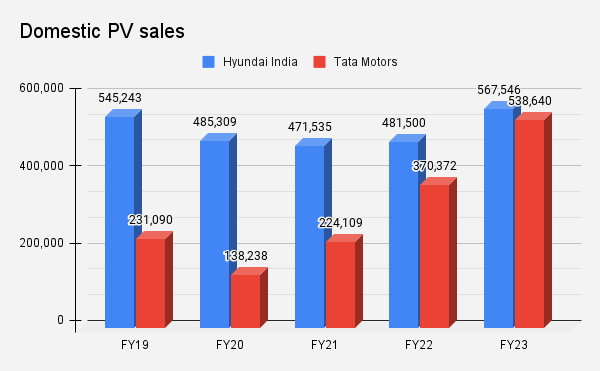

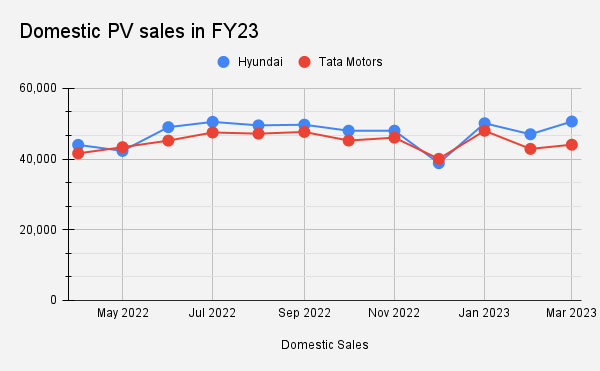

New Delhi: Country’s second largest carmaker Hyundai Motor India has retained its number two position in the Indian passenger vehicle industry during FY23. The maker of Creta SUV has clocked its highest ever domestic sales in the year since its inception in the country in 1996. This was recorded at 5.67 lakh units for FY23, ahead of Tata Motors by 28,906 units.

However, there is no denying that Tata has leveled up over the past two years to give a tough fight. It has recorded its highest ever annual domestic sales at 5.38 lakh units, with about 66% of the company’s total volumes coming from Nexon, Punch, Harrier and Safari.

In June last year, ETAuto analyzed the changing dynamics of the two carmakers in the disruptive car market.

“Healthy competition is good for the market. We are looking at not just the stated needs of the customer, but latent needs as well. Indian consumers are not willing to compromise in terms of features and technology in vehicles. Going forward, we are committed to the market,” Tarun Garg, Chief Operating Officer, Hyundai Motor India recently told ETAuto.

On the back of new product launches, FY23 has been a phenomenal year for Hyundai. Despite global headwinds, we see momentum in the Indian auto industry backed by a strong India growth story led by Gen MZ, Garg said.

According to Shailesh Chandra, Managing Director, Tata Motors PV, “The steep growth witnessed by the industry was driven by post COVID pent up demand in the early part of the year, the launch of several new vehicles, and easing of the semiconductor shortage. While SUVs and EVs led this growth, customers’ rising preference for safe vehicles and smart technology features was equally pronounced.”

Product Launches in FY23

At the launch of 6th-gen Verna, Hyundai said it is looking to double the sales in the mid-size sedan segment with the new model. This is crucial to maintain its lead over Tata Motors, which has a white space in this category.

Hyundai also launched the Venue N-Line in September, along with introducing a number of facelift models including the Venue in June, Aura and Grand i10 Nios in January this year.

To enhance its flagship model, the Nexon EV, in the electric vehicle portfolio, Tata Motors introduced the Nexon EV Max and Nexon EV Prime with higher range and advanced features respectively. In FY23, the automaker also crossed the 50,000 EV sales mark in the country.

Hyundai offers only two products in the EV segment- Kona EV and the recently launched Ioniq 5, unlike Tata which leads the market with over 80% share.

At the Auto Expo, Tata showcased the EV versions of Sierra and Harrier. It also displayed concept models of Curvv ICE, Avinya, along with a CNG model lineup including Altroz and Punch. The company first unveiled its Curvv concept in April 2022.

During the financial year, the maker of Nexon completed the acquisition of the Ford plant in Sanand, which will be focused on production of its EV models.

In the last 5-year period, Tata Motors has grown phenomenally on the back of its EV portfolio and new launches. Back in FY19, its domestic sales were less than half of Hyundai and the gap between the two OEMs was 3.14 lakh units. This came down to over a lakh in FY22 and has now reduced to less than 30,000 units in FY23.

Going forward, Chandra said the company expects the demand for personal vehicles to remain robust with the trend of electrification further strengthening.

“However, the growth rate of the PV industry may moderate due to a strong base effect as well as macro factors including hardening interest rates, rising inflation, and the cost impact from progressive regulatory norms. We continue to stay agile, carefully monitoring the supply situation, particularly semiconductors and any potential waves of Covid,” he said.