

In March this year the rating agency ICRA upgraded the rating for Pricol Limited to [ICRA]BBB(Stable)/[ICRA]A3+ from [ICRA]BB+(Stable)/ [ICRA]A4+.

However, ICRA said, “The company (Pricol) expects some increase in debt levels going forward from the December 2020 levels because of the incremental working capital requirements following a reduction in creditors in Q4 FY21. Nevertheless, it is expected to be significantly lower than March 31, 2020 levels. With anticipated healthy accruals and absence of debt-funded CAPEX, ICRA expects Pricol’s consolidated coverage metrics to remain healthy over the medium term.”

Another point of concern is that Pricol continues to derive 70% of its revenues from the 2W segment, and 57% from its top three customers. Further, over 90% of the revenue is from the domestic market. In the past three years, two-wheeler production has come down to 15.132 million in FY21 from over 21 million in FY19. To de-risk itself, the company is looking at diversifying through new joint ventures (JVs).

New JVs and product diversification

As the chip shortage and demand crisis grip the industry, Pricol shifts its strategy and beefs up the product line with less dependence on semiconductors. It is also entering the export markets.

Pricol had almost zero export till a few years ago but now it is gradually trying to build up the overseas business.

“We have started developing products for export not dependent on the chip. They include the complex geometry pumps for oil, fuel and water, for stationary engines, heavy vehicles, construction equipment, and for customers like Caterpillar, Polaris, Polar, Generac, etc. Demand for them is now picking up and we have confirmed contracts and those projects are slowly building up volumes,” Vikram said, adding that he sees deemed export is growing significantly and in the next two to three years it will also improve the bottom line.

The company gets 60% of revenue from driver information system (DIS) and claims that it is the second-largest DIS player in the two-wheeler market globally by volume and the fourth largest for commercial and off-road vehicles.

We are looking at a JV in the wiping systems to expand this businessVikram Mohan, Managing Director, Pricol Limited

Also as a part of the exercise, over the next few months, the company will be announcing a series of technology partnerships in HMI, in advanced vehicle information systems etc. It recently announced a tie-up with an American company called Candra Technologies.

“All of these partnerships will help us be among the lead players in DIS in specific areas of 2-wheelers and commercial vehicles and that we have a very large market share and a global leadership position,” he informed.

“Our pumps vertical is expanding both organically and looking for opportunities for inorganic growth. We also have plans to get into newer areas like coolant pumps, etc. for which we have tied up for technology. In the wiping systems, we are looking at growth through a joint venture,” he said.

“We are also talking to at least two global majors where we will be announcing JV companies. It could be 49:51 or 50:50 or 26:74 also in the next six to 12 months to get into new product lines and also to enhance offerings in the sensing space in the vehicle – the various electronic sensors that are coming in the vehicle in the future,” Vikram said.

New investments

About new investments Vikram said, “It is too early to discuss investment plans. Probably in 3 to 5 months, I will be able to comment on this as it is still under wraps. But one of them is definitely going into the automotive sensing space where we are getting more and more into electronic sensors.”

Today there are almost 120 sensors in a vehicle and a vehicle is going to get driven more and more by various sensors feeding in and driving the vehicle.

Vikram declined to comment on the product line details of the second JV, but he informed that this is an OEM-driven project. In fact, OEMs want them to get into business.

Both the JVs are going to be with foreign collaborators but primarily to service the Indian Market to start withVikram Mohan, Managing Director, Pricol Limited

Both the JVs are going to be with foreign collaborators but mainly to service the Indian market to start with. “We are looking at one JV with an Asian company and one with a European company,” Vikram informed.

The company is also trying to beef up exports. “We have started off in the space of the pump, working with stationary engines and off-road vehicle markets that will go to about INR 400 crore in the next three years. It will be a significant portion of our revenues going forward contributing to at least 25% of our bottom line. And that is a very clear strategy that we have to keep increasing our exports from a mere zero a few years ago,” he said.

Focus on R&D helps improve EBITDA

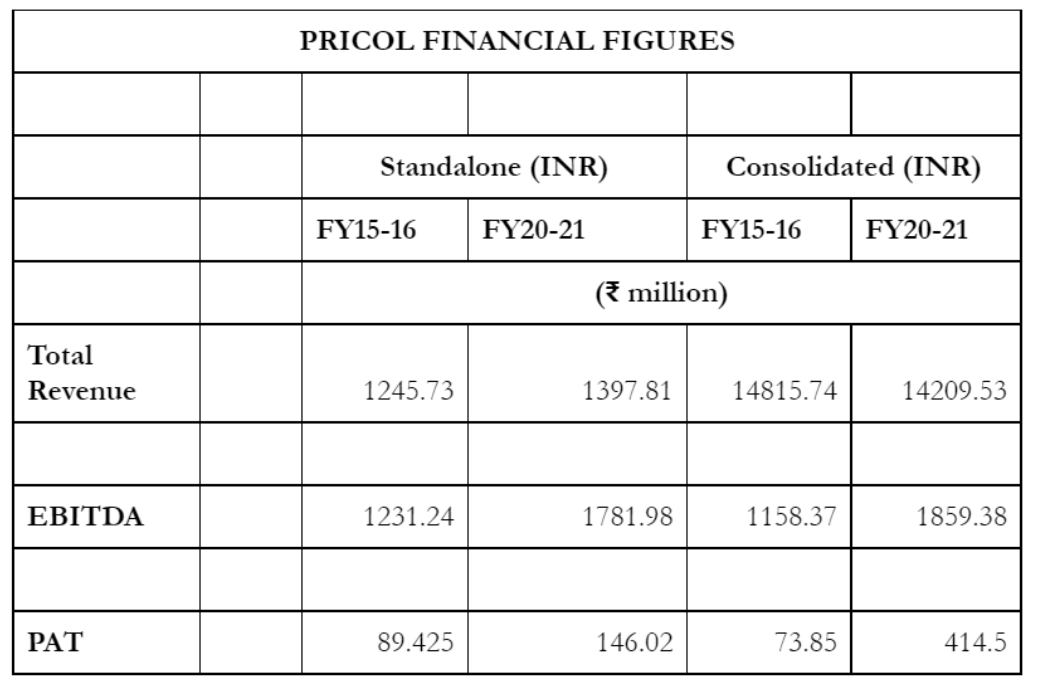

Pricol is becoming more of a technology player than a component manufacturer. While the average expenditure of the Indian automotive industry on R&D is about 2% to 2.5% of revenue, Pricol has taken a conscious call in the last five years to spend anywhere between 4.5% and 5% of revenue on both product and process technology.

“As part of moving up the value chain, out of the 800 white-collar employees, about 300 work in the R&D department,” Vikram said.

“This focus has resulted in helping us improve EBITDA and costs and also develop a slew of new products that have increased revenue and runway of products,” he added.

So, the spend on R&D, both product and process technology, will continue to be at around 4.5% of revenue both for this financial year and for the next. Whereas CAPEX is going to be near-zero.

I think Q3 of FY22 is perhaps going to be the worst quarter for the automotive industryVikram Mohan, Managing Director, Pricol Limited

The company feels relieved as it is on a CAPEX light mode or a sustenance CAPEX model for the financial years 2021, 22, and 23. However, it added two new plants and the capacity of many of the existing plants due to the increased demand in business and for the new products that it introduced.

“It will be more substance sustenance Capex and no significant Capex to increase top line. We do have plans for another significant round of Capex in FY24 to cater to some newer products and demand that we are anticipating at that point of time,” he said.

Vikram further added that the demand forecast is down by at least 30% and in the same line the company expects a drop by 30% in its turnover compared to expected sales of INR 1850 crore for this year.

“So, at a capacity utilization level, we are at about 60% right now. And with the changing product-mix we have a capacity and the runway and confirmed orders of business to take us to about INR 2200 crore to INR 2400 crore” he said.

Worst is yet to come for the industry

The supply chain crisis arising from chip shortage will worsen in the third quarter of the financial year 2021-22 Vikram said.

“I think the problem is reaching its peak and Q2, the quarter that has just closed, and Q3 of the current financial year FY22 would perhaps be the worst quarters for the automotive industry. This comes when the companies in China are cutting back production because of the electricity crisis,” he told ETAuto in an exclusive interview.

The industry is going to see the worst quarters possibly in the automotive industry so far, barring the first quarter of the last financial year which was a washout for most companies, Vikram said.

He believes that from January 2022, there will be some degree of relief and normalcy is likely to come back to the automotive sector in September or October 2022 and not before.

We don’t focus on the PLI scheme, we will grow our business independentlyVikram Mohan, Managing Director, Pricol Limited

About the recently-launched Production Linked Incentive (PLI) for the auto sector, Vikram said “We are not really focused on the PLI scheme because our business plans are independent and we are not building our business case based on any government subsidies.”

He emphasized that the industry is moving up in the technology curve. For example, ten years ago, the average price of a DIS, which was called an instrumental cluster in those days, was about INR 300, and today it has jumped to INR 1000 for a two-wheeler. In the next two years, it is going to become closer to INR 1800 and we are also developing much more complex DIS systems.

“We are focused more on tech and less on the product because technology disruption is so fast in electronics, not just in electric vehicles and electronics per se, and that is our focus area,” Vikram added.

Also Read: