New Delhi: With the Covid-19 second wave reaching its peak in the first month of the current fiscal year, the country witnessed a massive rise in virus cases during mid-April and May 2021. What followed were OEM plant shutdowns, disrupted production schedules, supply chain interruptions, severe impact on Indian hinterland and an overall negative sentiment in the Indian economy.

The passenger vehicle industry, which involves a highly intertwined supply chain to produce big-ticket items on a mass scale, has been under severe pressure over the past three years.

Meanwhile, looking at the sales trend for the current fiscal year, the segment has been picking up the fastest and three months down the line, there are visible green shoots in the OEM dispatches to the dealers. However, since this growth is on last year’s low base, the industry still stands far away from the normal volumes.

Going forward, industry experts remain optimistic about the sequential recovery due to increased vaccination, customer interest in SUVs and the excitement of new launches which may contribute in regaining lost volumes. However, overall outlook for FY22 remains uncertain with the fear of the Covid third wave and its repercussions.

According to Emkay Global Financial Services, domestic PV industry volumes in June 2021 increased to around 255,700 units, implying a 6% CAGR over June 2019.

“We have compared volumes with June 2019 numbers. The two-year CAGR was 34% for Tata Motors and 7% for Maruti Suzuki, while Mahindra & Mahindra saw a decline of 5%. We expect further improvement in Q2FY22, driven by the easing of lockdowns, pent-up demand and low dealer inventories,” the research firm said.

Winners and losers

While some companies are losing a significant volume of their market share to the rivals, others are gaining to rise up the ladder with customer traction over their fresh product launches from the last fiscal. Auto firms which were losing out in the market are further marginalised.

The undisputed leader of the Indian car market, Maruti Suzuki India Limited (MSIL), dispatched 293,062 units in the first quarter of the current fiscal year as against 64,976 units in Q1 FY21. The demand for personal mobility and the reliance on a trusted brand has been a distinguisher for the maker of Swift and WagonR. However, the company failed to launch any new product or platform during the past year. Its market share fell to 45.7% in Q1 FY22 from the previous high of 51% in FY20.

Country’s second largest carmaker Hyundai Motor India (HMI) is playing on its SUV portfolio. The automaker has established itself with the Creta model, and is maintaining its market share in the SUV segment.

Tata Motors remained as the third largest automaker, overtaking Mahindra & Mahindra by a position.

Shailesh Chandra, president, passenger vehicles business unit, Tata Motors, said, “In the EV segment, despite witnessing difficult business conditions, the company posted the highest-ever quarterly sales of 1,715 units. This was on the back of the increasing demand for Nexon EV, which posted its highest-ever monthly sales of 650 units in June 2021.”

In another development, the South Korean automaker Kia Motors which debuted in the Indian auto market in August 2019 with its Seltos SUV, has stormed and maintained its position in the list of top five carmakers in the country in terms of market share in Q1 FY22, leaving behind established players like Toyota Kirloskar Motors and Honda Cars India.

However, the SAIC-owned MG Motor, which also began operations in the Indian market along with Kia in June 2019, has not garnered as much interest and lost its position in the list of Top 10 PV makers with 7,139 unit sales in the first quarter of FY22. On Friday, the automaker confirmed that it is likely to launch its mid-sized SUV Astor for the Indian market by the end of 2021.

Coming back to the game, Japanese automaker Nissan Motor India has hopped onto the list, majorly riding on the success of its entry-level SUV Magnite launched in December 2020.

| Rank | PV OEMs | April 2021 Sales | May 2021 Sales | June 2021 Sales | Domestic Sales (April-June 2021) |

| 1 | Maruti Suzuki | 135,879 | 32,903 | 124,280 | 2,93,062 |

| 2 | Hyundai | 49,002 | 25,001 | 40,496 | 1,14,499 |

| 3 | Tata Motors | NA | NA | 24,111 | 64,386 |

| 4 | M&M | 18,285 | 8,004 | 16,913 | 43,202 |

| 5 | Kia | 16,111 | 11,050 | 15,015 | 42,176 |

| 6 | Toyota | 9,621 | 707 | 8,801 | 19,129 |

| 7 | Renault | 8,642 | 2,620 | 6,100 | 17,362 |

| 8 | Honda Cars | 9,072 | 2,032 | 4,767 | 15,871 |

| 9 | Ford | 5,469 | 766 | 4,936 | 11,171 |

| 10 | Nissan | 3,369 | 1,235 | 3,503 | 8,107 |

*Source: Industry Data

Most automakers are holding onto their positions with upgraded portfolios for the Indian consumers. Others are aided by the falling fortunes of brands like Skoda, Fiat, and Volkswagen, which recorded below 1% market share and are diminishing in the Indian market with reduced sales.

Early this year, Volkswagen said that it is taking significant steps towards its objective of gaining a 3% market share in India.

Meanwhile, the French carmaker Renault India rode over the Japanese Honda Cars India with its Triber model.

Ashish Modani, vice president and sector head – Corporate Ratings, ICRA said, “Domestic PV wholesale volume witnessed sharp recovery month-on-month during June 2021, primarily due to pent-up demand as well as some impact of inventory stocking at dealerships, which was relatively at a lean level earlier. Certain specific models/variants are currently commanding a long waiting period, thereby providing some support and visibility to overall PV volume.”

During the course of the year some OEMs may regain their market position, while others may lose out for not upgrading their product portfolios.

SUV boom

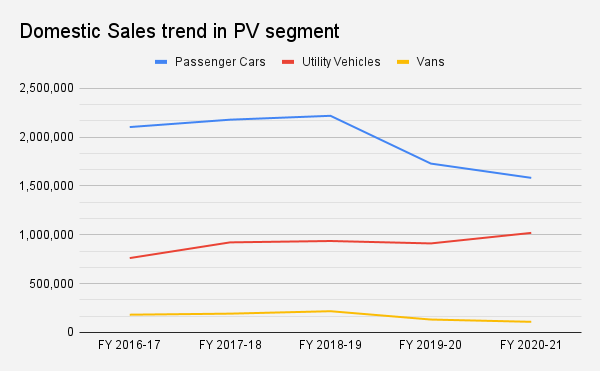

The Indian automobile industry which clocked 2,102,905 units of passenger car sales in the domestic market during FY17 has come down to recording 1,582,822 unit sales in FY21. In the past five years, the domestic sales trend has altered in favour of utility vehicles which rose from about 761,485 units in FY17 to 1,019,394 units in FY21.

The stellar sales performance of SUVs in an otherwise weak Indian automobile market reflects the burgeoning customer shift towards the emerging segments with innovative and technologically advanced product offerings. Moreover, the once popular sedans are facing customer neglect.