India’s mainstream carmakers, from Maruti Suzuki to Hyundai and Tata Motors, are seeking to democratize the electric power train in personal mobility through the introduction of one electric car a month over the next two years, breaking consumer resistance over affordability through more mass-market choices than ever before.

“The adoption of EVs in passenger vehicle segment in India has been rather slow . Currently it is only 2.2% despite the substantial GST rate advantage. There are mainly 3 reasons for this slow adoption: the high acquisition cost ( EVs are typically 1.35-1.7 times more expensive than corresponding gasoline cars ), range anxiety among potential buyers due to lack of charging infrastructure and the relatively less number of mass models in this segment. It is expected that as the battery prices come down and as more models are launched and range anxiety fades away, the adoption rate will increase”, Shashank Srivastava, senior executive officer (marketing and sales) at Maruti Suzuki said, adding, “Some research shows faster adoption once penetration gets to around 5%. After this inflexion point, it is expected that EV penetration in India will each around 20% by 2030.”

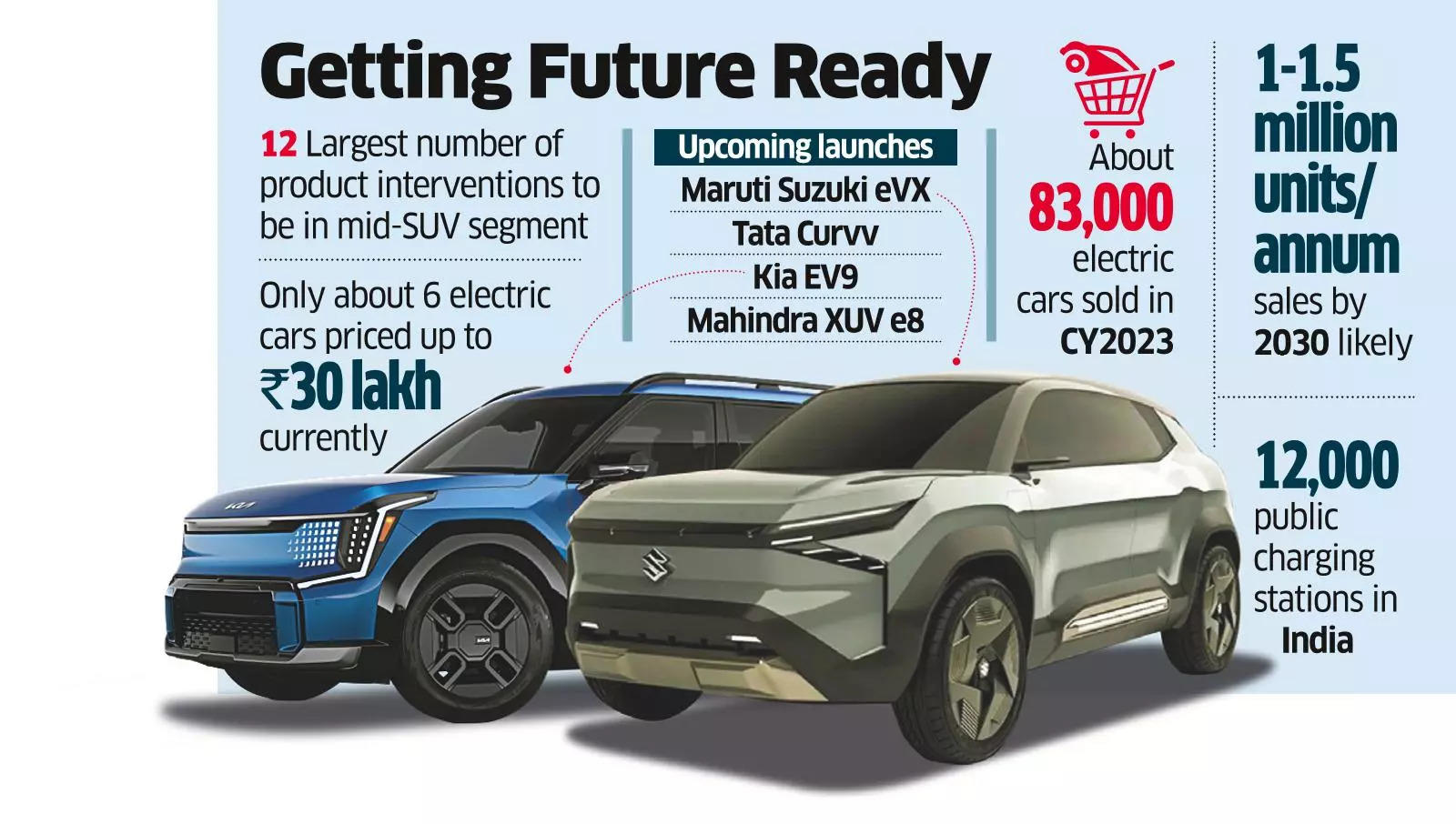

The largest number of product interventions – 12 – will be in the heart of the market in the mid SUV segment that has popular models such as Hyundai Creta and Maruti Suzuki Grand Vitara. Another half a dozen SUVs are scheduled for launch across the sub-compact, compact and premium SUV categories.

Also on cards are one electric hatch, each in the entry and premium segments, a premium electric sedan and an electric MPV for buyers looking at other body types.

There are only about six electric cars priced up to INR 30 lakh currently, limiting choices for customers at the more affordable end of the market. With these new product interventions, local auto majors expect sales of electric cars to grow more than ten-fold to over 1-1.5 million units per annum by 2030. About 83,000 electric cars were sold in the country in CY2023.

In FY25 itself, carmakers are set to launch 10 EVs including Maruti Suzuki eVX, Tata Curvv, Kia EV9 and Mahindra XUV e8.

Hardeep Singh Brar, national head (sales and marketing), Kia India, concurred.

“There are only limited models priced up to INR 30 lakh, restricting the options for customers in the mass market,” Brar said. “As more electric cars come in at affordable prices over the next two years, charging stations come up, penetration will go up.”

There are about 12,000 public charging stations in the country, compared with 68,000 fuel stations dispensing petrol and diesel.

The government, in collaboration with the private sector, is already working towards expanding the EV charging infrastructure across the country. Last year, the Ministry of Heavy Industries (MHI) sanctioned INR 800 crore as a capital subsidy to three state-run oil marketing companies to establish 7,432 public EV charging stations. It also approved the setting up of 148 charging stations by other entities.

Industry estimates the scheduled new car launches, which will almost triple the choice of electric vehicles on offer in the country together with an expansion in the number of public charging stations, will help the market reach the tipping point in 2-3 years.

Electric vehicles are likely to comprise 18-30% of new car sales by the end of the decade from the current 2%, depending on the pace of development of charging infrastructure. Even on a conservative basis, this would mean sales of nearly a million electric cars in the market every year by 2030.

In the base-case scenario, electric light vehicles production in India could be as high as 1.5 million units per annum by 2030, given the aggressive plans outlined by carmakers such as Tata Motors and Mahindra & Mahindra,” said Gaurav Vangaal, associate director (light vehicle production forecast, Indian sub-continent), S&P Global Mobility.

“Even market leaders Maruti Suzuki and Hyundai have announced plans for nearly a dozen models for launch in this space by the end of the decade,” he said. “That said, we should also keep in mind there is a lot of work happening on hybrids, CNG, ethanol and flex fuel vehicles which will co-exist with electric.”