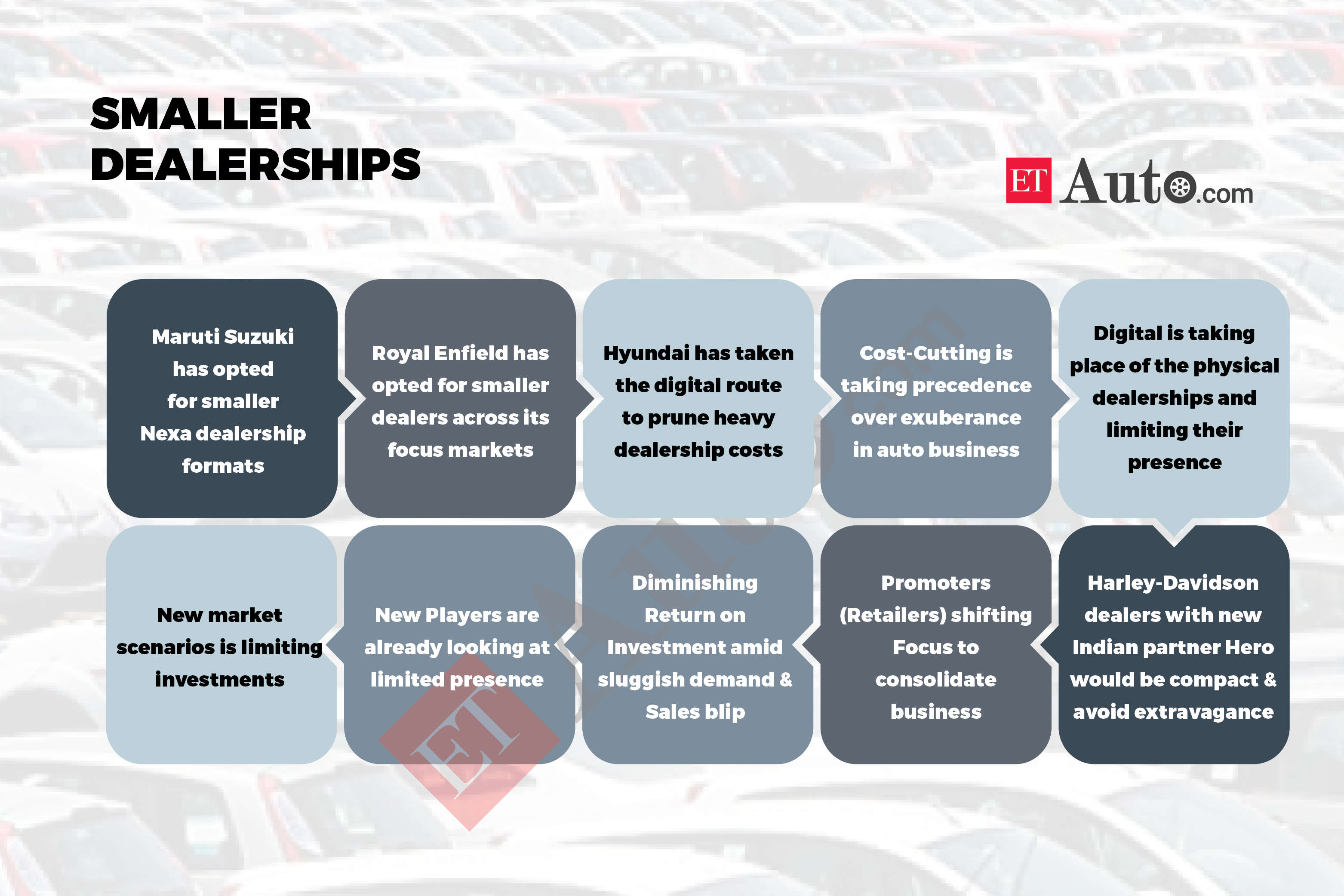

In the pre-COVID era, there were reports of closure of over 300 dealership outlets. The pandemic’s arrival created ruptures in the retail business, especially for small brands and fringe OEMs. The industry is all set to witness massive disruptions in the automotive retail business.

The first sign of the strain is the introduction of smaller and compact dealerships trying to cater to consumers looking for terrific deals and scorching every penny to buy new cars.

The new smaller-format dealerships will extend the reach of Maruti’s premium products to small towns and rural areas. “We have been continuously getting requests from customers seeking the Nexa experience in the cities where we are not present. To serve these customers, we plan to establish smaller Nexa showrooms.

These will have a 2-car display facility and will offer the same Nexa experience as offered by our current Nexa outlets across the country. These showrooms will help us come closer to customers seeking the Nexa experience and enhance customer convenience,” a spokesperson of Maruti Suzuki said.

Another major player, Royal Enfield, has gone for smaller studio stores across markets and plans to expand them into new markets and rural areas in the coming year. Eicher Motors, the maker of Royal Enfield motorcycles, has increased presence across local markets. The company believes that focusing on smaller, Tier-2 and Tier-3 towns is the way forward for growth and to enhance volumes in the domestic market.

We have noticed that the ‘Click to Buy’ has led to a surge in online inquiries to 25% from a mere 10% in 2019.Tarun Garg, director, sales and marketing, Hyundai Motor India

So far, Royal Enfield’s focus was on large format stores. It has about 1,000 such stores in the country. In the next leg of its growth story, the brand focuses on small outlets for semi-urban and rural locations. According to the company executives, lower cost of setting up and operating a store is the main reason for opting for such studio stores. The goal clearly is branding.

“More compact stores that are made to the defined brand identity standards and that provide the customers’ desired brand experience are definitely on. This is what the Royal Enfield studio stores are doing. We will have over 1,000 of these stores in India by March-end. We started on this three years ago, and it has gone well with our expansion strategy,” Lalit Malik, chief commercial officer, Royal Enfield Limited, said.

Digital push

The advent of digital business led to the erosion of the brick and mortar dealerships. COVID-19 expedited it. Today, no company can survive without the digital presence, and many OEMs are spreading their budgets elaborately on the digital portals.

Cheaper technology and access have led to a massive spurt in the online activity that has made online decision-making extremely popular. So much so that the companies are witnessing a massive diversion in the chunk of INR 87,000-crore advertisement spend to the technology space. Potential customers are making a beeline to online search to choose their next vehicles and to finalise their decisions.

Digital has made possible targeted buying and selling at the micro-level both from the buyer’s and the seller’s perspectives and to arrive at a proper decision. Along with India’s economic growth and the rising income levels across geographies, the car consumers are spread across the urban and rural areas.

“Digital makes it possible for the consumer to do most of his purchase journey on the web and this raises the interesting and previously unthinkable possibility of having digital dealerships rather than physical ones,” Shashank Srivastava, executive director, marketing and sales, Maruti Suzuki India, said. “But the experience worldwide suggests that physical dealerships are very important still, as consumers would like the touch-and-feel-generated trust that is so essential for large value purchases.”

It is pure digital that makes the presence felt for the companies to influence their customers and register the footprints to generate definite leads and sales. Customers prefer contactless digital touchpoints in their car purchase journey in the place of comparison, consultation, selection and booking of their chosen car. For most of the companies, digital sales have doubled in the past few months, largely expedited by the pandemic.

Royal Enfield has gone for smaller studio stores across markets and plans to expand them to new markets and rural areas in the coming year.~

With the prolonged slowdown in the industry and economy, the car dealer business has been in jeopardy since last year. The current pandemic and the national lockdowns have left over 25,000 retail businesses selling vehicles from two-wheelers to tractor-trailers dry and high.

Contactless online sales bring huge savings on real estate costs and salaries. Major OEMs like Maruti Suzuki, Hyundai Motor India, Tata Motors, Honda Cars India, and Volkswagen India have come out with their online car selling platforms, named ‘Click to Buy’ and ‘Click to Drive’.

“We have been able to channelise the customer’s journey of change as the digital is increasing. We have noticed that the ‘Click to Buy’ has led to a surge in online inquiries to 25% from a mere 10% in 2019. The current pandemic has expedited the evolution of the ‘Indian customer,’ and now we are communicating with multiple means of technology,” Tarun Garg, director, sales and marketing, Hyundai Motor India, said.

Luxury players like Mercedes-Benz, Audi India and Swedish carmaker Volvo also have launched campaigns on ‘contactless’ purchase for their customers across their online portals.

It’s Phygital

The downsizing is also abetted by the advent of digital warfare that disrupts the buying decision and process in the industry. Companies are looking at smaller displays and going into the ‘Phygital’ gateway to adapt to new business ways.

‘Phygital,’ a blend of physical and digital, signifies the general change in the automotive industry where austerity gains prominence over size and profitability for business volume. While there is a clear shift to the digital mode to select the right vehicle and ideal variant the overall experience of buying, it still remains physical where customers prefer to take the delivery themselves and enjoy the emotional experience of a big-ticket purchase.

The advantages of Phygital are not impacting the overall business, but allow the dealers to downsize with smaller formats and get faster returns on their hefty investments.~

“Vehicles have moved beyond mobility. It’s a means of safe personal transport that delivers a wholesome experience of ownership and security. Even if the buying decision is highly influenced by the online research and diligence, Indian customers prefer to visit the dealerships to buy vehicles with the family and enjoy the exclusive drive back home to have a fulfilling experience,” Rakesh Srivastava, managing director, Nissan Motor India Private Ltd, said.

The Phygital bug has overtaken not just the high-volume mass market but also the luxury brands that are looking at a similar experience to generate new car leads and sales with new modes of interaction.

“Customers go to the showroom to validate their car purchase after checking them online. Our fresh initiative, Digital Service Drive Next or ‘DSDNxt, helps them pay at their own convenience. These solutions aim to ensure seamless ownership experience and reinforce confidence in the luxury car market in India.

This smart financial solution ‘Pay at your convenience’ provides financial ease to the customers, as a key digital service initiative for a safe and hassle-free ownership experience where they can have a credit card EMI option for a tenure up to 12 months, zero-cost EMI option for three months, one swipe EMI easy payment option for both the preventive maintenance and general repairs,” Martin Schwenk, MD and CEO, of Mercedes-Benz India, said.

However, the advantages of Phygital are not impacting the overall business, but allow the dealers to downsize with smaller formats and get faster returns on their hefty investments.

Smaller dealership format

Most of the proactive OEMs diversify into the new cost-light retail formats to stay abreast of the changes on the ground.

The regular mansions of automotive retail, often called ‘Taj Mahal on the Highway’, are getting diluted and withering due to the rising operation costs and shrinking margins.

Maruti Suzuki, Volkswagen, Tata Motors and Nissan are among the prominent manufacturers to go for small formats. Nissan had initiated 20 fresh retail outlets on the small dealer format to unveil and launch its new compact SUV Magnite across Delhi, Mumbai, Bengaluru, Kolkata, and Hyderabad with an asset-light model to allow its dealers to trim costs. “It is a new model that allows faster lead generation and customer engagement with smarter ways to buy new vehicles. It’s the future of the automobile retail business,” Srivastava said.

Vinkesh Gulati, President of Federation of Automobile Dealers’ Association, echoed similar sentiments with ET Auto. “We don’t know what is going to be the new normal. At least what we have noticed in the past few months is that dealership’s physical structures are required only for delivery as the customers have already gone for digital choices.”

These are destinations to serve as validation points to the customers who want to ‘touch and feel’ the vehicles selected online after digital scrutiny.

Most manufacturers feel the shift where customers after analysing their requirements come for the physical feel of the cars and SUVs.

Market analysts say that a perceptible change is coming from many companies to tap the new evolving model. “Recent pandemic has pushed most of the OEMs to redraw their network strategies. We are getting lots of interest from various automakers to help them with alternative retail formats,” Amit Kaushik, managing director, Urban Science, a US-based consultancy firm, said.

A new trend of phygital dealerships is emerging. It allows trimmer costs with minimal manpower and less space and rent than the earlier retail outlets. “The automakers are thinking differently from the traditional bricks and mortar models to deploy a sustainable model for investors. In this scenario digitalisation has taken the front seat because the high fixed costs of traditional dealerships lead to viability issues in many cases,” Kaushik said.

Globally too many OEMs like Volvo, BMW, Peugeot, MG Motors, and Nissan have successfully deployed almost contactless online sales. The new phenomenon has diluted the original walk-in dealership models and led to new smaller outlets for validating customers’ choices.

But smaller formats can equally do that. They have the advantage of lower costs for dealers and consumers with a larger geographical spread.