By Niranjan N Prabhu

The Indian car market can be broadly classified into 4 segments: Sedans, Hatch, Multi Utility Vehicle (MUV) and Sport Utility Vehicle (SUV). The Sedans are represented by the likes of the Honda City, Maruti Dzire, Hyundai Verna etc.,. The Hatch segment includes Maruti Wagon R, Tata Tiago etc., MUV has s the likes of the Ertiga and the Hycross and lastly the current flavor of the markets, the SUV, which includes crossovers like the newly launched Maruti Fronx as well as hatchbacks on stilts like the S-Presso) represented by an amazing host of variations, sizes and engine power.

The Indian market until recently was characterized by small and affordable hatchback cars from Maruti like the 800, the Alto and the Wagon R as well as very strong sedan players such as the Honda City. Together they comprised over 80% of the car market.

SUVs and MUVs were more of the territory governed by Mahindra’s Bolero and Scorpio, Toyota’ Innova and Tata’s Sumo. Choices were limited and they formed the remaining 20% of the market.

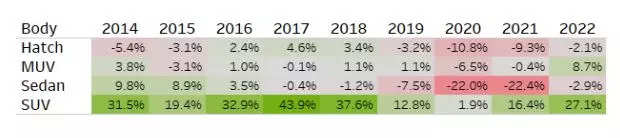

The past few years, however, there has a sea-change in terms of consumer preferences which has moved away from hatches and sedans (both show an overall negative volume growth) and towards SUVs and MUVs.

In this article we will try to understand the magnitude of this shift using charts and numbers as well as qualitatively reason out why this has happened

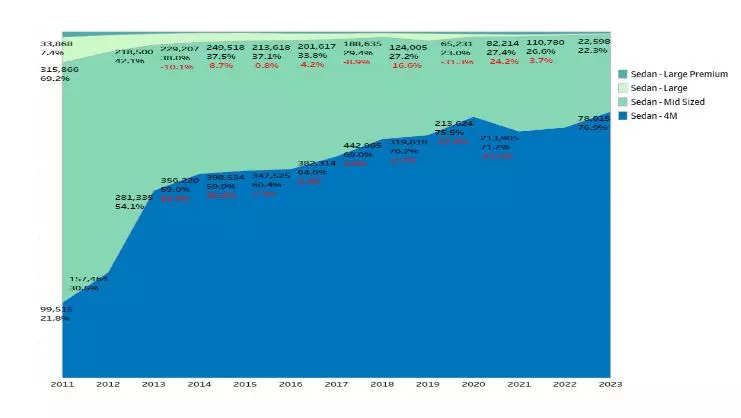

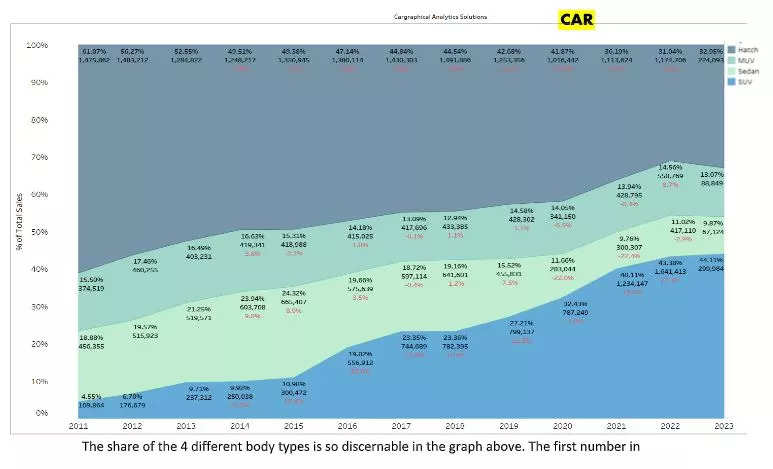

The share of the 4 different body types is so discernable in the graph above. The first number in percentage depicts the share of the body type in the overall market (Adding up the 4 in any year will total up to a 100%). The second number tells us the absolute volumes dispatched to dealers in that year, and the third number (in red) shows the 3 year CAGR numbers.

Absolute volumes for Sedans have fallen from 456k in 2011 to 417k in 2022. This is thanks to the introduction of exciting new models from the German twins (VW & Skoda) in 2021/22. Else the volumes in 2020 were 283k and 2021 were 300k. One can observe the 3-year CAGR (Compounded Annual Growth Rate) started showing a negative trend from 2017 itself.

Another table that throws a lot of light specific to the sedan segment

The trend and the numbers in the above graphs and tables can be interpreted as follows.

1. The share of sedans in India’s markets has fallen from almost a fifth to less than a tenth over the last decade or so.

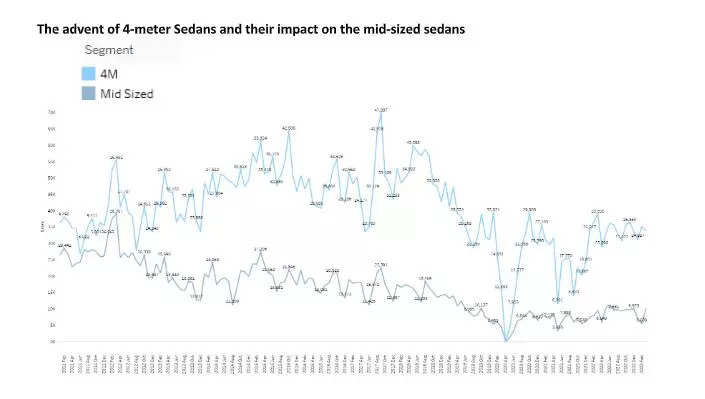

The extent of damage becomes clearer when you look at popular models such as the Honda City which gets categorized in the mid-sized sedan segment.(See the numbers marked in the box)

From 13% of the overall markets in 2011, the mid-sized sedan in 2023 is languishing at 2.2% of the overall markets. Despite this downfall it is beyond logic as to why OEMs like VW, Skoda and Hyundai are investing more money in this segment.

Even the very popular 4-meter sedan segment defined by the Maruti Dzire is today down from 13% + of the overall markets in 2015 to around 7.7% in the current year.

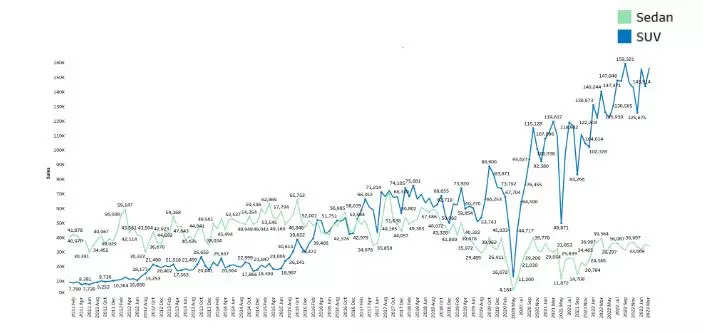

2. At the same time this negative growth in the sedan markets has benefited the SUV/Crossover segments whose volumes are up by almost 16 times , from around 109k in 2011 to 1.64 million in 2022! The UVs (SUV+MUV) overall are closer to 60% of the markets today up from 20% a decade ago.

The advent of the Dzire in its 4-meter format in 2011 changed the dynamics of this segment and challenged the Honda City directly with its brilliant feature list and much lower pricing. This led to Honda responding with the Honda Amaze, a 4-meter sedan based on the Brio hatch. The effect of the 4-meter sedans has been so painful to the midsize sedans that their share in the overall sedan market has shrunk from almost 70% of the sedan market in 2011 to around 22% today. There has been a fall in volumes by almost two thirds from 315k in 2011 to 110k in 2022. This translates to a negative CAGR of 9% over this period in volume terms. No other large sub-segment of the market has suffered as much. The next worst performing segment has been the hatch segment.

The 4-meter segment catapulted from around a fifth of the sedan market to almost 4-5ths of the sedan market within the last decade (See the chart below).

All this is happening even when these segments including the 4-meter sedan segment are showing overall negative CAGR values in terms of sales volumes!

Which segments are then the beneficiaries of this downfall of the sedan segment?

The graph at the top is very telling. The story of the SUV success started off on two fronts. One, in the mid-sized SUV segments, with the welcome introduction of the Renault Duster and the subsequent success of the Hyundai Creta. Two, in the 4-meter SUV segment started off by the Ford EcoSport and taken forward by Maruti’s Vitara Brezza. Ford could not keep up with customer demand and Maruti with its amazing capacities, simply swept this market in 2016. The Tata’s stepped up the game further in 2017 with the introduction of the Nexon. The story of the SUVs is another chapter altogether in the scripting of India’s PV markets.

The main reason we need to know about the SUV success is to understand who destroyed the sedan markets.

Why have SUVs globally overtaken the sedan markets? This is not just an India story but one that is being seen in the US, Europe, and China as well.

The main reason for the SUV success is the sheer feeling of owning the roads, that position of power given by a high vantage point, coupled with the comfort of being in a safer contraption, has brought about this change.

In India, the poor road conditions give drivers extra ground clearance to avoid hitting speed breakers (Honda City had a bad reputation for this), greater shock absorbers help in maneuvering pot-holed roads better, and the overall comfort and space that comes with an SUV/Crossover. Such is the craze that many hatchbacks are getting redesigned today to give entry level customers that SUV Feeling! Look at the success of models like the Maruti S-Presso and the Tata Punch. A point of great pain for SUV aficionados but a matter of joy and promise for entry level car buyers to get what they see as an SUV!

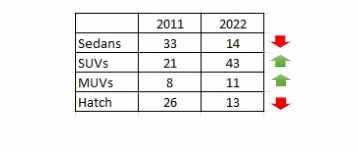

The shift in the number of models available across the different segments speaks volumes of what is happening in the markets today.

(Disclaimer: Niranjan N Prabhu is the CEO of Cargraphical Analytics Solutions. Views are personal)