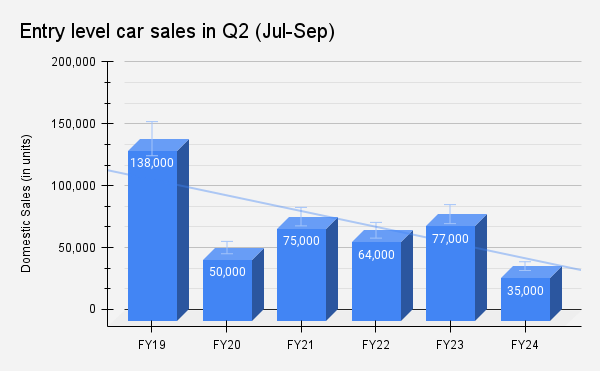

New Delhi: With demand for SUVs on a record-high and a number of new launches in this segment, the passenger vehicle (PV) industry has been reporting highest-ever sales numbers this year. However, a part of the industry has been on a constant decline- the small car segment.

The market for the entry level cars has not improved at all this year. In the July to September 2023 quarter, it has gone down quite significantly. But with about 16-18 million two wheeler owners in India, who are potential buyers of this segment and the kind of demographics that we have in India, the demand for entry level small cars has to come back, RC Bhargava, Chairman, Maruti Suzuki, said in a post-earnings call on Friday.

“We are now the fastest growing economy, with income levels in India going up. If the prices of cars stop increasing as rapidly as they have in the past because of regulatory norms and other changes, the affordability factor which is the reason for small car sales going down, is going to gradually erode. And in the next 2-3 years, we will find that people will be able to afford a small car once again and its market will gradually come back,” Bhargava said.

Future customers for SUVs or sedans will largely come from the people who have moved up from the entry level category. We will not get a lot of new entrants into the INR 15-20 lakh segment, so the revival of small cars is important, he added.

Earlier, ETAuto reported how Maruti Suzuki expected the rule for mandatory six airbags to have a major impact on the cost and subsequent demand scenario for entry level cars.

In March this year, the automaker discontinued the production of Alto 800, one of the most affordable and bestselling car brand in the country. Hyundai also realigned its business strategy in FY 2022-23 to focus on SUVs and sedans as it pulled the plug on the once popular Santro hatchback.

According to the Society of Indian Automobile Manufacturers (SIAM), compared to 2016-17, when the sales in this segment stood at 5.83 lakh units, the mini car sales have dropped 57% to clock 2.52 lakh unit sales in FY 2022-23.

For FY24, the PV industry is expected to mark a single-digit growth at 5.5% year-on-year, while Maruti is projecting a growth of around 10% for itself to clock about 18 lakh unit sales in the domestic market.

Additionally, it is looking the clock the production milestone of 2 million units for its total sales (including domestic, exports, sales to other OEMs) in FY 2023-24. During H1, the company recorded total sales of over 1 million units.

Going forward, the Chairman said that the industry is not very optimistic about next year. The growth levels are “stagnant”.

“I think it is partly a result of the fact that there has been de-growth in the small car segment, and India needs that segment to grow. Without growth at the entry level and the small car market in India, a high level of sustained growth in the car industry is very unlikely,” he added.

Maruti Suzuki said it has witnessed a balanced growth from rural and urban markets this year. The automaker’s demand from rural continues to be in a reasonably good shape, as it is growing slightly faster than the urban market at over 11%.

On Friday, the company reported a growth of 78.2% in its consolidated profit after tax (PAT) at INR 3764.3 crore during the July to September 2023 period. Its net profit stood at INR 2112.5 crore in the corresponding period of last year. Revenue from operations during Q2 FY24 was at INR 37,902 crore as against INR 30,541 crore in Q2 FY23.