By Ashim Sharma

Prices of the raw materials for vehicle manufacturing have been on the rise in the past two years. The price of automotive grade steels rose by 25%, aluminum by 75%, copper by 57%, and manganese by 6%. On the EV front, the price of Lithium increased by 400% in just one year. Automakers have to choose between absorbing some of this increase or passing it to the customer.

The other major challenge is the shortage of materials like semiconductors. This is hampering production, creating long waiting periods and hindering recovery.

Vehicle recycling can help resolve some of these issues. Advanced recycling centers similar to those in Japan and Europe can lead to 85% to 90% of material recovery from vehicles in the initial stages, and more than 95 over a period.

It is estimated that India will have about 22.5 million End of Life Vehicles (ELVs) by 2025 which could help generate five million tonnes of steel scrap, 1.2 million tonnes of aluminum, and about 0.2 million tonnes of copper. There is also the potential to reuse materials such as recycled polyurethane foam plastic in the seat cushions. Scrap bumpers can be reformulated and reused to make mud and splash guards and more.

In FY19, only 35% of India’s metal scrap consumption was met by domestic collection. That year India imported seven million tonnes of ferrous scrap. It is expected to double by FY25.

The recycling of the expected ELVs by 2025 can reduce ferrous scrap imports by five million tonnes with economic and ecological benefits.

The challenge

While the benefits of recycling are quite evident and a recycling policy has been formulated by the Government, challenges remain in ensuring adequate feedstock for the recycling centers to keep running. This is further compounded by the large geographical dispersion of ELVs making transportation to centralized facilities for recycling unviable. There is also the issue of customer education and incentivization to make them recycle their vehicles.

As a result of this, some recycling centers have come up. But their utilization is low and vehicles continue to end up in landfills, stray parking on the roadside or at the informal recycling facilities.

Solutions for organized players

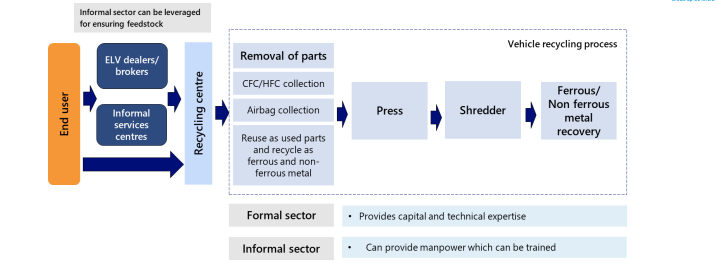

Joining hands with the informal sector: The informal sector has been carrying out recycling in all parts of the country with micro clusters in Pune, Jamshedpur, Indore, etc. and larger ones in Mayapuri in New Delhi, which handles 20% of all vehicles recycled in India, Pudupet in Chennai, Ukkadam in Coimbatore, Mallick bazaar in Kolkata and Lohar Chawl in Mumbai, etc.

Most of the traders in these clusters have been working in this segment for10-20 years and have a good knowledge of how each part of the vehicle is to be recovered and utilized. The dismantling process followed is similar across clusters with only variation in scale.

Rudimentary hand tools are used for vehicle dismantling with 2-3 people taking 3 hours to dismantle a car. These clusters have an ecosystem for sourcing the vehicles, dismantling and then selling the spare parts and the scrap.

However, use of unscientific methods for vehicle dismantling leads to leakage of hazardous constituents such as oils, coolants, glass wool etc. The material recovery percentage is also lower. Some of the parts sold for reuse may not be within the safe working limits. This could increase the chances of accidents in vehicles that install them.

The situation is similar for white goods such as refrigerators, air conditioners, washing machines, etc. However, their ability to source material regularly has kept them going. Although manual processes have a lower throughput, if aggregated, the feed stock sourced is similar to levels used to run a semi-automated plant.

The organized players can make use of these players as their own intermediaries and channel partners for sourcing the feedstock. This will help reduce the unhealthy competition between what these players can offer the end consumers and what an organized player does. It will also ensure that the livelihood of these people is secure. Their years of experience in this field will avoid the need for organized players to reinvent the wheel.

Operating models

The operating models could be setting up end-to-end recycling plants in larger clusters and setting up centers for intermediary processes in smaller clusters.

By establishing an end-to-end recycling plant in a larger cluster, say, in the Delhi-NCR area, many of the unorganized players can help source the feedstock. They can also be trained to work in the plant.

In smaller clusters, setting up centers for intermediary processes like baling to compress the feedstock volume makes the transportation to the larger centers more economical. Here again the existing informal sector players can act as sourcing agents and also be trained and deployed in these plants

The key shall, however, lie in devising the right incentive structure, both monetary and non-monetary, and educating the informal sector on the benefits of this setup. While it may appear that the margins in such a setup could be constrained on account of the expectations of the players who were hitherto operating with minimal or zero overheads. However, if looked at from a mid- to- long term perspective, it could offer a compelling solution to the biggest problem plaguing the current recycling centers.

Tie-ups with OEMs

Tie-ups with OEMs or instances of OEMs themselves venturing into recycling have been witnessed in the recent initiatives by players like Maruti Suzuki with Toyota Tsusho, Mahindra-Cero etc. The pan India dealer network as well as the ability to use recycling incentives as a way of ensuring brand loyalty or moving competitor brand owners to their fold helps OEMs acquire a pole position in this regard. OEMs can divert their CSR spend towards the training of the existing manpower in the informal sector, which will not only meet manpower requirements, but will also catalyze tie-ups with the informal sector. Independent players could tie-up with OEMs to set up regional Registered Vehicle Scrappage Facilities (RVSFs) which could increase scale by aggregating one or more OEMs e.g. a 2W maker with a PV maker.

The way forward

The recycling of vehicles as well as allied goods certainly hold a lot of promise on the economic and environmental front. By involving the informal sector, we can secure jobs, make them partners in this larger good and also avoid the classic case of large businesses displacing the downtrodden.

The sector can take cues from the e-waste management segment in India, where producers, driven by government policy to collect e-waste in proportion to their production, have tied-up with e-waste aggregators and collectors in the informal sector. The informal sector collects ~ 95% of the e-waste in India, thus enabling producers to reach their collection targets.

Producers in turn, apart from meeting the price requirement of individual collectors and aggregators, utilized digital payments to alleviate concerns over security and payment risks. They also provided business development to aggregators to expand their business. The elements of a strong governance mechanism, a fair incentive system as well as strong change management will, however, be needed to make this happen. Players that make the right moves in time, could see significant benefits accrue to them.

(This is the final article in the series of the ‘Nine Game Changers for the Indian automotive Industry in the next decade’.)

Disclaimer: Ashim Sharma is Partner and Group Head at NRI Consulting & Solutions India. Aashutosh Sinha, Senior Manager, and Nishant Shekhar, Manager, made significant contributions to this study. Views are personal.

Also Read: