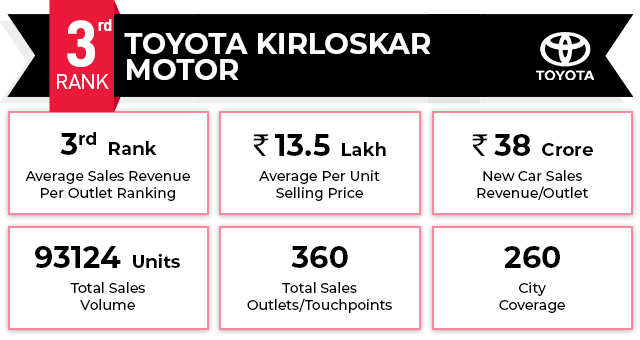

New Delhi: Toyota Kirloskar Motor (TKM), known for its dealer-friendly strategy, has one of the highest per-unit selling prices with the dominance of Innova and Fortuner. However, with the assimilation of Suzuki re-badged Glaza and Urban Cruiser, the average selling price has come down to INR13.5 lakh.

New Delhi: Toyota Kirloskar Motor (TKM), known for its dealer-friendly strategy, has one of the highest per-unit selling prices with the dominance of Innova and Fortuner. However, with the assimilation of Suzuki re-badged Glaza and Urban Cruiser, the average selling price has come down to INR13.5 lakh.Now, the rebadged models contribute heavily to the overall sales of TKM. Naveen Soni, senior vice president, sales and marketing, in an email interview with ETAuto, said, “ We have been witnessing a surge in demand for personal mobility particularly in the below INR 12 lakh segment that was growing at 20% to 30%t, before the latest lockdowns came into effect. We believe this demand will take a pronounced effect once the lockdowns across various parts of the country are lifted.” The edited Excerpts:

Q. What are the core focus areas for your dealer partners in a post-COVID world?

Currently, we are working on a special project to reduce the order-to-delivery lead-time and improve delivery accuracy besides ensuring there is no floating inventory at dealerships to plug the supply-demand gaps.

This helps them give a better image of the timelines by which the vehicle can be handed over to the customers. We are also taking steps to scale up our production so that we can reduce the waiting period. Moreover, a lean or floating inventory reduces the inventory carrying cost thereby benefiting the dealers.

At the same time, we are also strengthening our processes and enhancing the workforce capability of our dealer partners to enable them to cater effectively to the increasing demand for personal mobility.

More importantly, at dealerships, we are optimising preventive protocols by adopting the highest standards of safety and hygiene meant for both dealer employees as well as customers so that every interface of a car buying experience is undertaken in a safe manner.

In addition, we have digitized our sales operations to help us assess the market requirements with able support from our dealer partners. Today, our customers can take a virtual tour of our products, choose from an array of financing options, get online quotations and receive doorstep delivery of their new cars, thereby facilitating the entire purchase process both for our customers as well as our dealers especially in the post-COVID scenario.

Q. Is a smaller set up becoming the norm going forward – what percentage of sales outlets will be large, small, sub-outlets and mobile outlets?

We have been witnessing a surge in demand for personal mobility particularly in the below INR 12 lakh segment that was growing at 20% to 30%, before the latest lockdowns came into effect. We believe this demand will take a pronounced effect once the lockdowns across various parts of the country are lifted.

TKM is geared to cater to this demand through a mix of digital and conventional sales channels. Our sub-12 lakh offerings, Glanza and Urban Cruiser, have been runaway successes for us in this segment, drawing customers in both metros and tier II and III cities and towns.

Hence, we believe a healthy mix of large and small outlets besides digital sales across tier I, II and III cities and towns will be the appropriate way for us going forward. Moreover, as we expand to smaller markets and areas, we believe that the economics would drive leaner & smaller dealerships.

Q. How many outlets do you have right now — in terms of 3S, only sales, only service, etc., and what are your expansion plans?

We have more than 419 customer touchpoints in the country spanning traditional and newer emerging markets, with 50 new outlets being opened last year. In the coming months, we are trying to have dealership expansion in such a manner that we can meet the market requirements and be able to offer even more competitive products to reach more markets in the country.

We are targeting to add more than 80 PRO Service facilities to the already existing 330 outlets spread across 260 cities to serve the customers better. Further, to increase our reach, we recently launched ‘Toyota Service Express-Lite’ Mobile Service Vehicles to reach far-off customers and provide doorstep services of minor and medium periodic maintenance and general repairs as per their convenience.

By the end of this year, we aim to deploy more than 150 Service Express Lite vehicles across India, which will be an addition to the more than 500 plus service points.

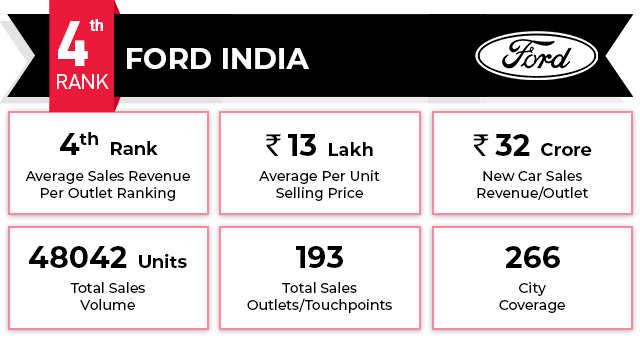

Ford India

The only American carmaker hanging on to the Indian market, Ford is placed at 4th position in terms of average per-unit sales per outlet. Having a total of 193 sales outlets with most of them in the cities where the investment is on the higher side. In FY21 every outlet on an average sold about 249 units.

Note: All the data is an estimation based on the information received from various sources and extrapolated by ETAuto research.

Sales Outlet: Sales Outlet means all kinds of physical outlets/dealerships/touchpoints from where cars were sold.

Average Sales Revenue: This is based on the ballpark average selling price per unit multiplied by total units sold in a year divided by the number of outlets.

Average Selling Price Per Unit : This is an estimated price derived from the price range and the calculation done by ETAuto. It may differ slightly from the exact price.

Also Read: