New Delhi: The demand for off highway tyres (OHT) has hit an all-time high propelled by strong requirements from both the domestic and the international markets. Driven by improving mechanization, urbanization, massive investments in public and private infrastructure and rise in construction activities, the country is emerging as a global manufacturing base for the OHT.

These tyres are used in heavy-duty trucks and vehicles for off-road activities such as mining, agriculture, logistics, and construction. The growing use of off-road vehicles such as excavators, special purpose vehicles, telescopic handlers, dump trucks, and tractors is also fuelling the OHT business.

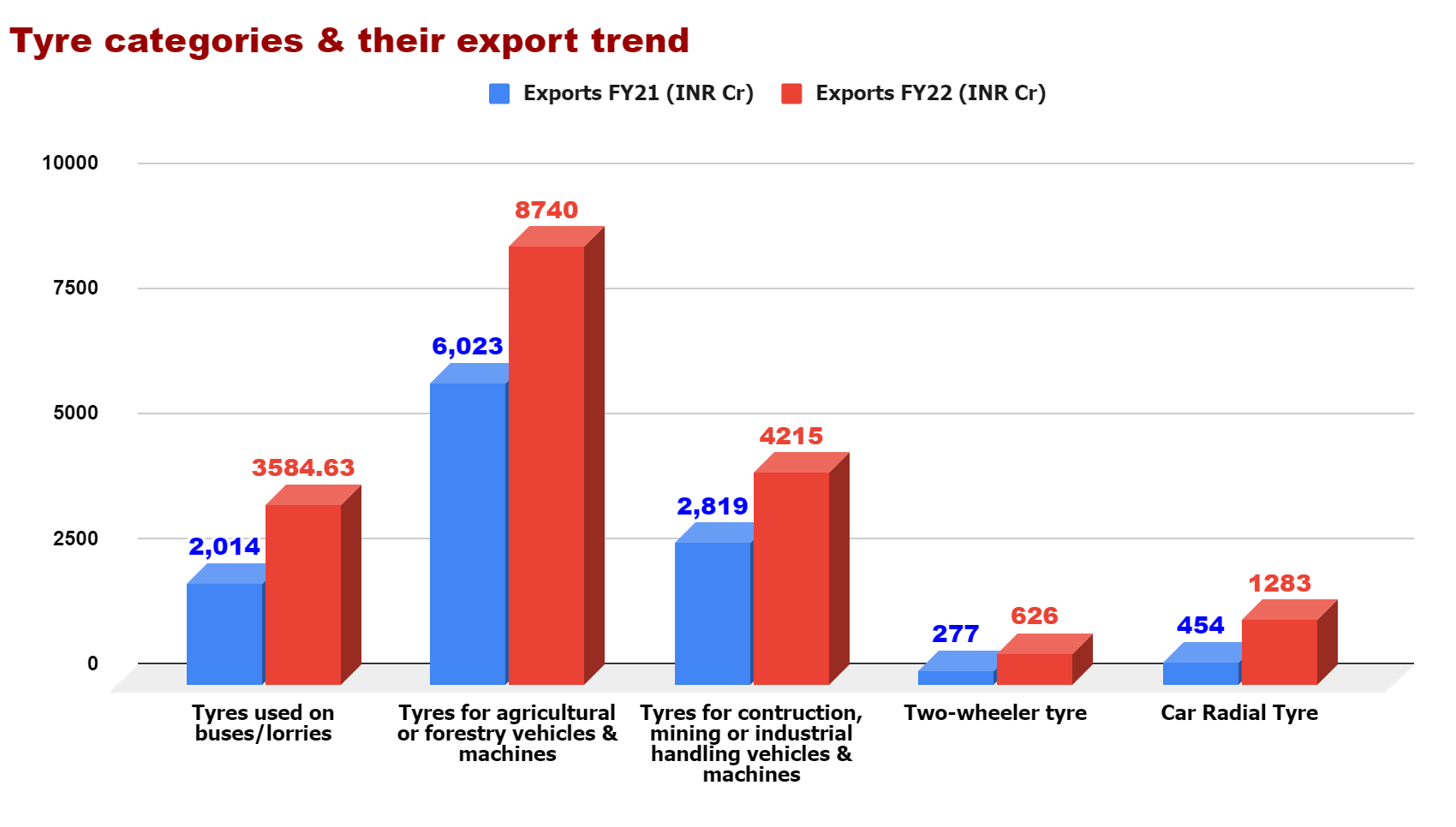

Moreover, the demand for Made-in-India off highway tyres is also on rise in Europe and North America. This has pushed the tyre industry export figures to a record high of over INR 21,000 crore in FY 22. Among the different tyre categories, export of OHT leads in value, with a 46.52% jump to INR 12,955 crore in FY22 from INR 8,842 crore in FY 21.

The business potential for OHT is huge. The domestic tyre companies are increasing production capacities for high-performance, highly reliable and all season traction off-road heavy-duty application tyres. Moving beyond the SUV and electric vehicle tyres, OEMs are jacking up R&D investments on OHT for strong and durable side walls along with self-cleaning connectors for increased pull force.

Gauging the demand

India’s off-highway tyre market was for 10.81 million units in 2021. The market is estimated to have demand for 19.17 million units by 2028, with a CAGR of 8.5%, according to a Blueweave Consulting report.

A major chunk of the domestic demand is from the construction equipment sector. It is on the cusp of becoming the second largest globally by 2030. The overseas market is also turning to India to fill the void left by the established tyre makers.

Renowned tyre companies like Michelin and Pirelli are moving out of OHT in the US and European region. Their renewed focus is on SUV, EV or motorsport tyres. According to Rajiv Budhraja, Director General, Automotive Tyre Manufacturers’ Association (ATMA), for every tonnage of production, the margins of PCR tyres is 20% to 25% higher than OHT. That is why some prominent manufacturers are dropping it.

“This has created space for high quality moderately priced tyres in the export market, giving Indian tyre makers the opportunity to fill the void,” he added.

The series of anti-dumping duties by Europe and the US on Chinese tyres since the past 3-4 years also have worked in favour of the Indian companies. “The global anti-China sentiment and the ‘China plus one’ factor have greatly helped the Indian players. Hence, the Indian tyre makers are charting their exclusive export strategy in these two regions,” Budhraja said.

The big movers

Leader in off-highway, agriculture and industrial tyres Balkrishna Industries that sells under the BKT brand, is eyeing to deepen presence in both the domestic and the export markets. The Mumbai-based company expects its domestic market share to touch 12%-15% from the present 6% -7% as it has been witnessing increasing demand for its farm sector offerings.

At present BKT nets almost 80% of its revenue from exports, with domestic sales accounting for the rest. The tyre maker is expanding manufacturing capacity at plants in Bhuj, Gujarat, and Waluj in Maharashtra by over 26% to 360,000 tonne a year by the end of FY23.

The managing director of Ceat, Anant Goenka, in a recent analyst call said that the company’s OHT segment is ramping up as per plans. Out of the growth capex of INR 750 crore for FY23, priority will be given to the more profitable OHT segment, he added. The Mumbai-based tyre maker claims that its existing OHT range caters to 80%-85% of the farm sector demand.

“We are currently operating at about 67 tonne daily which will go up to 80 tonne a day by October in our Ambernath plant, which primarily manufactures radials for OHT,” Goenka said. The company plans to invest up to INR 200 crore for the expansion of the Ambernath plant for OHT.

Another prominent player JK Tyre sold about INR 300-crore worth OHT last year. “In the domestic market, the construction and mining sectors are opening up in a big way boosting this segment. We are exploring markets like the US and Latin America for export,” Srinivasu Allaphan, Director-Sales & Marketing, JK Tyre & Industries, said.

Promoted by the Mahansaria family — and a new entrant in this segment — the company intends to invest INR 1,652 crore in a greenfield OHT facility in Gujarat.

Restraints

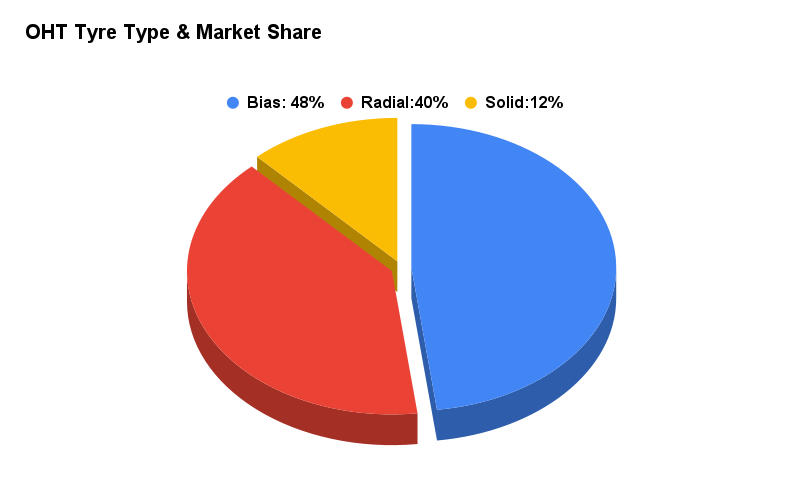

Among the OHT types, bias tyres still hold the largest market share at 48% owing to their lower cost and higher demand across the country. On the other hand, the export market has shifted almost entirely to radials in the OHT segment for advanced applications. Now with only 40% of radial OHT production, the companies are able to meet only a fraction of the export demand.

Even the local markets are also increasing the use of radial tyres in the construction/mining sectors. Several players that supply extensively to international markets have to focus on the domestic market also.

Another constraint is not having enough capacity to cater to the humongous demand. Companies are doing their best to ramp up OHT production but that is still not enough. The tyre industry is already operating at 85%-90% capacity. Any addition to or expansion of production is time-consuming. Experts fear that companies might miss the real-time demand.