New Delhi:

Pune-based Bajaj Auto became the top motorcycle maker in November with total wholesales (Domestic + Exports) of 3,38,473 units, racing ahead of the market leader Hero MotoCorp, which sold 3,29,185 motorcycles during the month.Bajaj Auto’s domestic sales for November 2021 dropped 23% to 144,953 units as against 188,196 units in November 2020. Its exports also fell 2% to 1,93,520 units in November this year, compared to 1,96,797 units in the corresponding month last year. However, in spite of the 2% YoY fall in exports, more than half of Bajaj’s total motorcycle sales came from shipping them to international markets.

In the exports market, Nigeria, Egypt and Mexico achieved their highest ever motorcycle retail sales. In Latin America, the company is focusing on strengthening its position in the sports segment, it said.

Rakesh Sharma, Executive Director, Bajaj Auto, said, “Our presence in over 70 countries has allowed us to deliver a steady performance despite the volatility in the environment.”

According to Mitul Shah, Research Analyst, Reliance Securities, demand remains strong across major geographies and the little decline in exports can be attributed to container availability. “The company aims to maintain a monthly export volume of ~200k over the next few months. It aims double-digit growth in export volume in FY22E,” he said.

Kaushik Madhavan, Vice president- Mobility, Frost & Sullivan, said, Bajaj’s regional distributors have picked up certain models and its exports to the Latin American and African countries have been good.

However, this could also be due to stocking up and we cannot be sure that it will sustain, he added.

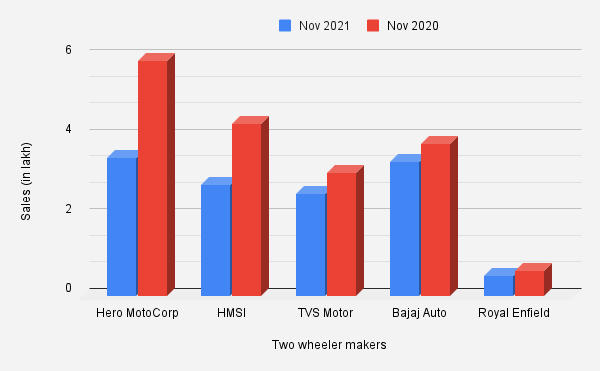

Motorcycles sales on YoY basis:

| OEM | Nov 2021 | Nov 2020 | % change |

| Bajaj Auto | 3,38,473 | 3,84,993 | -12 |

| Hero MotoCorp | 3,29,185 | 5,41, 437 | – 39 |

One’s gain is another’s loss, so is for Bajaj Auto. One may say that its top position in the motorcycle segment is also due to the two-wheeler market leader Hero MotoCorp’s significant sales drop.

In November 2021, Hero MotoCorp sold 329,185 motorcycles (Domestic + Exports) as against 541,437 units in the same month last year, marking a decline of 39%. Following this, the company’s shares also touched a 52-week low on Thursday.

“Delay in harvesting due to the late withdrawal of monsoon in many parts of the country, impacted the demand post festive season. With the economy gradually opening up coupled with several other positive indicators, such as encouraging farm activity, confident consumer index and marriage season, a swift revival in sales is expected in the fourth quarter,” Hero MotoCorp said in a regulatory filing.

Talking about Hero’s sales, Shah of Reliance Securities said, “Slowdown in the entry-level bike segment and shifting preference for higher-end bikes impacted the sales of its overall bike portfolio. Higher fuel prices and sharp price increase impacted the two wheeler demand in the rural markets. The impact was more pronounced for Hero MotoCorp as it is a key rural player. Moreover, post festive inventory correction of ~2 weeks also impacted sales.”

Going forward, Madhavan expects the domestic two wheeler sales to be better than November as the dealers and OEMs would want to clear the current calendar year’s stock. “We expect the two wheeler OEMs to hike prices by a small percentage in January. So, December sales might bounce back due to the consumer’s pre-buying sentiment,” he said.

We expect the two wheeler OEMs to hike prices by a small percentage in JanuaryKaushik Madhavan, Vice president- Mobility, Frost & Sullivan

Last month was a rare occasion when Bajaj has managed to overtake the motorcycle segment, however Hero MotoCorp remains the market leader for total two- wheeler sales (motorcycles and scooters) in November 2021. Hero sold 3,49,393 units in the domestic and international markets, while Bajaj sold 3,38,473 units during the month.

For November 2021, retail volume was higher than the wholesale volume in two wheelers due to inventory correction, Shah said.

Post the second wave of Covid this year, two-wheeler sales continue to face headwinds across the segment. Scooters being a semi-urban and urban phenomenon, its sales have revived to an extent due to opening up of activities. However the mass market or entry-level motorcycle segment continues to remain a worry, and this segment with the 100cc-110cc bike category occupies a larger part of the pie for Hero MotoCorp’s sales.

The Rajiv Bajaj-led company manufactures Pulsar, Dominar, Avenger, Platinum and CT motorcycle brands in India, while Hero MotoCorp makes Glamour, Xpulse, Passion, Xtreme, Splendor and HF Deluxe motorcycle and Pleasure, Maestro, Destini scooter brands.

Also Read: