Lithium ion as a battery technology virtually dominates the entire EV market and may remain popular for the foreseeable future. However, technologies like Sodium ion and supercapacitors are set to be adopted as new energy storage solutions in the emerging EV and energy storage sectors. Betting on this likely scenario, Godi India has lined up USD 3 billion investment plan to be executed over the next 5 years.

While the 4-year-old startup has started its innings with Lithium-ion technology, its founder and CEO, Mahesh Godi is betting on non-Lithium ion technologies also. He expects such technologies to have a 30% share among electric energy storage solutions by 2027 if the issue of bulk manufacturing of materials for Sodium-ion technology gets sorted out soon.

“Maybe next year it will be 5%-10%, followed by 10% to 15%. Incrementally it will go up,” Godi told ETAuto. He expects “a lot of players” to enter the sodium ion market in 2025-26. The R&D and engineering team of 70 members at Godi India is “already working at the level of the materials” and doing applied research with their own material technology.

The availability of raw material for sodium ion technology within the country can enable players to make a truly indigenous battery. What engineers will have to figure out is to reduce or offset the energy density of the technology compared to the popular LFP (Lithium Iron Phosphate) and NMC (Nickel Manganese Cobalt) chemistries of Lithium-ion batteries.

It is estimated that while the energy density of a Lithium-ion battery with NMC chemistry is at around 280 watt/hour per KG, and 180 for LFP, for Sodium-ion it’s at around 120. Therefore it is seen as a “much cheaper” and “really good candidate” for stationary energy storage applications in offices and homes where space is not a constraint.

There could be EV applications too for the technology. If things move as planned, Godi says the first batch of sodium ion cells will be locally manufactured before December this year.

Godi, a former Silicon Valley and Wall Street professional, see Supercapacitors as the other emerging energy storage solution. His company is investing to the tune of USD 40 million in the development and manufacturing of supercapacitors. An announcement with more details is expected next month.

While these new plans shape up, Lithium-ion technology is attracting business and investment interest for Godi India, which received its BIS (Bureau of Indian Standards) certification for its 21700 cylindrical NMC811 lithium-ion cells that were designed in-house and locally made. TUV was a third-party testing agency. With this, GODI India claims to have become the first Indian company to get this certification for lithium-ion cells in India.

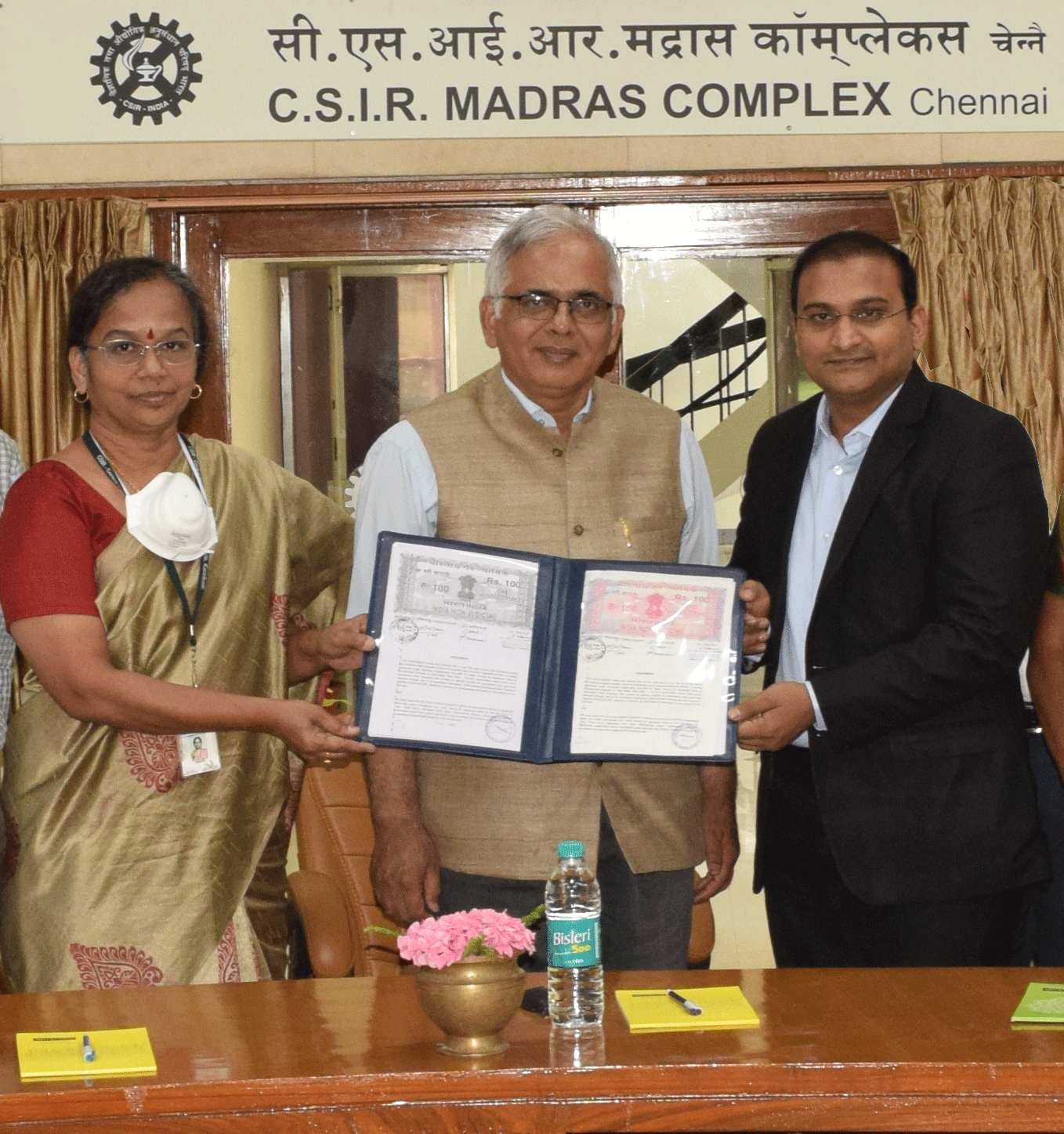

On Tuesday, Godi India and CSIR-CECRI (Central Electrochemical Research Institute) announced a ‘first time in India’ public-private partnership to operate and maintain advanced Lithium-ion cell manufacturing. The facility, based in Taramani, Chennai, was inaugurated by Shekhar C Mande, Former Secretary, DSIR (Deptt. of Scientific and Industrial Research) and Former Director General, CSIR, in the presence of Kalaiselvi, Director, CECRI.

With the prospects for energy storage businesses improving with the demand growth in the EV and stationary energy storage sectors, Godi India plans to expand its manufacturing footprint in India beyond Hyderabad and Chennai, to Europe, and North America too.

The USD 3 billion investment plan will cover the expansion plans too. The funding for the investment, Godi said, will be met through investments in tranches by private equity players, an IPO planned for 2025, and the revenue generated by the business.

Since the announcement of manufacturing Lithium-ion cells locally, the company claims to have received inquiries worth “almost USD 200 million” from the players in the domestic market, and from markets like Europe and North America.

The lack of local manufacturing of cells has been a major hurdle in the Indian EV ecosystem. While Godi has made a key move, more players, including Reliance Industries, are set to join the new race. The challenge for startups like Godi India will be to remain ahead in the technology curve and race well.

Also Read: