New Delhi: With gradual improvement in the semiconductor supplies, demand in rural areas, new product launches and growing trend for SUVs, passenger vehicles clocked the best ever domestic dispatches for May this year.

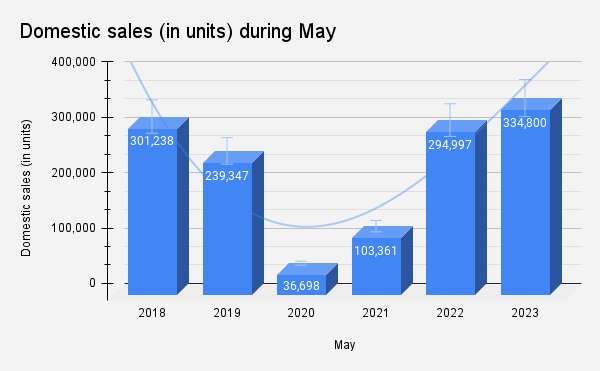

Shashank Srivastava, senior executive officer (marketing and sales) at Maruti Suzuki noted that May 2023 was the best monthly dispatches ever for the month of May. The previous high was in May 2018-19 with wholesales of 3.10 lakh units.

The two wheeler segment which has been under stress for a long while now, has also shown green shoots owing to the replacement demand and wedding season.

The following is a segment-wise report of vehicle dispatches to dealers during May 2023.

Passenger Vehicles

According to industry estimates, the domestic PV sales volumes during May 2023 marked a YoY growth of 13.5% and stood at 3.35 lakh units, as against 2.95 lakh units in the year-ago period.

The company’s utility vehicle sales, including Brezza, Grand Vitara and Ertiga, grew 65% to 46,243 units as against 28,051 vehicles in the corresponding month last year.

Srivastava said that the retail volumes in the industry were less than wholesale for the second consecutive month where retail lost 325,258 units. But when compared with May 2022 it stood at 2.85 lakh units, marking a growth of about 14%.

He expects the retail volumes to lag behind the wholesale. ”Due to semiconductor issues for the past few years the channel inventory was being limited. So, as the situation normalizes and production becomes better, there will be an increase in the network stock.”

The PV channel inventory is at about 26 days in the industry, which is still slightly less than what it used to be during the pre-COVID, when it used to be about 30 days. So till the time it reaches this, wholesale is expected to exceed the retail. As the semiconductor situation gets better and we see availability of popular models, retail is also likely to boost, he said.

Some of its models including Ertiga, Brezza and Grand Vitara were still facing production issues. However, he stated that the Q2 should be better.

Industry estimates overall pending bookings at around 6.6 lakh units.

Veejay Nakra, President, Automotive Division, M&M said, “We continue our growth trend, backed by strong demand in SUVs. The sales volume for both SUVs and Pik-Ups were restricted by a short-term disruption in engine-related parts at the supplier end. The semiconductor supply constraints on specific parts like Air Bag ECU, continued during the month too.”

Hardeep Singh Brar, National Head, Sales & Marketing, Kia India said, “Although we faced some production limitations due to our plant annual maintenance shutdown for a week in May which impacted our numbers, we are confident of strong performance in coming months.”

During May, iMT technology contributed to 38% of Kia’s total sales.

Two Wheelers

“The momentum is expected to continue in the coming months, driven by an uptick in customer sentiments, forecast of normal monsoon and a host of new launches in the premium segment,” Hero MotoCorp said in a statement.

Commercial Vehicles and Three Wheelers

Auto major Tata Motors reported a 12% dip in domestic sales during the month.

Tractors

Hemant Sikka, President – Farm Equipment Sector, Mahindra & Mahindra said, “Record high Rabi crop output, good reservoir levels, improved terms of trade for farmers and IMD’s prediction of a normal southwest monsoon augurs well for the upcoming Kharif season..”

“Overall, the macroeconomic factors and farmer sentiments remain positive, resulting in a positive sales trend across most geographies. Going forward, we expect the current momentum to continue in the near term led by normal rainfall forecast, adequate reservoir levels, better liquidity and consumer credit availability,” Escorts Kubota said in a statement.

(This is a developing story. We will keep updating as OEMs release their sales data).