Two-third of the 9500 NBFCs are exposed to the automotive sector. This indicates the magnitude of the crisis. They finance 75%-80% of new commercial vehicles, 70% of new two-wheelers and 50-55% of new cars in the country. More than half of the vehicles sold in rural markets are financed by NBFCs.

Another dimension of this problem is that most of these companies cater to informal and self-employed borrowers. And they are the worst affected by the present crisis as they are unable to service their loans. Consequently, the cash flows for these companies are disrupted. But they have customers waiting to be catered to though in fewer numbers than in the previous years.

Compared to the pre-pandemic days NBFC loan repayment collections have fallen by 15%-20% while their disbursement rate has reached only 65%-70% because of the reduced vehicle sales.

The overall wholesale of vehicles during FY21 across categories, including passenger vehicles, two-wheelers and commercial vehicles, declined 13.60% to 18,615,588 units as against 21,545,551 units in the previous year, according to data released by the Society of Indian Automobile Manufacturers (SIAM).

As vehicle sales ebbed, NBFCs which are the major lenders to the auto sector have seen a continuous downtrend in loan demand. For the FY 2020-2021, sanctions of automobile loans from NBFCs declined 37% due to sluggish demand and more stringent lending norms coupled with their liquidity crisis. As per the data provided by FIDC, the total number of loans disbursed in the last fiscal year to the auto sector was around INR 94,462.24 crore, against INR 149,867.22 crore in FY 2019-2020.

Sum of Sanctioned Amount (Cr)

| Lender Type | FY 2019-2020 | FY 2020-2021 | %Change |

| Auto Loan | 2,774.25 | 1,225.74 | -58.81 |

| Auto Loan (Personal) | 58,827 | 35,583 | -40 |

| Commercial Vehicle Loan | 78,378 | 21,826.64 | -72.15 |

| Construction Equipment Loan | 9,887.98 | 35,826.86 | 262 |

| Total | 149,867.22 | 94,462.24 | -37 |

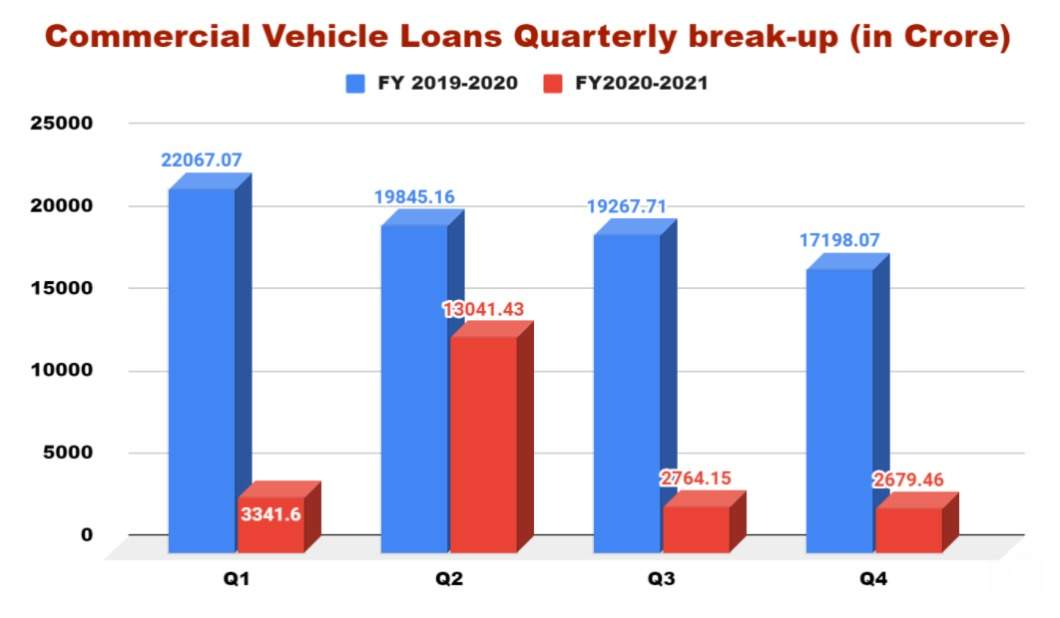

CV financiers are the worst hit

Out of all the segments, financiers to the commercial vehicle sector continue to remain cautious as the overall truck utilisation level at the national level touched historic lows with no signs of a major rebound in demand in the near future. “Combining the three factors – restructured loans, increase in delinquencies and hike in write-offs, incremental stress of 300-350 bps has created CV loans in the past one year. This has prompted NBFCs to tighten credit risks,” AM Karthik, vice president and sector head, financial sector ratings, ICRA Chennai, said.

Before hitting the bottom during April-May, the business of Shriram Transport Finance, one of the leading NBFCs that derives 75% of its revenue from the CV sector, had reached almost pre-COVID level January-March when the economic activity started returning to normalcy.

According to Umesh Revankar, CEO & MD, Shriram Transport Finance, truck operators continued to suffer due to various restrictions on their movements which heavily impacted the new disbursement cycle.

“During the first two months of the current fiscal, our disbursement to the sector has reduced to less than half. This segment is still reeling under the impact of revised axle norms. The pandemic blows further worsen the condition. Though we expect to see some green shoots from this month onwards,” Revankar added.

Banks vs. shadow banks

In the auto segment, the NBFCs have been consistently losing their business to the scheduled commercial banks. Of late the public sector banks have been very aggressive with a major contribution in inventories coming from them, said an Emkay Research note. “Due to lower interest rates and longer loan tenures, customers prefer banks to NBFCs,” the research note pointed out.

During the first two months of the current fiscal, our disbursement to the sector has reduced to less than half. This segment is still reeling under the impact of revised axle norms. The pandemic blows further worsen the condition.Umesh Revankar, CEO & MD, Shriram Transport Finance

Karthik of ICRA Chennai highlighted that banks are increasing their exposure in high-ticket segments like passenger vehicles and commercial vehicles. “COVID is the primary reason for the decline in disbursement. Most importantly, there is increased competitive pressure from banks because they started looking at the auto sector as a source for diversification when their corporate loans stopped growing,” he added.

Another factor is during the first wave of COVID and its aftermath, many owners held onto their vehicles. According to Vinkesh Gulati, president, FADA, the customers largely traded in the old ones as their source of income dried up. “Loan performance weakened due to the continued high unemployment rate that limited the borrower’s income and their ability to service debt,” he pointed out.

The outlook for FY22

The car makers’ bumpy roads may be temporary. Pent-up demand, a strong employment picture and the upcoming festive period, traditionally a good season for vehicle sales, may turn things around to their favour.

According to Fitch Ratings, a less severe economic impact from the pandemic’s second wave and resilient buyer sentiment will support a swift rebound in India’s automotive demand after curbs are eased.

“We believe less stringent curbs and lower business disruption will limit the economic fallout compared with last year. The drop in auto sales volume in Q1 FY22 from Q4 FY21 will be slower than the decline of more than 70% in Q1 FY21,” said the rating agency.

However, industry observers are cautious. Unlike the first COVID wave which was cushioned with multiple measures such as regulatory moratorium, additional funding through the emergency credit line guarantee scheme and a sharp pent-up demand recovery, experts opine that the outcome may be different during the second wave.

Underlining the impact, Gulati said, “As the infection has penetrated in rural areas this time, collections will become more difficult. Moreover, reduced borrowers’ savings and rising operating costs due to fuel inflation will also cast a spell on borrowers’ cash flows.”

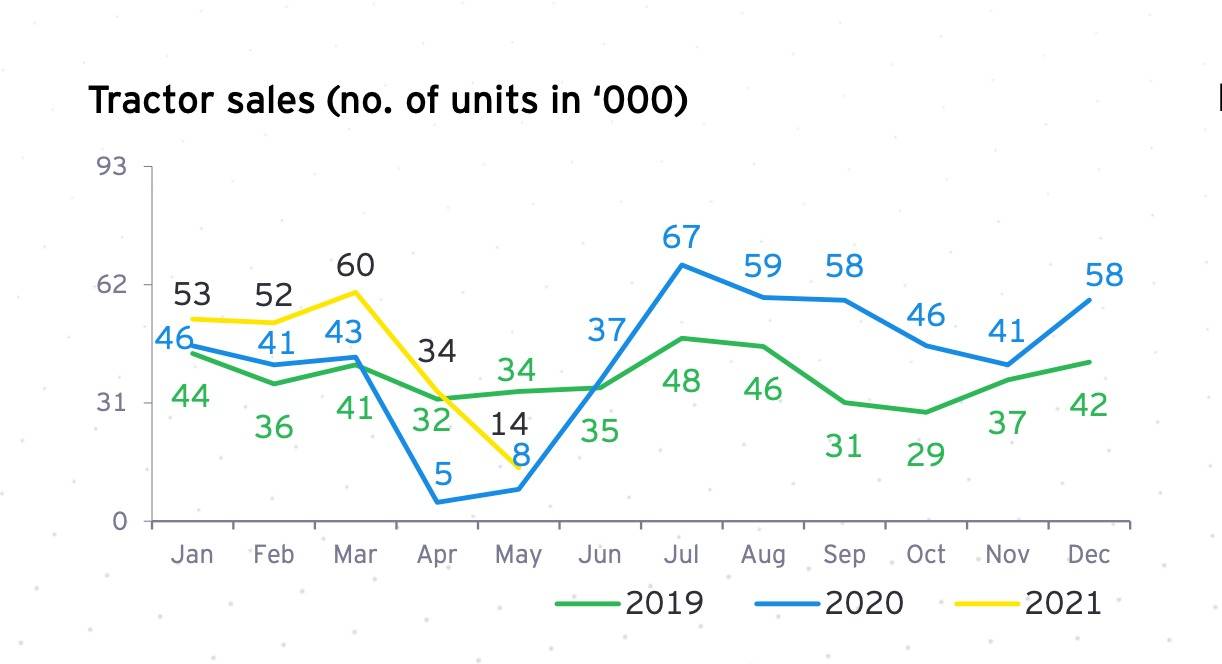

All-time low sales of heavy trucks forced some of the shadow banks to look for other lending destinations for survival. “Due to erosion of demand few NBFCs in the commercial vehicle space diverted to tractor financing where sales continued their healthy run even during the lockdown. This helped in bringing the credit growth of financing companies, ” said one industry expert.

Regardless of diversification, there will be a marginal impact on the profitability of these companies as the spread of the virus is more acute in rural areas in this wave, the person mentioned above said. And therefore, he added, rural demand and sectors dependent on the rural economy including tractors have come under stress.

As per industry data, tractor sales in May crashed to about 14,000 units on a sequential basis from about 34,000 units in April.

On the outlook, India Ratings and Research see a significant impact on the asset quality of CV financiers due to their borrowers’ reduced capacity utilisation, higher operating costs, and moderating cash flows.

“The emerging trends of rising loan tenures across vehicle financiers to reduce the servicing burden for borrowers, however, could lead to a rise in losses given the defaults for collaterals,” the agency added.