One such sector is India’s three-wheeler market. Though one of the largest in the world, it is reeling under the impact of its steep fall in demand owing to several crushing factors, with the pandemic in the lead.

A structural shift in the mode of mobility from shared to personal and the market preference for electric three-wheelers have already pushed back the conventional three-wheeler segment by almost a decade, reveals the data from SIAM, the apex body of the automobile manufacturers. Domestic sales in fiscal 2020-21 were at less than one third of the pack volume of 7 lakh units in 2018-2019.

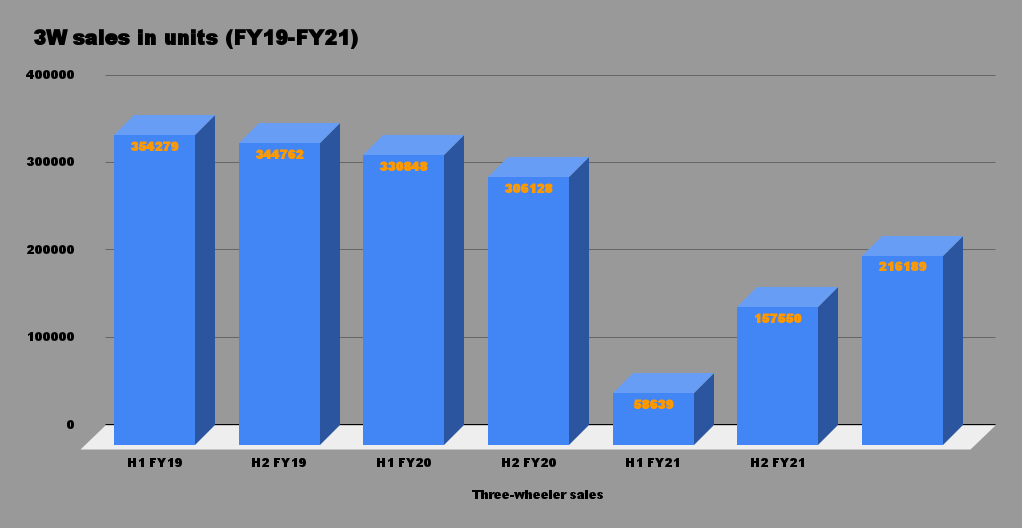

Data for the past four years shows that domestic sales of three-wheelers were in FY18 at 6.36 lakh units, in FY19 (7.01 lakh), in FY20 (6.37 lakh) and in FY21 (2.16 lakh). The compounded annual growth rate (CAGR) declined sharply by 30.2%.

“The domestic sales of three-wheelers at 2.16 lakh units last fiscal is even below the 2.32 lakh units in 2002-2003,” Rajesh Menon, director general, SIAM, said.

A drastic fall in the last-mile transport requirements after the pandemic-induced shutdowns of offices, schools and other public places, along with the inherent financing problems and price hike after the transition to BS-VI broke the back of this segment.

Industry will most likely be down by almost 80% in Q1 FY22 over a normal Q1 of say FY20Rakesh Sharma, executive director, Bajaj Auto

“Domestic sales have been sharply impacted by the second Covid-19 wave almost in the same line as during the first wave last year. Industry will most likely be down by almost 80% in Q1 FY22 over a normal Q1 of say FY20,” Rakesh Sharma, executive director, Bajaj Auto, told ETAuto.

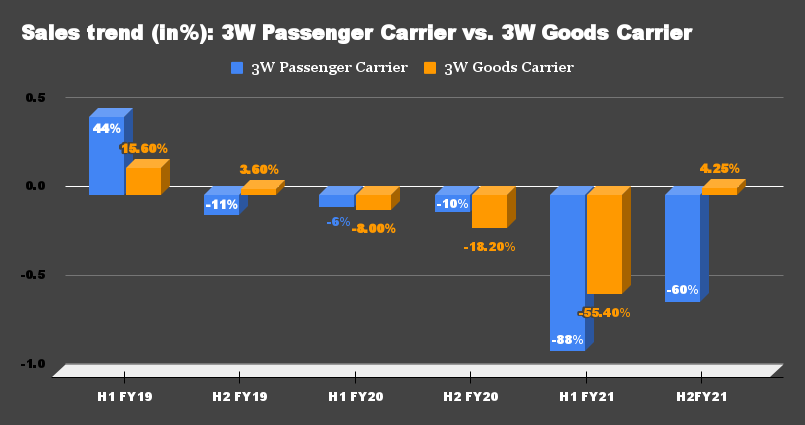

In FY21, three-wheeler domestic sales stood at 216,189 units compared to 636,976 units in FY20, witnessing a decline of 66%. While passenger carriers, which constitute more than 75% of the total sales volume, tanked by 74% at 134,102 units, the cargo segment posted a relatively smaller downfall of 48% at 35,305 units.

The stay-at-home culture and complete halt in leisure time movement further muddied the waters for the passenger carrier segment. Meanwhile, its counterpart managed to sail through the rough waters on account of renewed demand for intra-city movement of small cargo for e-commerce and grocery segments.

According to Diego Graffi, chairman and MD, Piaggio India, 70% of the company’s overall sales at present is coming from the cargo segment. “We are seeing good traction in the cargo segment due to intra-city commutations which has helped us in compensating for the demand dearth. Now with the increased transportation of goods to rural and semi-urban areas we expect goods carrier sales to reach pre-Covid levels at a much faster rate. Cargo segment definitely should recover fast, mainly in CNG and EV versions going ahead,” he said.

With the increased transportation of goods to rural and semi-urban areas we expect goods carrier sales to reach pre-Covid levels at a much faster rate. Cargo segment definitely should recover fast, mainly in CNG and EV versions going aheadDiego Graffi, chairman and MD, Piaggio India

Financing trouble

The contraction in financing had impacted the sales of three-wheelers even before the outbreak of the pandemic. Experts signal that things may only get worse before they can improve in the long run if the financing situation won’t improve in the coming months. They also point out that the fear of infection has killed the scope of steady earnings of three-wheeler auto drivers, particularly in passenger space, due to which loan defaults have increased at a massive scale in the past few months.

Less usage of the vehicle means less income for the owner and he may not be able to pay the EMIs. “About 90% of three-wheelers are financed and if the owners or drivers don’t earn daily, their ability to service EMIs gets impaired causing finance companies to hold back on new sales as well,” Sharma added.

Some green shoots on sales and trust from the private banking system were visible in the February-March period that entirely got washed away with the advent of the second wave of Covid.

“Now we expect NBFCs to be more and more cautious in the next few months to finance the sector, especially for the passenger segment,” Graffi added.

Dealers are also bearing the brunt of massive price hikes post-BS-VI implementation. A three-wheeler dealer said the prices of vehicles in the diesel segment shot up by about INR 40,000-INR 50,000. Consequently, the EMI payments of buyers suddenly increased to INR 8,500-INR 6,000 that resulted in postponement of purchase, the dealer added on condition of anonymity.

Will E-3W cannibalise the segment

With rising fuel cost and squeezing pockets, electric-three wheelers are gradually emerging as a preferred option among the consumers. With rising input cost in the conventional segment, the total cost of ownership of electric three-wheelers has become quite comparable even with a battery pack.

Underlining the industry’s efforts, Som Kapoor of EY said that OEMs are introducing large battery capacity and working on solutions like battery swapping to accelerate adoption and tackle range anxiety.

“Electric three-wheelers could be at an inflection point – spurt likely to be witnessed over next 1 or 2 years as traditional OEMs have made in-roads beyond startups and unorganised market. The lightweight and compact nature of lithium-ion batteries used in electric three-wheelers makes it well-suited for the battery swapping model,” Kapoor added.

Electric three-wheelers could be at an inflection point – spurt likely to be witnessed over next 1 or 2 years as traditional OEMs have made in-roads beyond startups and unorganised marketSom Kapoor, EY

Despite crashing 37% in the last fiscal year, electric-three wheelers are performing well above market expectations on the strength of massive push from the e-commerce segment and government support.

Before Covid-19, this segment which is largely dominated by unorganised players and startups, sold over 6 lakh units in FY19.

“Light electric mobility will come in big numbers in India before the transition happens in a bigger way on the passenger vehicle segment. For this space our product portfolio is complete like in electric three-wheelers. By 2025, we believe, electric-three wheelers would be 15%-20% of the conventional market,” said Anil Kumar, managing director and president of SEG Automotive – a company that manufactures components such as high range electric motors for e-rickshaws.

Under the recent revision of the FAME-II scheme, the government will go for aggregation via EESL to bring down the cost of electric three-wheelers to the level of ICE-three-wheelers. EESL aims to aggregate demand for three lakh electric three-wheelers through this method.

However, some manufacturers do not see this as a demand generator.

“This could have been certainly an inflection point for higher adoption of electric three-wheelers but making EESL the nodal procurement agency may hinder the required growth and I think the government must reconsider and make it more open like electric two-wheelers,” Mahesh Babu, CEO, Mahindra Electric, said. He added that both traditional ICE three-wheelers and electric three-wheelers will continue to co-exist.

Can exports be the saviour?

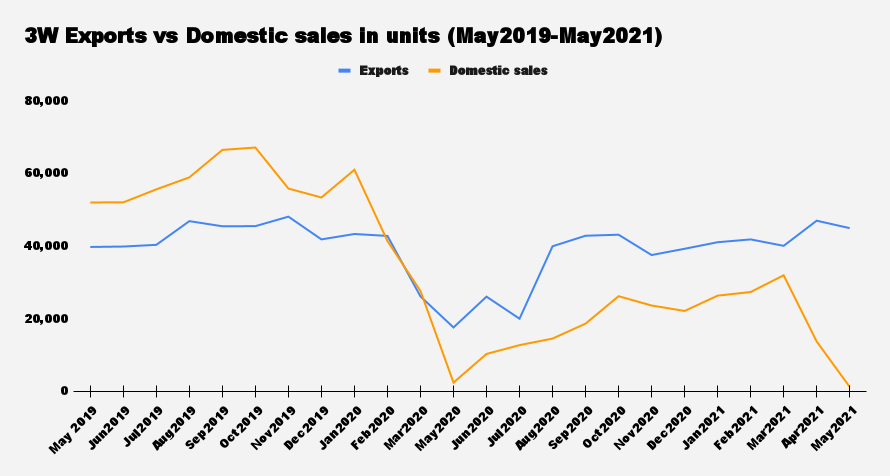

Around 216,189 units of three wheelers were sold in the Indian market in the FY21 while the export volume was 389,095 units in the same period. Although both the domestic sales and exports saw a double digit de-growth owing to the pandemic, a steeper dip was seen in the domestic volumes due to the inherent slowdown and the increasing adoption of electric three-wheelers.

In a bid to survive the present doom and gloom, companies in this space are focusing more on exports to make their business sustainable. Analysts indicated that OEMs are pushing their exports significantly and also eyeing new areas of expansion in the overseas markets. “Currently many OEMs are exporting more in order to mitigate the losses of the domestic market. As there has been no clear indication on re-opening of corporate places we will continue to see strong export momentum within the three-wheeler space in the upcoming months,” an industry expert said.

Recovery will take time

About a time frame for the recovery of the three-wheeler segment to the pre-crisis level, the analysts say it could take 12-15 months depending on the economic impact of the Covid-19 pandemic. But the OEMs are still undecided on that.

According to Bajaj Auto’s executive director, revival is contingent on people coming back on the streets and needing to move around. “This directly depends on the opening of schools, colleges, offices etc and the complete restoration of normalcy,” he added.

While we expect that the sales of the cargo segment will start recovering from the start of the festival season in Q3 of FY22, revival in the passenger segment will begin not before Q4 of FY22, and reach pre-Covid sales volumes by mid of FY23Kavan Mukhtyar, Partner & Leader – Automotive, PwC India

Kavan Mukhtyar, Partner & Leader – Automotive, PwC India, believes that the passenger segment will take at least a quarter more time to recover than the goods carrier segment.

“While we expect that the sales of the cargo segment will start recovering from the start of the festival season in Q3 of FY22, revival in the passenger segment will begin not before Q4 of FY22, and reach pre-Covid sales volumes by mid of FY23. This is because of sufficient fleet capacity as well as a continued preference for personal mode of mobility with restricted travel for a few more months,” he explained.

Also Read: ETAuto Exclusive- Those sinking wheels no one is talking about