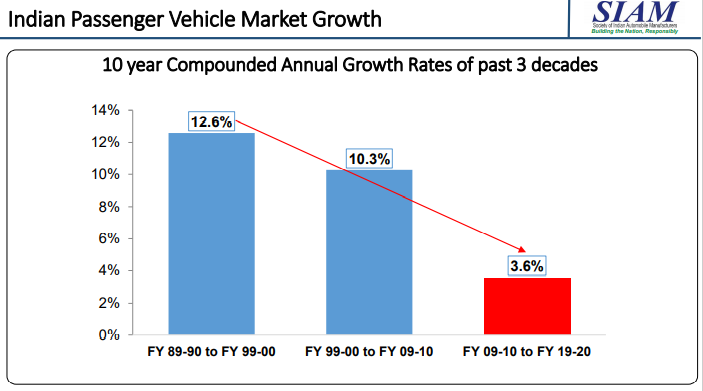

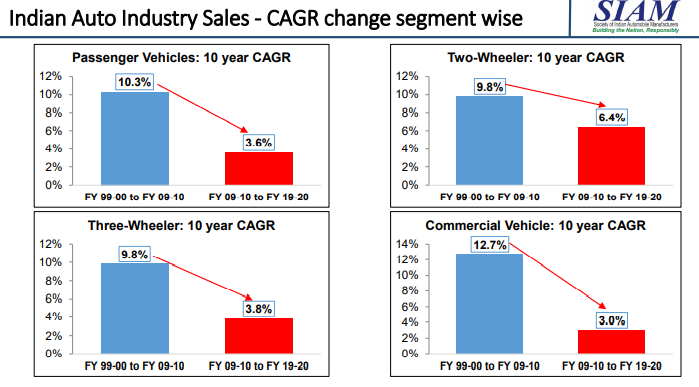

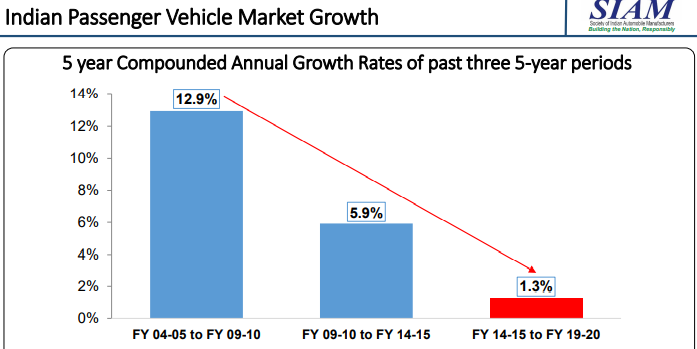

The study on the growth rate of the Indian automobile industry till March 2020 clearly indicated that there is a deep long-term structural slowdown in the industry as the compound annual growth rate (CAGR) across all major vehicle segments has declined over the last three decades.

The CAGR of the Indian passenger vehicle industry was at 12.6% between 1989-90 and 1999-2000 which dropped to 10.3% between 1999-2000 and 2009-10. However, it reached a new low of 3.6% in the decade to 2019-2020, the study reports.

In the two-wheeler segment, CAGR has dropped from 9.8% during 1999-2000 to 2009-10, and to 6.4% during 2009-10 to 2019-20.

Similarly, three-wheeler sales have dropped from a CAGR of 9.8% during 1999-2000 to 2009-10, and to 3.8% in the past ten years.

Meanwhile, the commercial vehicle segment witnessed still more drastic drop in annual growth rate. From a CAGR of 12.7% in 1999-2000 to 2009-10, it has come down to 3% in the past decade.

Factors behind the fall

A combination of factors like new safety and environmental regulations, taxation, liquidity crunch after the NBFC crisis, fuel price hikes along with unstable economic conditions have driven the fall in vehicle sales. The pandemic accelerated it.

The regulatory mandate for switching to BS-VI engines and fuel norms from April 2020 increased cost of production and only a portion of it has been passed on to the consumers through price hikes.

The NBFC crisis in September 2018 exacerbated liquidity and dampened demand in the economy. This was another nail to the coffin of the industry as a good share of vehicles bought is financed by NBFCs.

Auto loans account for about 30% of NBFCs’ assets. In recent years they funded only about 55%-60% of new and used commercial vehicles.

New insurance norms mandating third party insurance cover to be paid upfront for three years for passenger vehicles and five years for two-wheelers has also raised the on-road price for the respective segment for consumers and impacted demand.

Revised axle load norms and hike in prices by manufacturers have played their part in squeezing demand for commercial vehicles. In July 2018, the government increased the official maximum load-carrying capacity of heavy vehicles by 20%-25%. This reduced demand for more vehicles to cater to the existing transport needs.

Petrol and diesel prices do have an impact on the sale of automobiles. The two are complementary products and fuel cost accounts for 20% to 50% of the cost of vehicle ownership in India, depending on the distance travelled daily.

While the above factors were playing their role in diminishing demand for automobiles, manufacturers continued to pump their supply leading to inventory pile-up. This has hurt dealers the hardest. As demand failed to pick up even during the peak festive season, a supply glut got created and the auto companies had to cut production.