New Delhi: The past two years have obviously been difficult for much of the economy. The onset of the second wave of the pandemic and looming threat of Omicron has affected the already-struggling India’s journey to prosperity. With the slowdown that the economy had suffered, the country’s growth rate had decelerated from 8.3% in 2016-17 to 4% in 2019-20.

With this background, when Finance Minister Nirmala Sitharaman stepped up on the podium to table the Union Budget for 2022-23, it was the second budget amid the fear of COVID-19. Even the Economic Survey report presented in Parliament a day before the budget noted the challenges from the new variants of COVID-19 and the uncertainties in the global economy.

And, that is why perhaps the run-up to the Budget has been less noisy within the auto industry this year than usual. However, that doesn’t mean the sector had no expectations and demands from the finance minister.

It is no secret that the Indian auto industry has faced a significant slowdown because of COVID-19, global semiconductor shortage and unbridled commodity price increases.

Both the OEMs and the component suppliers were hoping to get some direct fiscal and policy support in this year’s budget to battle the odds for resilience and survival. Electric vehicle segment was expected to be the focus area. Providing an impetus for investments was also much needed. Huge bets were also being placed upon taxation and infrastructure development among many others that will help the industry embark on a long-term growth path.

While the Finance Minister’s budget speech on February 1, 2021 outlined several new provisions and increased investments to get the auto industry back on track, some significant opportunities were also missed. Moreover, the auto industry did not find any direct mention in Union Budget 2022, which dismayed most of the stakeholders.

In this reading list, we take a closer look at some major takeaways of the Budget, which had a fair number of hits and misses.

The hits:

Enhanced allocation of capex, high target for national highways, the proposal of an EV battery policy, tax incentives for startups, support for MSMEs, Emphasis on rural economy, and boost to local parts manufacturing, and are some of the major hits of the Union Budget 2022 from the automotive industry perspective.

Enhanced allocation of capex

An increase in capex expenditure, and focus on infrastructure across the board, is a big positive. The government has announced a sharp jump of 35.4% in capex outlay to INR 7.5 lakh crore next year as against INR 5.54 lakh crore in the current year. This move will provide the much-needed impetus for the commercial vehicle sector, especially the M&HCV segment, which has witnessed sharp demand contraction over the past two years.

High target for national highways

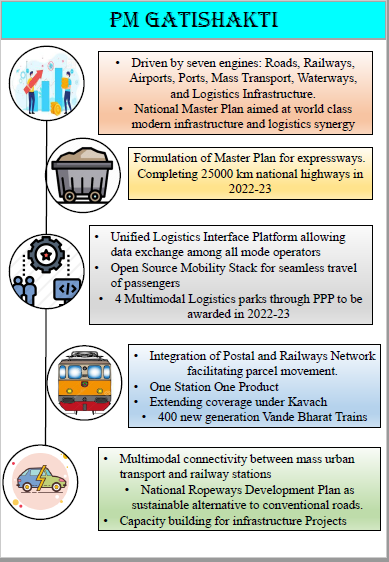

Expansion of national highways by 25,000 km under the Government’s Gati Shakti Programme, that encompasses thrust on seven different engines of growth, including roads, railways, and multi-modal logistics infrastructure, augurs well for the demand for commercial vehicles, especially Tipper Trucks, construction sector and tyre sector.

Experts opine that allocation of INR 20,000 crore for road infrastructure projects is likely to lead to a spillover demand for heavy duty trucks and construction equipment and also increase consumption of tyres.

Coming soon, EV battery policy

One of the landmark announcements of this Budget is the battery swapping policy, which has the potential to be a game-changer in catalysing the migration to EVs. Further, the government’s move to create special mobility zones for EV along with encouraging the private sector’s involvement to create sustainable and innovative business models for battery and energy as a service will boost the entire EV ecosystem of the country.

According to the experts, commercial EV manufacturers, particularly in electric two and three-wheelers, will profit from this announcement and it is likely to add confidence to the potential passenger EV buyers also. The proposed battery-swapping policy will help create standards of interoperability thereby making EVs more accessible and affordable.

Besides, auto component manufacturers will also get a fillip as the proposal will encourage fresh investments for indigenous battery makers.

Tax Incentives for startups

In recent years, the number of mobility startups has increased fast and more support has become available in all dimensions. In a bid to give a boost to the country’s “growth drivers,” the finance minister on Tuesday announced an extension of the period of incorporation of eligible startups by one more year for providing tax incentives.

In her Budget speech, the Finance Minister also proposed capping surcharge on long-term capital gains arising on transfer of any type of assets at 15%.

“This step will give a boost to the startup community and along with my proposal on extending tax benefits to manufacturing companies and startups reaffirms our commitment to Atma Nirbhar Bharat,” Nirmala Sitharaman said.

She also suggested the setting up of an expert committee to monitor mobilization of funds for startups through venture capitalists and private equities.

Support for MSMEs

The MSME sector in the manufacturing space gets a boost with rolling out of the government’s Raising and Accelerating MSME Performance (RAMP) programme with an outlay of INR 6,000 crore over five years. The objective of this programme is to improve credit and market access of MSMEs. The Finance Minister also said that the Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE) scheme will be revamped with a required infusion of funds and will facilitate additional credit of INR 2 lakh crore for MSMEs and expand employment.

MSMEs form around 80% of local auto parts and RAMP programmes will help address many of their burning issues like delays in payment and access to credit.

Emphasis on rural economy

The announcement on MSP payment of INR 2.37 lakh crore to farmers would encourage rural demand, which has remained sluggish after the second wave of COVID-19. “The idea is to enhance rural income and enable rural consumption by putting money directly in the hands of the farmers,” Rajat Wahi, Partner, Deloitte India, said.

According to rating agency ICRA, the Government’s continued focus on rural development and farmer welfare in the budget will uplift rural sentiments, and thereby remains positive for the tractor and two-wheeler segment.

Boost to local parts manufacturing

The Budget proposed increasing import duty on certain components (such as braking systems, electronic and engine parts like lights, windscreen wipers, turbo chargers) to 15% from 7.5% -10% earlier. This will certainly encourage local manufacturing of these components, which has been another focus area of the government. However, on the flip side there are some drawbacks as well.

“In the interim it could increase the price of vehicles further, which has been on an upward trend amid increasing input cost, and thus hurt the overall demand,” Shruti Saboo, Associate Director, India Ratings and Research, said.

The major misses:

No rationalization of GST on automobiles, and no relief in personal income tax are some of the major misses in the Budget 2022. A major shock is the plan to impose an additional differential excise duty of INR 2 a litre on unblended petrol and diesel.

No rationalization of GST on automobiles

The government yet again side-lined the long-standing demand of the automotive industry for lowering GST rates. All the auto and related products are currently taxed at the levels of luxury items and fall in the bracket of highest 28% slab. On top of that, cess is levied from 1% to 22% if the vehicle exceeds a certain body or engine size.

Higher GST rates are making vehicles unaffordable for buyers especially when increased prices of raw materials, successive fuel price hike, tougher safety and emission rules have already amplified the input cost.

Along with this is the government plan to impose an additional differential excise duty of INR 2 a litre on unblended petrol and diesel, auto fuel will certainly become more expensive in days to come. Consequently, sales of the ailing commuter two-wheeler segment will tend to get another massive jolt in coming months.

Petrol price spiked in almost all the months of 2021, sometimes even in every week of a month that shot up the ownership cost of 100-125 cc motorcycles and 110 cc scooters anywhere between 14% and 15% last year. Notably, this entry segment constitutes 75% of the two-wheeler sales in the domestic market.

No relief in personal income tax

Individual taxpayers and salaried middle class are highly disappointed as the finance minister did not make any major announcement to provide any relief to this segment. From the auto industry point of view, they are probably the prime consumers in the local market, hence neglecting them in the pandemic-induced market will further delay the revival prospects.

In conclusion, the budget is unlikely to immediately trigger a consumption revival within the auto sector though it is curated to generate liquidity for consumers in the long term in both rural and urban areas. As per Vikas Bajaj, president of the Association of Indian Forging Industry (AIFI), “Apart from encouraging EVs (electric vehicles) by creating a battery-swapping strategy to overcome EV charging infrastructure, I believe there isn’t much in the budget to support the auto sector as was expected.”

Also Watch: