New Delhi: The Indian used car market is poised for continued expansion, fuelled by a burgeoning middle class with rising disposable income, a growing desire for personal mobility and shorter vehicle replacement cycles.

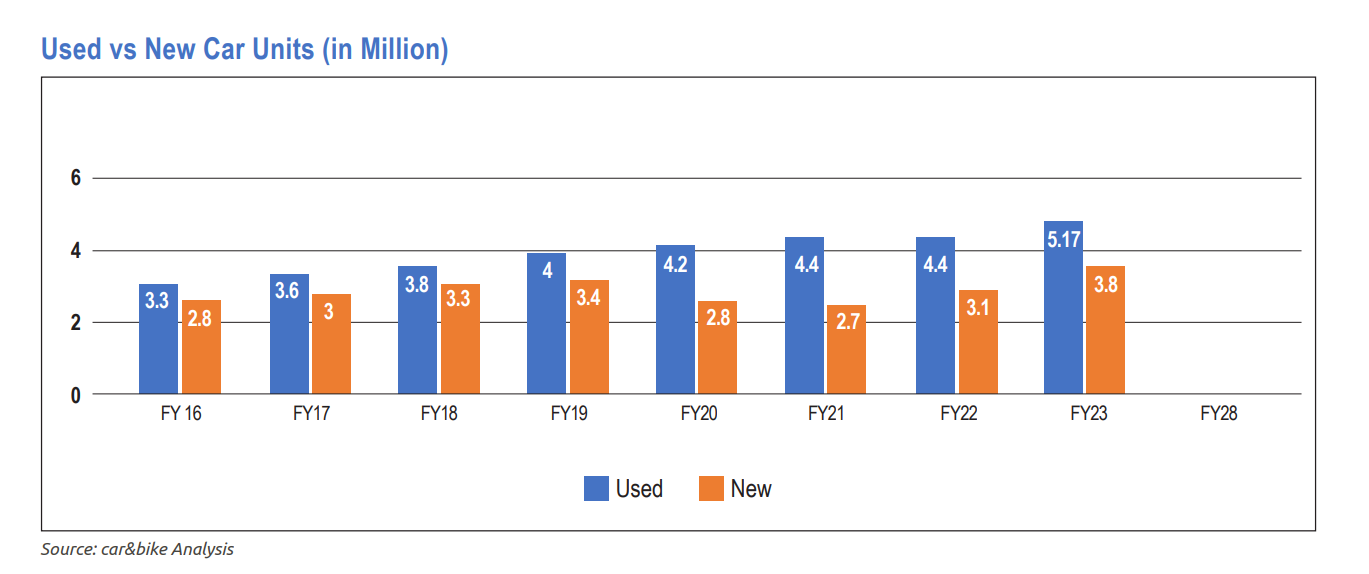

In India, buying a pre-owned vehicle is no longer considered a ‘compromise’. Currently, the market stands at 5.1 million units. In FY27, it is expected to reach about 8 million units, and by FY28, more than 10 million units, shows a market research presented by Volkswagen’s Das WeltAuto, and car&bike.

In India, the used car market continues to remain fragmented, with the unorganized sector having a market share of about 45%. However, over the years, the presence of organised players in the industry has gone up. This includes OEM initiatives like Maruti True Value, Mahindra FirstChoice, Hyundai H Promise, Volkswagen Das WeltAuto, and startups like Spinny, Cars24 etc.

Mohammed Turra, CEO, Mahindra FirstChoice, sees the sector in a stable phase and expects the industry to close this year at about 6 million units. On an average, as long as a used car does not sit for more than 45 to 60 days, that means that car is moving.

About 7 years ago, the organized sector comprised 10%-12% of the overall used car market. This year the share is about 24%-25%. “With technology and digitisation, easing of documentation and transactions, the structure of the market is growing. Over the next three years, the organized sector is expected to reach almost 45% of the used car market,” said Ashish Gupta, Brand Director, Volkswagen Passenger Cars India.

CNG cars are least preferred in the used car market, due to reduced boot size and a lack of accessibility to CNG gas filling stations. Predictably, the petrol segment continues to dominate the market

The used car industry is generally three to five years behind the trends in the new car market. While the purchasing power may be different, customer aspirations are the same. “The preference for SUVs is growing. Right now, diesel cars in the market are actually having higher resale value, because the supply is getting lesser in the used cars. But this will change– it is a curve which will mirror the new car market.”

During the past few years, the prices of used cars have gone up on an average by almost 8 to 10% every year. More customers are looking for young used cars, which are used for three to five years, whereas the availability of cars is five years and beyond. So that is driving the selling price in the market.

Gupta recalled that in 2016-17, the penetration of finance was hardly 7%. Today, with the prices of used cars also going up, it is above 20%. “Availability of finance is not a problem, but a large portion of customers in the used car market actually prefer to do barter deals, or complete deals through cash.”

Mahindra FirstChoice enables used car sales through inspections before it goes for financing. Second, it provides a B2B auction platform for dealers called EDIC. Third, the yard business for parking the cars.

About the business model, its newly appointed CEO, Mohammed Turra said, “We are the engine behind selling used cars in the market. So these three make up most of the revenue, and then there is a retail business where our part is facilitation fee, warranty fee, and the transaction percentage.”

Over the past few years, Mahindra FirstChoice has rebranded its physical retail stores as car&bike.

Globally, the trend shows that the US and Germany are the two countries with an upside in the used/ new car ratio.

In 2022, the global used car industry was valued at USD 896 billion. It is expected to cross the USD 1500 billion mark by 2028, with a compound annual growth rate (CAGR) of 9.1% during 2023-28.