New Delhi: Revenue Secretary Tarun Bajaj has asked the automobile industry to do a deeper analysis to understand why car sales are not going up.

There are contradictions in economic terms in the SUV sales growth by a higher percentage while it does not happen for smaller cars, the revenue secretary told at the 61st Annual Convention of the Society of Indian Automobile Manufacturer (SIAM) on Wednesday.

GST rates vary from 28% for a small hybrid vehicle, going up “very high” for SUV, along with the compensation cess, Bajaj added.

RC Bhargava, Chairman, Maruti Suzuki India Limited (MSIL) said, “Yes, people have moved away to SUVs, but that category of people are the ones for whom a few thousand rupees don’t matter.”

The Indian automobile industry has been under stress and witnessing a deep structural slowdown across the segments even before the COVID-19 pandemic impacted the industry last year. However, the SUV segment in passenger vehicles has grown over the past few years with new products and innovative technologies entering the market.

In the calendar year 2015, the SUV segment contributed only 13.5% to the overall passenger vehicle sales in India. This number went up to about 26% in CY2019, and 29% in CY2020.

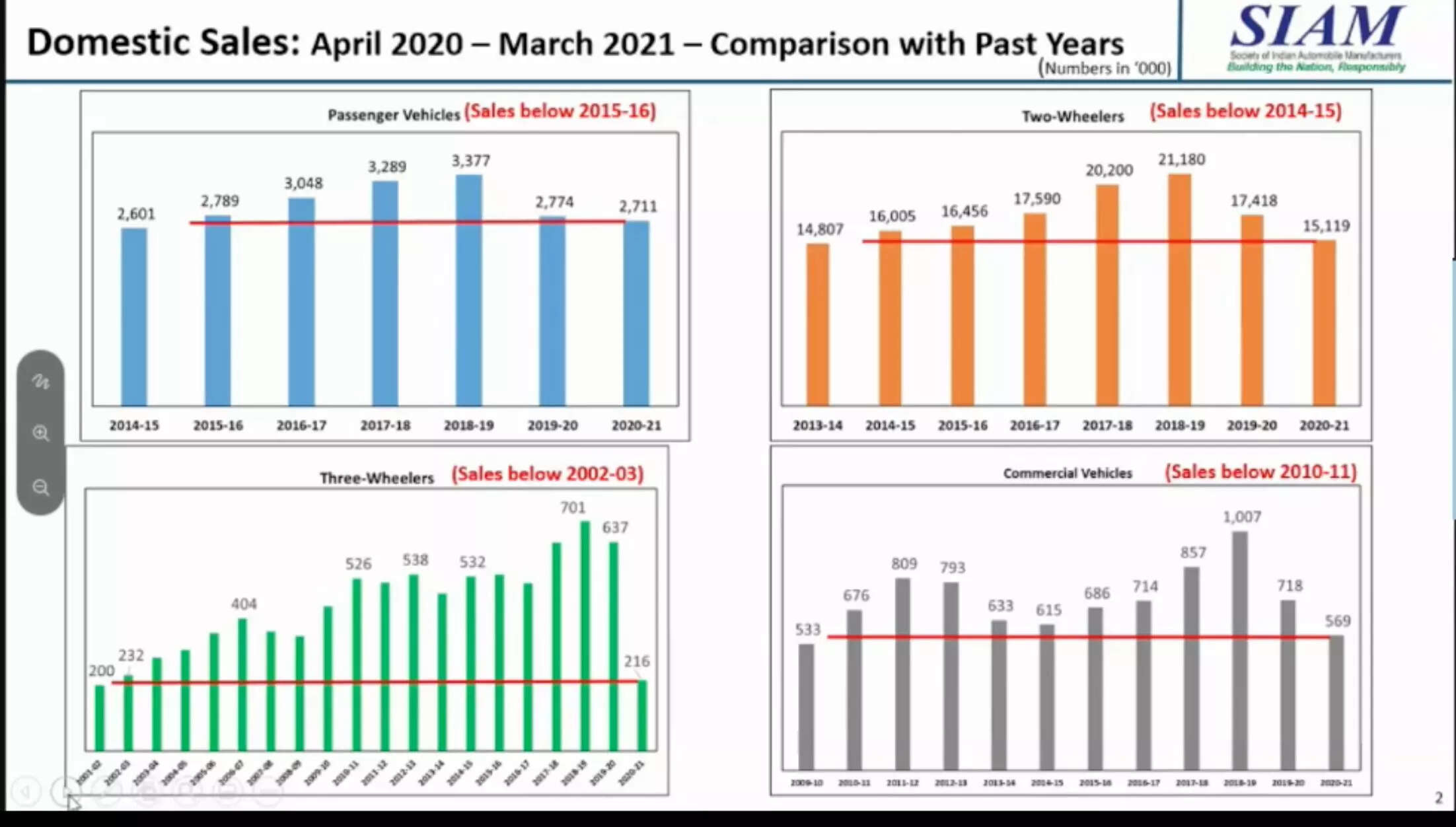

Looking at the vehicle sales figures, Bajaj said that 2017-18 and 2018-19 have been “glorious years” for the auto industry- except for passenger vehicles, sales of commercial vehicles were up 10%, three wheelers were up 30% and two-wheelers were up 16%. “The industry was doing well at a certain stage, so I need to understand what changed so drastically after 2017-18 that the sales dropped.”

Car sales are recovering, but commercial vehicles and the three-wheelers are facing the “maximum brunt” and sales are not recovering, even though direct tax collections are rising, Bajaj said.

The revenue secretary questioned whether it is the overall economy, the COVID-19 pandemic and other things that have disturbed the functioning of the auto sector or simply the existing tax rates.

“Is it the GST rates, the high rates as you call, that came in 2017-18? I also want to understand, before GST, in the major states where more cars are sold, like Maharashtra, Tamil Nadu, Karnataka, Delhi, — what was the then taxation structure? Was the taxation structure any less? I think it might have been a little higher,” he said.

There have been ups and downs in the auto sales over the past years, however the overall trend has been downwards, Bhargava said.

He added, “The rates of GST are more than double in India, compared to the EU, Japan or the US, and given the lower income levels in India, the question of affordability comes in. GST is not the only thing. States have the one-time road tax, which adds another 8%-9% and takes up the overall tax rate to 37%-38% on cars. Do we need the kind of high taxes we have?”

Venu Srinivasan, Chairman & MD, TVS Motor Company, said a two-wheeler which is “the basic mode of transportation for the country” is being taxed at 28% GST, the highest and at a level equal to that of a luxury product. “The switch to BS-VI, increased cost of ABS, Supreme Court ruling on mandatory purchase insurance, and a one-time tax have pushed prices of two-wheelers higher.”

As per Bhargava, there have been a lot of statements made by the government about the importance of the automobile industry. “But in terms of concrete actions, which would reverse the decline in trend, I haven’t seen any action on the ground.”

“I am afraid words don’t get us very much in the terms of extra sales but you need concrete action to make this happen,” Bhargava added.

He also said that if the auto industry is supposed to drive the economy and the manufacturing sector, the car penetration in India shall move from 25 or 30 per 1,000 to even 200 per 1,000 cars and it requires millions of cars to be made every year.

“Are we sure we have enough customers in India who have the means to buy these millions of cars every year? Are incomes going up that fast? Are jobs growing up that fast? I think those aspects are often ignored when we make our plans of what we are going to do and what’s going to happen,” he said.

According to Bajaj, direct tax collection is growing by a robust 40%-50% and collections are expected to be better this year.

“While I’m not denying that there has been some unemployment, in a class of people which would be your buyers, the income levels are going up. If the income levels of people are going up, why is it that the car sales are not happening? Whether it is just the price elasticity or whether there is anything else? I think SIAM should do a deeper analysis of this fact and come back to us to say what changes you require,” Bajaj said.

It is not a “simple intervention” of reducing the taxes that will benefit car sales. There is a need to take a 360-degree view of what policies are needed to support this industry, the revenue secretary said.

He noted that the government is facing a lot of flak on high excise duties on fuel. However, it also needs revenues to balance its budget, because it cannot afford to continue with high levels of borrowing every year.

“If we continue to borrow this money and give relaxation in other fields, it will come back to haunt us at a later stage. Inflation will be so high, prices will go up. You will then notice that your raw material prices which have already gone up will go up further,” Bajaj said.

“The fact is that the focus of any policy cannot just be on the fact that we want the auto industry sales to go up, not even knowing whether changing this would actually increase sales,” he added.

Bajaj also urged the industry to move ahead and keep pace with the changes in technology.

Bhargava said that he supported safe, clean and electrification of vehicles, but then it should not come at the cost of affordability for the consumers. “I don’t think the car industry will revive with ICEs, with the CNG and biofuels or EVs unless we address the question of affordability of cars for the customer,” he said.

“Having adopted all the European standards of safety and emission which we have in the last two years, the cost of vehicles has gone up substantially. Given the lower income level in India the question of affordability comes in when you expect people to buy cars which in terms of all the features are similar to European counterparts except that our tax levels are much higher,” Bhargava added.

Giving an example, he said that because of the new safety regulations, the company had to do away with the Maruti 800 model, which drove the motorisation of India. “We have seen that small increases like what happened two years ago can lead to a fall in the growth of the car market. The new regulations for BS-VI have added INR 22,000 to a car again, making cars unaffordable”.

According to Venu Srinivasan, there is no point in promoting EVs because lithium itself is a scarce resource and it causes a lot of pollution both when it is mined as well as disposed of. “We will also need to look at the amount of power required in the next 10-20 years,” he said while adding that even though he supports EVs it will not necessarily result in a green and sustainable economy if we do not solve the related issues.

Also Read: