By Ushma Ghosh

New Delhi:

After nearly four months, oil marketing companies in India raised prices of petrol and diesel for the first time on Tuesday as the reality of global crude prices of over USD 100 per barrel began to hit home. In the next few days and weeks, prices may rise further causing significant inflationary pressure to the economy but there is one big silver lining. It could hasten the shift to electric vehicles.According to an independent study by Council on Energy, Environment and Water (CEEW) India could save on crude oil imports worth over INR 1 lakh crore (USD 14 billion) annually should electric vehicles (EVs) garner a 30% share of new vehicle sales by 2030.

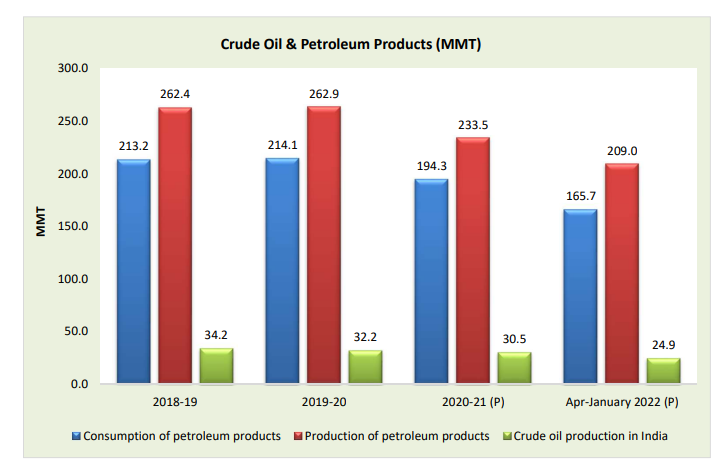

“India depends on imports for approximately 85% of its domestic oil consumption, and spends a third of its total import values on crude oil alone. If electric vehicles occupy 30% share in new vehicle sales by 2030, India’s oil import bills could reduce by 15% by around INR 1.1 lakh crores in 2030 alone,” said Himani Jain, Senior Programme Lead, Council on Energy, Environment and Water (CEEW). “A high public transport modal shift along with fleet electrification can double the savings to INR 2.2 lakh crore in 2030.”

India depends on imports for approximately 85% of its domestic oil consumption, and spends a third of its total import values on crude oil alone. If electric vehicles occupy 30% share in new vehicle sales by 2030, India’s oil import bills could reduce by 15% by around INR 1.1 lakh crores in 2030 aloneHimani Jain, Senior Programme Lead, CEEW

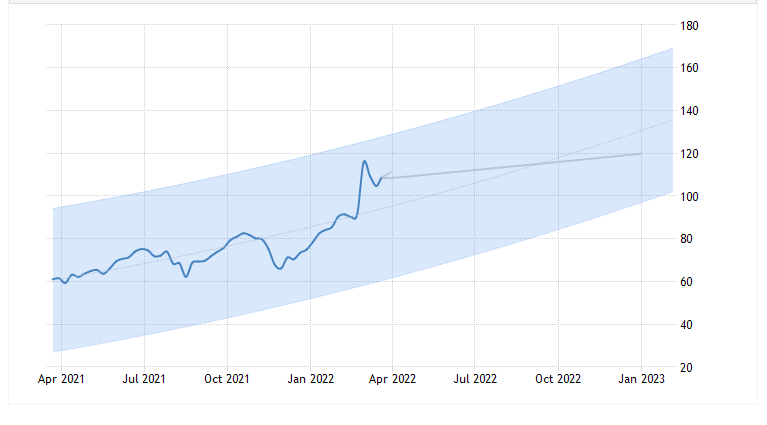

India is highly dependent on oil imports for meeting its energy requirements. Nearly 85% of crude oil has to be imported to meet the demand of 5.5 million barrels a day. Any spurt in global prices has an adverse impact on the economy–every USD 10 per barrel rise in brent crude prices impacts the country’s GDP by 16-20 basis points. So far this year, prices have jumped over USD 35 per barrel and the prognosis for the future isnt very bright. Goldman Sachs Research recently raised its 2022 and 2023 Brent spot price forecast to USD 135/bbl and USD 115/bbl, up from USD 98 and USD 105/bbl respectively. Soaring prices for gasoline, diesel, and other products made from crude oil could drive cost-sensitive consumers more quickly into electric vehicles and boost investment in competing clean technologies like hydrogen. This may be the perfect time to promote EV penetration and adoption across all vehicle segments including consumer and public transportation.

“The oil price crisis is yet another reminder why India needs to decarbonize transport as fast as possible by shifting to electric vehicles. Government support for EVs has increased 4 times over the last three years, to INR 1411 crore in 2020, but it remains low compared to ambition – for 30% of all new vehicle sales to be electric by 2030,” said Balasubramanian Viswanathan, Policy Advisor, International Institute for Sustainable Development (IISD). “The government can also do more to ramp up support for manufacturing – including EV parts, batteries and waste management – as well as greening the power system so that EVs deliver truly clean mobility.”

The increase in electric vehicles penetration could also increase the combined market size of powertrain, battery, and public chargers to over INR 2 lakh crore (USD 28 billion). In addition, a substantial number of new jobs are likely to be created in the emerging areas such as battery recycling, telematics, and allied construction and services, the CEEW report stated.

India’s position

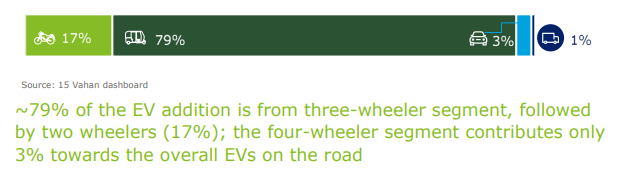

Crude oil demand is growing at a pace of 3%-4% a year, and India could be consuming about 7 million barrels a day by 2030. This presents a great opportunity for it to leapfrog into decarbonizing the transport system moving towards a “zero or low carbon emission” model by promoting the use of alternative fuel vehicles and electric vehicles (EVs).

- The analysis shows that in three years, the total cost of ownership of an e-two-wheeler would be roughly 30–50% less than an ICE two-wheeler.

- A comparison between an average ICE and EV four-wheeler shows that over an 8-year period, the total cost of ownership of an e-four-wheeler is marginally cheaper (5%).

- With the support of subsidies, the Total Cost of Ownership of an e-bus is already less than diesel buses. By 2030, India needs around 300,000 new buses to meet the demand of its rapidly increasing population.

As compared to a business-as-usual (BAU) scenario, the CEEW study also highlights that 30% EV penetration would include trade-offs such as an estimated 19% fewer jobs in the oil sector and in the internal combustion engine (ICE) vehicle manufacturing sector combined. Further, the combined annual value-add loss in the oil and the automobile sector could amount to about INR 2 lakh crore (USD 25 billion). In addition, the central and state governments would lose over INR 1 lakh crore in tax revenue annually from reduced sales of petrol and diesel.

Others may argue that lithium and nickel, key minerals used in batteries that power electric vehicles, will also pose similar challenges in the future. However, India can become self-reliant in e-mobility by ensuring a circular economy of lithium-ion batteries. The strategic advantage of lithium is that it can be reused and recycled endlessly, unlike petrol and diesel which burn to nothing. By 2030, India’s lithium-ion battery market size is expected to reach about 800GWh, with EVs accounting for 80% of this need, in line with the government’s ambitious electrification targets.

Why electrification?

Fossil fuel: Fossil fuels like coal and crude oil release greenhouse gases on burning that produce tiny molecules known as PM2.5. Even under the pessimistic scenario in which electricity for EVs is coming from coal and gas, electrification would still lead to a net emission reduction in nitrogen oxides and CO2, with a marginal to no increase in PM2.5.

Emissions: By 2030, 30% EV penetration alone would bring down PM and NOx

emissions by 17%, co2 emissions by 18%, and GHG emissions by 4%.

Net zero: At COP26 in 2021, India committed to a net-zero goal by 2070, and by 2030, India aims to raise its non-fossil fuel-based energy capacity to 500 GW, meet 50% of its energy requirements from REs, reduce projected carbon emissions by one billion tonnes, reduce carbon intensity by to less than 45%. With the transport sector contributing 13.5% of India’s energy-related CO2 emissions, and road transport accounting for 90% of the sector’s energy consumption, India cannot meet its net-zero targets without large-scale electrification, particularly road and railways.

New target approaches

The EV adoption had left its initial footprints in the second half of 2020, signalling a turning point in sustainable mobility solutions. Several automakers have also declared to stop investing in new ICE platforms and models, while others have already set a deadline for the end of ICE car production. However, as electrification continues to accelerate, OEMs and the broader EV ecosystem are facing increased pressure in their supply chains to meet these targets.

The recent spike in oil prices provides a compelling economic case for renewable energy-powered EVs over the gasoline-powered ICE counterparts..Nitish Arora, Lead, Electric Mobility & Clean Energy, NRDC

Nitish Arora, Lead – Electric Mobility and Clean Energy, NRDC, said, “The recent spike in oil prices provides a compelling economic case for renewable energy-powered EVs over the gasoline-powered ICE counterparts. It’s an opportune time for India to remain committed to bold climate reforms and accelerate its effort for turning transport and electricity green to reduce its oil import dependence. Subsequently, it would trigger and drive cost-conscious consumers to switch towards EVs more quickly.”

The clear message that stands out is that India needs to reduce its dependence on imported oil, and subsequently on petrol and diesel. Road transport accounts for 85% of India’s oil and gas needs – 99.6% of petrol and 70% of diesel is consumed by the transport sector.

With the spectre of the war against climate change becoming even more intense in the latter half of this decade, for the domestic automotive industry it could be a sheer semblance of the rise of one (crude oil prices) and the fall of another (ICE vehicles).

Also Read: