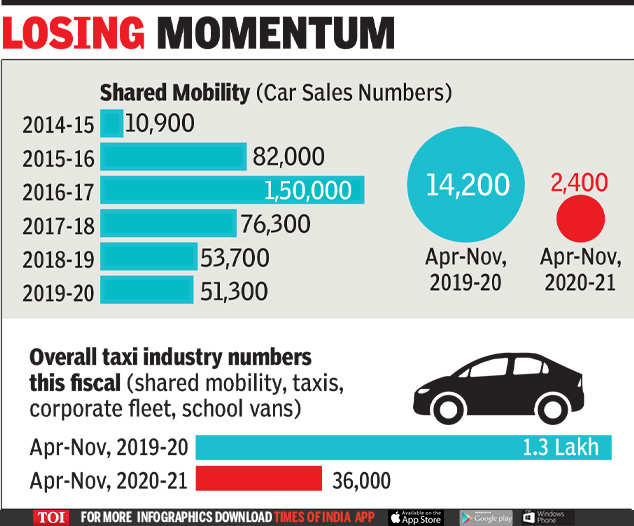

NEW DELHI: It was seen as the sunrise sector till just a few years ago, but fears over spread of coronavirus through use of app-based taxis have punctured the growth of shared-mobility companies like Ola and Uber. The new fleet addition to the segment has reduced to only around 2,400 cars in the first eight months of this financial year, down from the nearly 14,000 cars added to the line-up in the same period of 2019-20.

The demand for commercial taxis and corporate fleet has also suffered a similar fate on a sharp decline in office and tourist travels. The closure of schools has also seen their numbers come down drastically.

Overall, taxi, corporate fleet and shared-mobility sales are estimated to have crashed by around 70% to 36,000 units, or 2.3% of the overall retail sales of 15.8 lakh units in the April-November 2020-21 period, according to industry estimates. Sales in the same period of 2019-20 were at 1.33 lakh units, or 7.1% of overall retail sales of 18.7 lakh units.

Analysts and industry officials said that demand for taxis is likely to remain weak for some more time, though the gradual availability of the corona vaccine in the coming months is likely to add life back into this category. “People are moving away from public transport and shared mobility this year. For reasons of health and safety, people have moved over to personal mobility,” Shashank Srivastava, director (marketing & sales) at Maruti Suzuki told TOI.

The trend is palpable as there has been a resurgence in the sale of new as well as used cars. Fearful of the spreading virus, people have been buying personal cars, much against the earlier growing trend of moving over to shared mobility.

The sale of cars for use in Ola and Uber — bought mostly by the drivers engaged with the companies — had touched annual levels of 1,50,000 units in 2016-17, before starting to taper off as the companies looked to reduce the benefits and incentives offered to the driver-partners. According to estimates, numbers had gone down to 76,300 units in 2017-18, 53,700 units in 2018-19, and 51,300 in 2019-20. This fiscal will make it a trickle, say analysts and auto company officials.

Srivastava said that the impact through a decline in travel tourism, employee transportation, and even school vans has hit private taxi operators. “People are also holding on to their vehicles longer.”

Ravi Bhatia, president of research firm JATO Dynamics, said that pressure had been building on shared mobility industry for some time. “Even before Covid-19, there were profitability pressures on micro-mobility and ride-hailing companies and we saw some consolidation in the sector… Government restriction on mobility and lifestyle choices for citizens has resulted in further battering of the core business of ride-hailing companies. Customers place higher weightage on safety, health, and reliability over cost and convenience.”

JATO feels that there will be further consolidation in the sector. “We see that the profitability pressure and increased government requirements will force consolidation in micro-mobility and shared mobility sector.”

Maruti’s Srivastava, however, said that demand for public transport and the shared mobility will start coming back as the environment gets safer, following the rollout of vaccines.

However, the fleet and office transportation segments are likely to see some irreversible trends as work-from-anywhere trend strengthens. Already some of the IT companies have indicated that they will not be going back to full strength even after a full unlock and would have limited manpower in offices, while others work from home.

C P Gurnani, CEO of Tech Mahindra, which employs over 1 lakh, says that the trend is here to stay. “We do envisage work-from-home continuing in the longer term, which reduces the need for physical infrastructure to support any operations. Also, we can tap a diverse base of talent across different cities,” Gurnani said. The same trend has been predicted by other larger IT companies such as TCS and Wipro.