Russia’s invasion of Ukraine may turn out to be a double blow for Indian personal vehicle buyers. Prices may go up on rising input cost on one hand, while the waiting for vehicles will likely get longer for consumers on the other with expectations of further disruptions in semiconductor supplies.

Vehicle makers ET spoke to said they had not seen any impact yet and were closely watching the situation.

Input cost, which was showing signs of easing, may now see a sudden spike on the back of crude oil crossing $100 a barrel for the first time in seven years and aluminium, a key material in vehicle manufacturing, hitting record high prices.

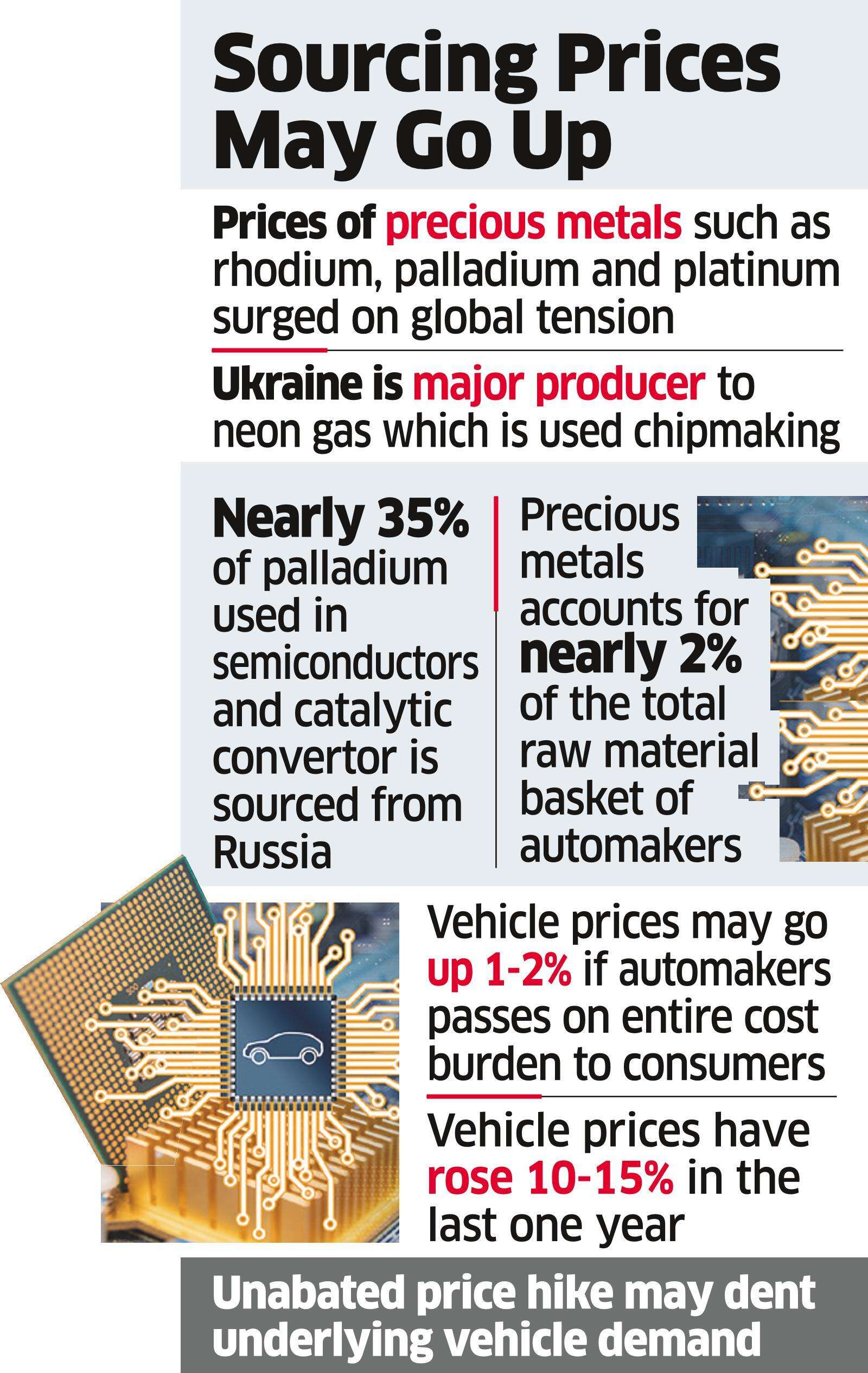

The prices of precious metals such as rhodium, platinum and palladium, which are used in catalytic converters in automobiles, have reached 30-36-week highs. Russia and Eastern Europe are major suppliers of some of these materials.

The steepest movement has been in rhodium, where the price is up 30% in the current quarter compared with the average of the previous quarter. Aluminium, which accounts for nearly 10-15% of the total raw material cost, has become 20% costlier this quarter and is trading at a record high level around Rs 250 per kg.

About 78-84% of the revenue of automakers goes towards raw material cost. Amid the higher raw material cost, the gross margin — an indication of how raw material impacts profitability — has been 8-10% lower than the long-term average of 27-32%.

A possible acceleration in inflation may also lead to hardening of interest rates, raising the vehicle acquisition cost for buyers.

Newswire Reuters, citing research firm Techcet, reported that Ukraine supplied more than 90% of the US’ semiconductor-grade neon, a gas integral to the lasers used in the chip-making process, while Russia accounted for 35% of its supply of palladium, a rare metal that can be used to create semiconductors.

Russia, along with South Africa, is also a key supplier of palladium globally, the Techcet report said. Palladium prices jumped more than 7% on Thursday.

A full-scale conflict disrupting exports of elements like palladium might hit players such as chipmaker Intel, which get about 50% of its neon from Eastern Europe, according to JPMorgan.

It could disrupt the global supply chain of semiconductors and India too is likely to be affected. Already, regional issues in Malaysia have hurt chip supplies to India, affecting manufacturing of automobiles and electronic products. The supply situation was improving in recent months, but the current crisis may now further exacerbate the shortage.

“As of now, we do not see any direct impact of the Russia-Ukraine crisis situation on our business. We will keep watching the situation including for any indirect impact, and share if there is any concern,” Rahul Bharti, Maruti Suzuki’s executive director, corporate affairs, said in an emailed response to ET’s questions. Daimler India Commercial Vehicle and Mercedes-Benz said it was too early to comment on the impact on prices.

Emails sent to Hyundai Motor, Tata Motors and Toyota Kirloskar Motor did not elicit any response till press time Friday. Mahindra & Mahindra and TVS didn’t want to comment.

According to experts, the higher prices of precious metals alone would increase the raw material cost of two-wheelers and passenger cars by 4-5%. “In addition, the surging aluminium prices and ripple impact of soaring crude oil on freight and tyre may cumulatively impact margins by 200-200 basis points. This means passenger car and two-wheeler prices need to be hiked by Rs 10,000 and Rs 700 per unit, respectively, to offset the higher raw material cost,” said an auto analyst at a domestic brokerage house.

Vehicle prices have already gone up by 10-15% in the last one year and there are already half a million customers in India who are waiting to drive home the cars they have booked.

CLSA in a recent research report said rising metal cost and the resulting increase in the cost of ownership hurt price-sensitive customers in the entry and executive motorcycle segment.

In December 2021, car market leader Maruti Suzuki’s average selling price had increased 14% from a year earlier, but its sales volume had fallen. At India’s largest bike maker, Hero MotoCorp, average selling price rose 15% to Rs 61,010, but volume dropped 30%.

The hatchback and compact sedan segments of passenger vehicles could be impacted more than SUV segments due to the price increase. “At current commodity prices, two-wheelers and Maruti Suzuki will require a further 1-1.6% price increase to offset rising raw material costs,” the note added.

Typically, the price change of raw material is fixed with vendors with a lag of three to six months. This means the impact of the current uptrend in commodity prices will impact margins from the first quarter of the next fiscal year

Also Read: