New Delhi: A combination of factors like poor cargo availability from the factory gates, lower cargo movement and hike in fuel prices have proven to be costly for transporters. During December 2020, cargo availability from factory gates dropped by 8%-10%, diesel price went up by INR 2/litre, and truck rentals on key truck routes dropped by 3%-4%.

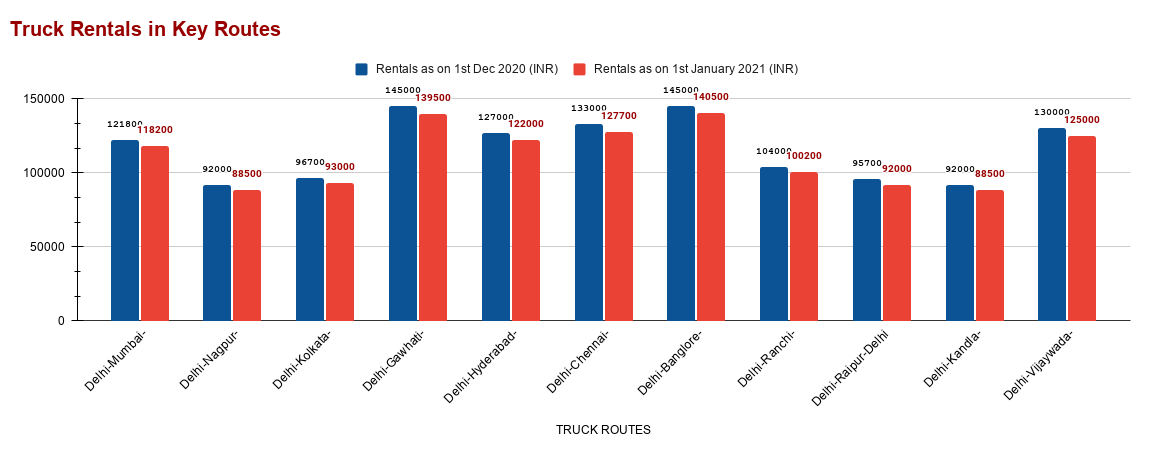

Industry watchers say truck rentals on key truck routes dropped 3%-4% during December 2020 as demand dried up after the festive season and resulted in lower fleet utilisation. Dispatches of food items, however, remained steady across the truck routes. Truck routes are the main routes in which cargo moves across the country

According to the Indian Foundation of Transport Research and Training (IFTRT), the rising prices of FMCG, automobiles, construction material and general merchandise are not helping the trucking industry to get more cargo. Main truck routes like Delhi-Mumbai-Delhi are down by 3% while Delhi-Hyderabad-Delhi is down by 4%. Others like Delhi-Kandla-Delhi have also declined by 4%, as per the IFTRT data.

“As many sectors, including auto, have increased the price of end-products, the production at related MSMEs has remained at low levels. They have adopted the strategy to work on low production as consumer spending squeezes post festive period which has impacted the cargo availability,” SP Singh, senior fellow at IFTRT, said. It seems this slowdown in volume will continue at least for the next two quarters unless the government pours excess investment into the infrastructure segment, he said.

Almost all the automakers hiked vehicle prices in the range of 2.5% – 10% across segments from January 2021 due to rising commodity prices. Experts caution this could upset the demand and delay recovery in the commercial vehicle segment (CV).

Unlike passenger vehicles and two-wheelers, CV segment has still not recovered from the virus-induced sales crash. One of the key reasons is that the fleet operators, who are the bulk-buyers of medium and heavy commercial vehicles (MHCV), are unable to replace their existing trucks as lower fleet utilisation has impacted their profitability. Notably, 70%-80% of the demand in the CV segment comes from the replacement market.

Due to the low base effect of the previous year, OEMs managed to score positive wholesales in December 2020, but analysts opine that year-on-year growth of the segment is possible only in FY22.

According to Amit Hiranandani, senior analyst at East India Securities, MHCV market was down by about 35%-40% YoY on the retail level last month. “On the expected lines, heavy truck demand remains softer as economic activities are yet to pick up in full speed. Besides, lower freight rates and utilisation are further dampening the prospects,” he added.

Moreover, owing to the higher prices of BS-VI trucks, fleet operators are reluctant to buy them, Singh said. “This has affected the purchase of BS-VI trucks. Fleet owners are content with retaining their BS-IV vehicles and this situation may continue for another 3-4 quarters,” he said.

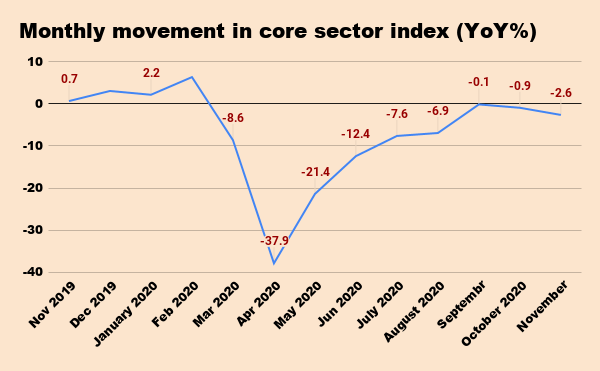

In industry parlance, CV sale is a key indicator of the economy. And therefore, crash of demand in this space is not accidental. The growth of the cumulative index of eight core industries crashed to 11.4% in the first eight months of the ongoing fiscal against a growth of 0.3% in the year-ago period. In fact, the output growth during November 2020 was even lower than the 0.6% de-growth in October 2020 majorly on account of persistent fall in crude oil, refineries, natural gas, and steel output.

On the outlook, experts expect CV demand to remain weak because of restrained economic activity and presence of excess idle capacity. It is estimated that the overall heavy truck industry will witness 35%-50% decline in FY21. They reckon that the turnaround in the truck rental segment is only possible with pickup in factory activities and goods movement. Under MHCVs, tipper trucks, however, could see demand coming from the gradual resumption of construction activities.