By: Ashim Sharma

In line with our ‘Nine game changers in the next decade for the Indian automotive industry ‘, Electric Vehicle is a big opportunity area. This is evident from the rising rate of sales of electric vehicles India which have grown at a pace of 13% from FY18 to FY21. While this is largely driven by 2W and 3W segments, cars and buses too have begun to witness a rising trend in annual sales volumes. Although each segment will reach an inflexion point of adoption at its own pace depending on multiple supply and demand factors, what remains a common denominator across all vehicle segments to determine future rate of adoption, is a country wide and efficient network of charging stations.

EV charging in India

EV charging network in India is still at a nascent stage of development compared to other major auto markets. As per IEA (International Energy Agency), India accounted for 0.2% of global EV charger stock in 2019. While China was one of the frontrunners with 17 chargers per 100 electric vehicles running on road, India was still at 4.4 and the world average was 12.3 for the same year.

Of the current installed stock of 1,800 EV chargers in India, 95% are slow chargers. Going forward, depending on the vehicle type and the use case, a wide network of slow and fast chargers across multiple locations will need to be installed to cater to the rising number of electric vehicles on road.

Taking cognizance of this fact, the government has provided an outlay of INR 1,000 crore to incentivize setting up of charging infrastructure and provisions have been made to provide up to 100% funding for the charging station. Multiple standards for slow and fast chargers have also been notified by the Ministry of Power to standardize the charging equipment.

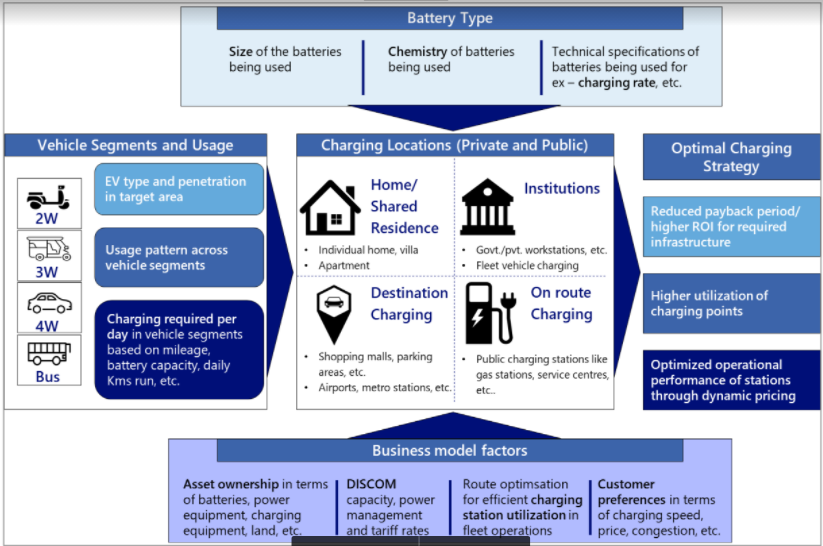

However, to make sure the efforts of the government and the private sector are utilized in the most efficient manner, a comprehensive analysis of the need, type and location of charging infrastructure required for each vehicle category, is the imminent need of the hour.

Charging locations

To cater to the charging requirements of different EV types, chargers need to be installed at multiple places. All these locations can be classified under 4 categories:

Home charging: Consisting of individual homes and housing complexes.

Institutional charging: Places with a defined aggregation of EVs such as office premises, depots, fleet operator parking lots etc.

Destination charging: Commercial areas such as malls, airports, train stations etc. which serve as temporary destinations for different vehicle types.

On-route charging: Inclusive of public charging stations akin to petrol, diesel and CNG filling stations, in cities and along highways.

Role of vehicle type

Vehicle operating parameters and usage conditions will determine the feasibility of one charging location over another for different vehicle categories. A 2W used for personal use differs from a 2W used for commercial use when it comes to charging requirements. While the former runs up to 20-30 km a day on an average and typically has a fixed commuting area, the latter has a higher running and a wider area of travel.

Therefore, a personal use 2W might need just one charge a day which can be provided at night at home using a slow charger while a commercial use 2W will require multiple charges per day of which at least one needs to be a fast charge at a destination, institution or on-route. Similar nuances are present in all vehicle categories such as cars whether taxis or personal, 3W, LCVs and buses.

EV Charging Framework

Role of the battery type in selection

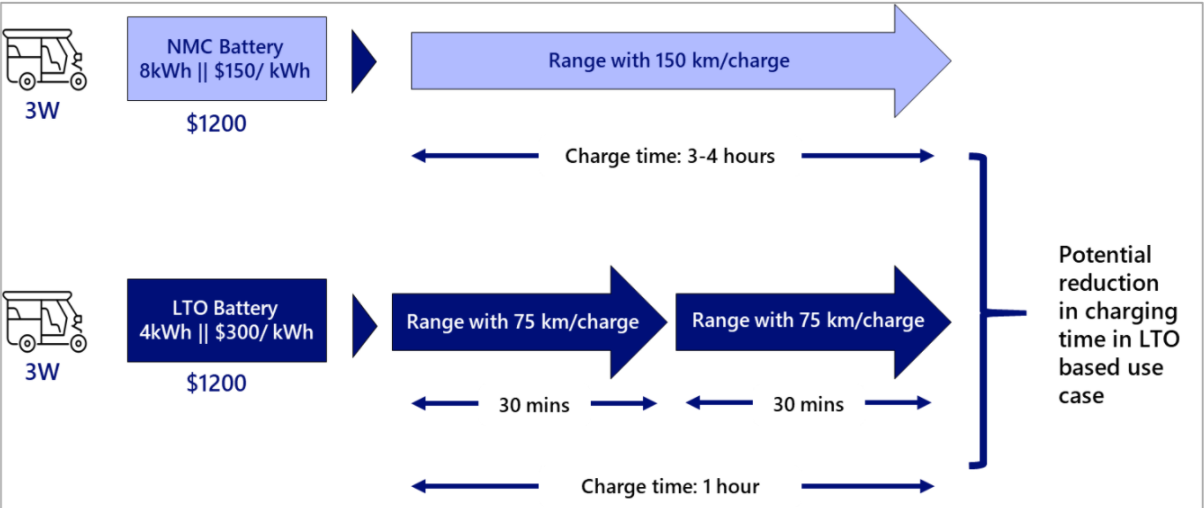

The type and size of battery will also play a key role in determining the most optimum charging solution. Most EVs currently are equipped with an NMC (Nickel, Manganese and Cobalt) or an LFP (Lithium Iron Phosphate) battery. Both these battery types provide a cost effective solution with a desired level of performance, however, they can accommodate charging rates only up to 1C (although some LFPs are also taking of 3C).

This means that for higher capacity batteries, it will be not be feasible to have multiple charges a day using slow chargers. On the other hand, battery chemistries such as LTO (Lithium Titanate Oxide) provide very high charging rates. Even a higher capacity battery can be quickly charged in minutes with a fast charger. The higher pricing of LTO currently has, however, resulted in lower usage in mobility applications.

A use case might emerge wherein a low capacity LTO battery can be installed in commercial vehicles and the consequent reduction in range can be compensated by the quick charge capability, thereby maintaining the daily running with minimum downtime

Battery type & size to determine charging solution

Role of the business model factors

Other parameters which will have an impact on determining the need, nature and location of charging are battery ownership, tariff rates of electricity, availability of parking space, customer preference, charging station utilization, service levels expected by the consumer, etc. Charging stations business can encompass a variety of business models with varied levels of asset ownerships as well.

For EV user segments like public 3Ws etc. wherein the upfront cost of the vehicle is also a constraint, a business case can be formulated that combines battery leasing along with charging of batteries. E.g. a solution based on the business model type wherein the vehicle, the battery and the charging station is owned by one entity and the vehicle moves in more or less a fixed route, could be battery swap model with fast charging of batteries in a temperature controlled environment to prevent battery degradation.

This could be employed for city buses by the city transport corporations. Another example wherein the service levels expected by customers could influence the choice of charging stations is luxury cars wherein the customer’s propensity to pay for a better service level (lower down time) is much higher and the investments in fast charging would be easily justified as shown by the Tesla Supercharger network.

The optimal charging network strategy

Charging station utilization will have a huge bearing on the return on investment (ROI) for the operator. Our estimates suggest that for an attractive payback period of 5-7 years, station utilization needs to be upwards of 60-70% if tariffs are to be kept in a feasible range. In addition, there are multiple challenges faced by a charging station operator e.g. higher infrastructure cost (land, capex etc.), availability of electricity at acceptable quality levels, tariff rates set by discoms etc.

While a few of them can be overcome through policy measures by the govt. such as demand aggregation, capex and opex subsidies etc., others can be managed by undertaking multi-factor analysis based on the vehicle type, the battery type as well as the business model factors to ensure the most optimal charging network can be created which on the one hand helps the operators reach the targeted returns on investment and on the other provides end consumers with the convenience and service levels that make the use of EVs as convenient as their current mobility options.

We believe that if these challenges are overcome through smart investing by the industry and support from the government, there is a huge opportunity that awaits the EV charging industry in India.

An estimated investment of USD 6 billion will be required by 2030 to set up the network of charging stations in India. This will not only serve the charging needs of millions of EVs on Indian roads but will also have a potential to generate a million new jobs for the economy.

(Disclaimer: Ashim Sharma is Partner & Group Head at NRI Consulting & Solutions India. NRI’s Yogesh Shivani (Senior Manager), Adnan (Manager), and Arnab Mondal (Senior Consultant) made significant contributions to this study. Views expressed are solely of the author.)