New Delhi: Domestic two-wheeler sales surged in the first quarter of 2021-22 compared to the previous year’s similar quarter. However, CRISIL Ratings has trimmed its growth estimate for two-wheelers this fiscal to 10%-12% against an earlier estimate of 18%-20%, owing to deeper and wider penetration of the second wave of the Covid-19 pandemic into the hinterland, temporary closures of dealerships and higher channel inventory.

Gautam Shahi, director, CRISIL Ratings, said, “Though forecasts of normal monsoons in the impending season bode well for the rural segment, higher rate of Covid-19 infections in rural areas will impact income levels and constrain offtake for most of the first half of fiscal 2022. Moreover, unlike during the first Covid wave, channel inventory for the industry was higher at 40-45 days in April 2021 compared to 20-25 days in April 2020 due to BS-VI transition. Hence, the benefit of channel filling will not be available this fiscal, as the impact of the Covid wave abates from Q2 of the current fiscal, resulting in lower growth.”

The benefit of channel filling will not be available this fiscal, as the impact of the Covid wave abates from Q2 of the current fiscal, resulting in lower growthGautam Shahi, director, CRISIL Ratings

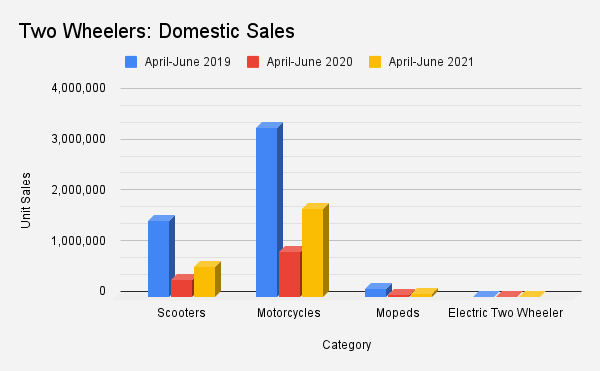

According to the Society of Indian Automobile Manufacturers (SIAM), the domestic two-wheeler wholesales in first quarter of 2021-22 witnessed a double digit growth of 85% at 2,403,591 units as against 1,294,509 units in the Q1 of fiscal 2020-21.However, the sales figures are much lower than the pre-Covid volumes of Q1 2019-20 at 5,013,067 units. Rajesh Menon, director general, SIAM said, “Sales of 24.04 lakh units for the two-wheeler segment, were lowest in the past 12 years, but for Q1 of FY21.”

After the zero sales of April 2020 with the nationwide lockdown due to the Covid first wave, April and May 2021 sales also were marred by the second wave because of the lockdown in several states. This affected production schedules and dealership operations.

What made the second wave more devastating than the first one was its widespread impact on the rural economy and market. Analysts predict that the big debt and low income in the countryside will hold back economic recovery and dent private savings and investments for longer than anticipated.

In the first quarter of the current year, SIAM reported 1,740,198 motorcycle sales and 592,445 scooter sales in the domestic market as against April-June 2020 when sales nosedived to 901,743 units of motorcycles and 339,008 units of scooters. In April-June 2019, the industry recorded 3,330,868 motorcycles and 1,514,202 scooter sales.

Sales of 24.04 lakh units for the two-wheeler segment, were lowest in the past 12 years, but for Q1 of FY21Rajesh Menon, director general, SIAM

Rohan Kanwar Gupta, vice president and sector head, corporate ratings, ICRA, said, “The extensive localised lockdown measures, implemented due to the second wave between April and June 2021, were almost akin to the nationwide lockdown last year. Several two- wheeler OEMs advanced their shutdown maintenance schedules during these months, which hit wholesale volumes significantly in April and May 2021.”“This reflected in a sharp sequential fall in two wheeler retail sales in the mini festive and wedding season in April-May 2021. The inventory at dealerships, at 30 days+ at May-end, was also relatively high, which could mean only a gradual recovery in wholesale volumes, till the stocking begins for the forthcoming festive season,” Gupta added.

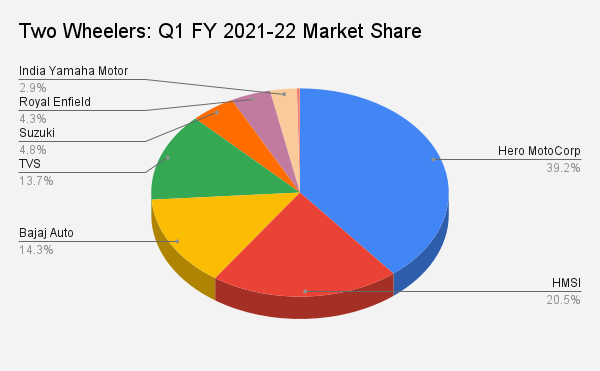

Q1 FY22 market share

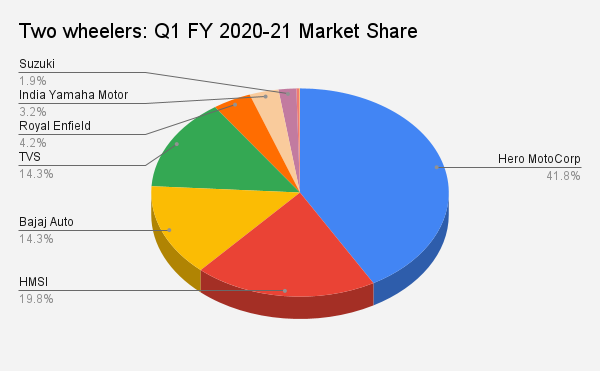

During the first quarter of FY21 (April-June 2020), the country’s largest two-wheeler maker Hero MotoCorp gained a market share of about 5% to cross the 40% mark for the first time in almost five years (past 19 quarters). However, the automaker ended the first quarter of the current financial year (April-June 2021) just below the mark at 39.2%.

The Pawan Munjal-led company sold 8,79,144 motorcycles and 61,453 scooters in the domestic market in Q1 FY22 as compared to 5,00,605 motorcycles and 39,132 scooters in Q1 FY21.

Honda Motorcycle and Scooter India (HMSI) gained marginally to record 20.5% market share in Q1 FY22 from 19.8% in Q1 FY21. Earlier, the company had clocked 27% share in Q1 FY20.

The country’s largest scooter manufacturer saw a growth of 57% in its domestic scooter sales at 2,67,479 units during the first quarter of this fiscal year as against 1,69,995 units in the corresponding quarter previous year.

For the last financial year, the company recorded 25.58% market share, which is a sharp loss from a peak of almost 29% in FY18 and 27% in FY20.

Interestingly, Suzuki Motorcycle India jumped up to the fifth spot in the top 5 two wheeler makers list this quarter from the position of number 7 in the first quarter of last fiscal year. The company earned 4.8% market share in Q1 FY22 as against 1.9% in the corresponding quarter last year. During the April-June 2021 quarter, Suzuki sold 1,13,224 scooters and 3,642 motorcycles in the domestic market.

Bajaj Auto and premium bike maker Royal Enfield maintained their positions at 14% and 4% respectively, with no significant change in their market share. While the Chennai-based TVS Motor lost almost 1% market share as compared to Q1 FY21.

India Yamaha Motors market share dropped from 3.2% in April-June 2020 to 2.9% in the same period this year.

Premium motorcycles, after the past three fiscals of volume decline, are expected to grow at 12%-15%, given the higher number of new launches and increased focus of two-wheeler makers on ‘premiumisation’CRISIL

In the 110cc-125cc motorcycle segment, HMSI (CB Shine) took a lead with 1,65,951 unit sales during the April-June 2021 quarter as against the highest of Hero MotoCorp (Glamour, Splendor) that clocked 1,29,530 sales in April-June 2020 quarter.

The demand for 150cc-200cc premium commuter motorcycles witnessed a sharp increase of 189% with domestic wholesales in this category clocking 1,69,947 units in Q1 FY22 as compared to 58,686 units in Q1 FY21. While HMSI sells Hornet models in the product segment, TVS sells Apache brand, and Bajaj offers Avenger, Husqvarna, KTM, Pulsar bikes. Hero MotoCorp’s Xpluse 200 and Xtreme in this category garnered 8,455 units in this quarter against 1,066 units in the corresponding quarter previous year.

Outlook for FY22

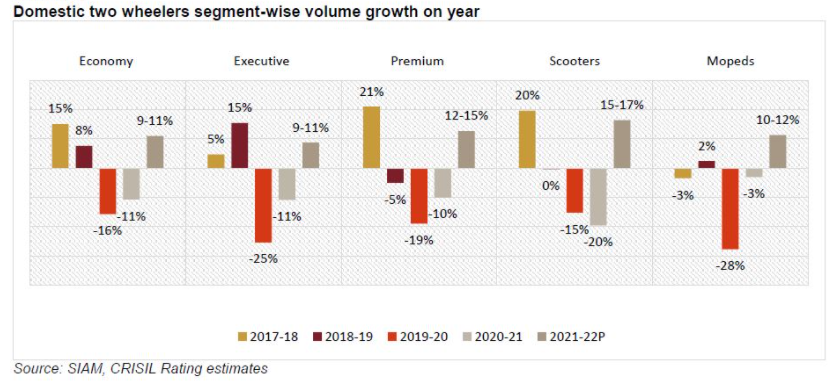

According to CRISIL, motorcycle volumes will see higher moderation as 70-75% of these are sold in rural areas, compared to scooters’ which is predominantly an urban product. Among the domestic two wheeler segments, growth of rural-focused executive and economy motorcycles will remain constrained at 9%-11% this fiscal.

And the premium motorcycles, after the past three fiscals of volume decline, are expected to grow at 12%-15%, given the higher number of new launches and increased focus of two-wheeler makers on ‘premiumisation’.

“The scooters segment is expected to stage a good recovery this fiscal, registering volume growth of 15%-17%, albeit on a relatively low base, supported by faster recovery in urban incomes, continuing preference for personal mobility, and the graded opening up of offices and educational institutes, as vaccination drive gathers pace. This growth, though, is on the back of three consecutive years of volume decline.” CRISIL said.

Sushant Sarode, associate director, CRISIL Ratings, said, “Credit quality of two-wheeler manufacturers will remain resilient considering strong balance sheets, limited debt, efficient working capital management, robust liquidity (over INR 40,000 crores), and limited need to add more capacity, given low capacity utilisation over earlier two fiscals.

Ratings agency ICRA expects a 12%-14% YoY growth in two-wheeler volumes in FY22, amid an evolving Covid-19 situation. While the overall consumption and investment demand may take some time to recover after the devastating second wave, India’s rural economy is expected to provide some support. Expectations of a healthy rabi production, timely arrival of the monsoons, a hike in minimum support prices for kharif crops and other income support schemes by the Government are likely to help revive rural demand sentiments and support the two-wheeler offtake in the festive season.

According to ICRA, given the high operating leverage of the industry, subdued demand and continued hardening in raw-material costs are expected to keep the operating margins constrained for the two wheeler OEMs in the current fiscal. However, these will likely be near-about the FY2021 levels (13.5%-14%), supported by price escalations, a depreciating rupee and continuing cost rationalisation initiatives. The RoCE of two-wheeler OEMs would also continue to remain at healthy levels, ranging between 22%-24%.

Rohan Gupta of ICRA said, “In line with ICRA’s Stable outlook on the industry, the credit profile of two wheelers OEMs is expected to remain healthy, supported by strong balance sheets, limited debt and healthy cash and liquid investments. While the capex would likely be higher than the FY2021 levels, major expansion plans are expected to be deferred till a meaningful demand recovery. Nonetheless, the OEMs will continue to invest in new product development and network expansion in both domestic and overseas arenas.”