As the CASE (Connected Autonomous Shared Electrification) megatrends grow, software content in the automobile of any segment is also on the rise. And that trend is expected to boost the balance sheets of automotive software suppliers. According to a McKinsey report, the global automotive software and electronics market is expected to touch USD 468 billion by 2030, a 5.6% CAGR from 2019.

“I think it’s not too far when software will become the reason why people will buy their vehicles, and software will be the reason why there will be recalls,” Kishor Patil, co-founder, CEO and MD, KPIT Technologies told ETAuto. And that could happen as the conventional vehicle swiftly changes its character to become a software defined vehicle (SDV).

Industry experts believe that 2023 is a crucial juncture for the SDV trend. Patil opines that there’s a transition from ACES to SDV. Harald Kroger, Board member and President – Automotive Business, at SiMa, a technology company specialising in Machine Learning, says, “Two or 3 years ago, people thought it could be some luxury carmakers and some tech companies first, and then very slowly volume players will follow. What we see today is that almost all big players, when they do their next generation vehicle on some platform, are moving to this new (software) architecture.”

The industry veteran who has had stints at Daimler, Bosch, Tesla, and Rivian agrees that 2023 will be the year “where the majority of all sourcing in the world will be software defined vehicles.”

The core of the change

So, what is the biggest change in an SDV? The core of the change is the software architecture. As software content grew over the years, the trend has been moving from distributed, to domain controllers, as the features and applications list grows longer and more complex. Now, the movement is from domain controllers to a central software architecture.

According to Patil, in the volume passenger vehicle industry the major shift to a central architecture started in 2022 with varying degrees of success by OEMs. But “2023 is very critical for people to understand and realise actually how their real progress will be. The critical part is that people are understanding a lot of nuances of this. It’s not as easy as it looks on the face,” he says.

The shift to a centralised software architecture trend means higher computing power, but a less number of ECUs (Electronic Control Unit). The number of ECUs in a high-end car for example could come down from over 120, to less than 10. “There will still be what we call Edge ECUs which will be smaller microcontroller-based ECUs which work on the edge which is more near the sensors and which will be responsible for pulling out the data,” says Bosch Global Software Technologies’ (BGSW) Executive Board member and senior VP – Automotive R&D, Peter Jacob.

Bosch’s Bengaluru-based global engineering hub with over 30,000 engineers, is also working on a range of advanced technologies for SDVs. Last year, BGSW hired 5,500 engineers. It plans to hire the same number of engineers, or more, this year.

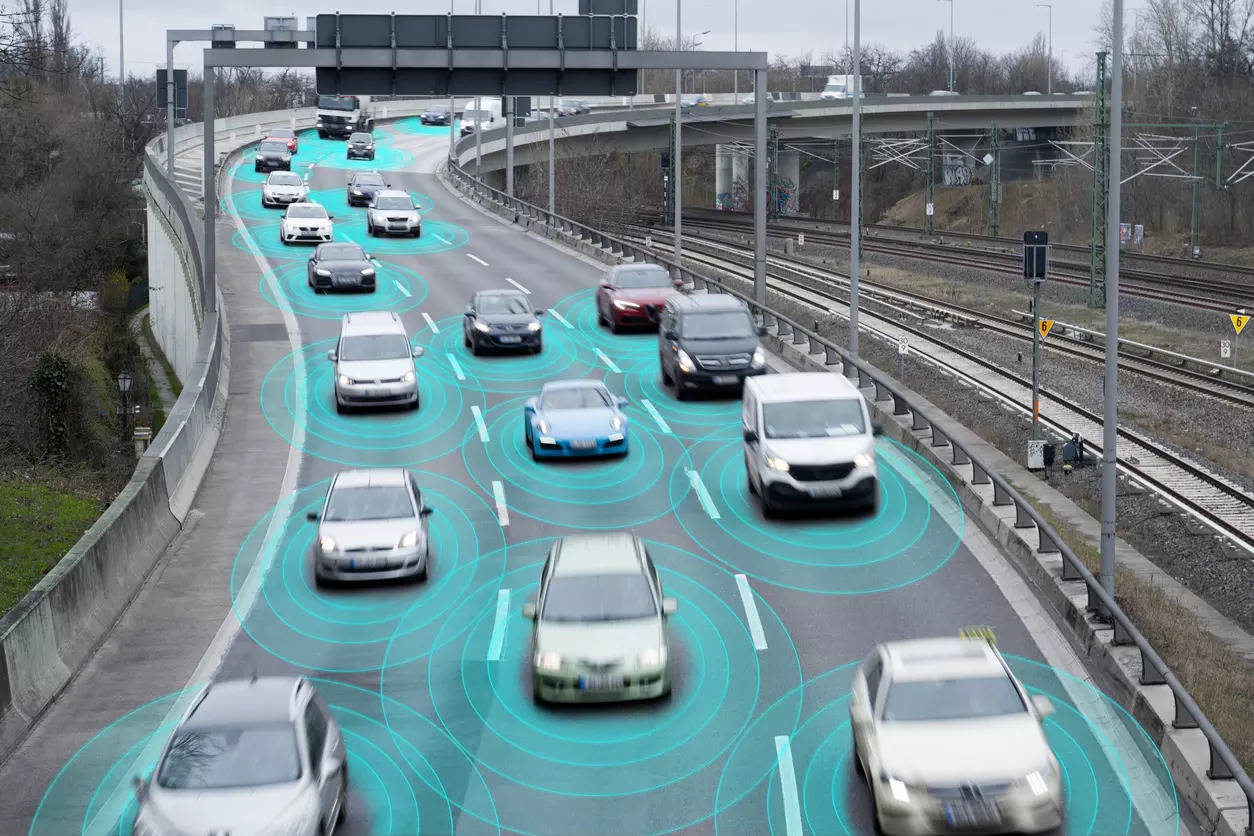

Connected vehicle megatrend

Connected vehicle megatrend is a key driver for new software architectures. Jacob expects the architectural change to pervade across vehicle segments, and connectivity will be “one of the big drivers that fundamentally makes a consumer demand for such features”.

Patil also believes that the connected vehicle megatrend will be responsible for the vehicle to be more and more software-defined. Players like KPIT Technologies and Bosch are looking at better prospects given that the connected vehicle market is projected to grow at a healthy clip.

According to S&P Global Mobility, sales of connected light vehicles (up to 3.5 tonnes by GVW) should increase from 41.7 million units in 2021 to 72.5 million units globally by 2028, representing an 8.2% CAGR. Approximately 52% of all new light vehicles sold globally are connected currently, and this number is expected to grow to around 80% by 2028.

Connected and safe

The new electrical/electronic (E/E) architectures in vehicles help complex future vehicle systems to be manageable. The less number of ECUs also mean less wiring, which in other words means less copper used. “But for the consumer, it would be more the ability to get features refreshed over a period of time, which is what everybody expects nowadays, because you’re used to using a mobile phone when you get refreshed,” says Jacob.

As much as connected vehicle technologies add value by keeping the vehicle updated, Jacob says the most valuable attribute will be the ability to enhance safer mobility. “I would put an emphasis on technology-aided features which provide safety using the ubiquitous connectivity, which is going to be a part of most cars, rather than just streaming music and maybe changing the AC and unlocking the door from somewhere, which are also good to have,” he says.

The e-call feature, which enables the connected car to call a dedicated call centre for medical aid is one instance of leveraging connected technology for safer mobility. Currently, some Mercedes- Benz cars have this feature supplied by Bosch. The Tier 1 major is in talks to supply the feature and service to an Indian OEM or two.

SDVs for revenue generation

According to a couple of industry leaders, a new wave of SDVs have started taking shape in 2023, with series production expected to start in 2025/26. “This (2023) will be the year which will really make them take proper decisions in this area. Secondly, I feel this is also because of the external environment, and other people will have to prioritize this (SDV programmes) over other expenses,” says Patil.

Global OEMs like Renault, and Stellantis are betting big on SDVs to also boost their revenues with monetizable connected features. Stellantis, for example, plans to sell 34 monetizable connected vehicles by 2030. The Group is targeting to generate an incremental amount of around EUR 20 billion from its SDVs.

Going ahead, some matured, saturated markets globally may or may not see growth. In such markets particularly SDVs will be more important for their makers to increase the average revenue per vehicle.

The developments happening in the automotive software technology space is leading to a creation of an automotive operating system. And this market is set to see some strong growth. KPIT Technologies cites a McKinsey study which expects the automotive operating system and middleware (tech that helps communicate among different applications) to see a CAGR of around 12%, to grow from USD 2 billion, to approximately USD 7 billion in 2030.

The prospects are strong, and so is the risk factor. While OEMs and their technology partners design and build highly advanced software architectures, their security levels will also have to be robust enough to ensure that the makers don’t end up paying any penalty where they could have gained revenue.

The transition from domain software architecture, to a centralized one can have potentially contrasting effects. “It can have a positive impact if it is done well. It can have a significantly negative impact if not done well,” says Patil.

The automobile has always been a canvas for technology. Now, that canvas is set to get a significant new dimension. It’s set to offer a great deal of new advantages, and some level of new vulnerabilities too. The challenge for technology providers and OEMs will be to ensure that the software tech makes the vehicle more attractive and safer, and definitely not more vulnerable.

Also Read: