Our learning in the past one year, based on the changing trends, suggests the following business focus areas in terms of maintaining business continuity, and subsequently addressing the structural changes brought by the pandemic:

Digital: The prospective customers now tend to enquire digitally first. We are using our digital platforms extensively to reach out to customers, and providing them the best of the services in these challenging times. We have a lot of digital options to support the dealers. They include a demo through the Renault virtual studio, website booking facility with full payment option, the smart finance calculator through which a customer can apply for and get loan approval online.

Rural: There is a huge opportunity in the rural markets. We have seen that in the past one year as we have been pursuing an innovative and comprehensive strategy to amplify and grow our presence in rural India. Recently we have partnered with CSC Grameen eStore, a subsidiary of CSC eGovernance Services India Limited (CSC-SPV).

As part of this, Renault India’s leading product range will be listed on the CSC Grameen eStore and made available to the potential customers in hinterlands through aspirational Village Level Entrepreneurs (VLEs). We have also initiated a special project, VISTAAR, to amplify and grow our presence in rural India and our dealership teams have recruited specialised sales consultants to reach out to the prospects in these markets.

Q. Is smaller setups becoming the norm going forward – what percentage of sales outlets will be large, small, sub-outlets and mobile outlets?

Size of the setup is dependent on the market requirement. Infrastructure cost varies across markets. For deeper penetration in rural markets, we have smaller outlets starting from 500 sq ft, which are set up with very low investments. We also have showrooms / sprawling 3S setups which can display up to 10 cars. Our network strategy ensures a balance of network depth and width to ensure convenience for the customers.

Q. What is the total number of dealership outlets you have right now — in terms of 3S, only sales, only service- please provide the breakup. What were their numbers in FY20?

Outlet Type as on May 1, 2021:-

3S: 167

Only Sales: 343

Only Service: 103

Mobile Service units: 81 (they provide service support to 230+ locations)

We have smaller outlets starting from 500 sq ft. They are set up with very low investments.Sudhir Malhotra, Vice President – Sales & Marketing, Renault India Operations

This network strength adds to 510 sales touchpoints and 500+ service touchpoints, comprising 161 smaller format showrooms (VISTAAR outlets).

Under our VISTAAR strategy, we first prepared mobile service units to extend after-sales services to semi-urban, rural and deep rural locations. We followed this up with establishing showroom outlets in these locations.

As a result, Renault India so far has added 133 sales touchpoints and 50 service touchpoints after January 1, 2020. (The mobile service units had been supporting 200+ locations till December 2019).

Majority of these showroom outlets came up in 2020. VISTAAR outlets have been opened at locations which had service coverage through our mobile service outlets in 2019.

Till December 31, 2019, there were 377 sales touch points and 450+ service touchpoints.

Q. What is the average cost per unit of your cars?

The ex-showroom prices (INR) range as follows:-

KWID : 3.18 lakh to 4.92 lakh

TRIBER: 5.30 lakh to 7.83 lakh

KIGER : 5.45 lakh to 9.75 lakh

Duster : 9.73 lakh to 14.12 lakh

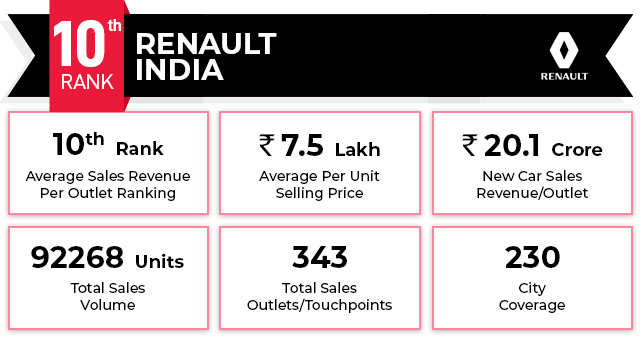

Note: All the data is an estimation based on the information received from various sources and extrapolated by ETAuto research.

Sales Outlet: Sales Outlet means all kinds of physical outlets/dealerships/touchpoints from where cars were sold.

Average Sales Revenue: This is based on the ballpark average selling price per unit multiplied by total units sold in a year divided by the number of outlets.

Average Selling Price Per Unit : This is an estimated price derived from the price range and the calculation done by ETAuto. It may differ slightly from the exact price.

More on ETAuto Car Retailing Report