New Delhi: Auto major Tata Motors on Thursday reported a narrowing of its consolidated loss to INR 1,032.84 crore in the quarter ended March 2022, as compared to INR 7,605.40 crore in the corresponding quarter of last year.

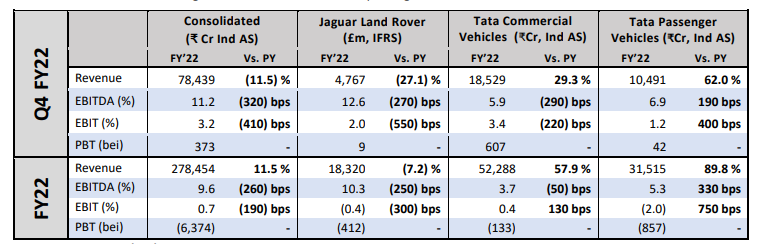

The automaker’s total revenue of operations dropped 11.4% and stood at INR 78,439.06 crore during the quarter under review, due to lower volumes of JLR, as against INR 88,627.90 crore in the corresponding quarter of last fiscal year.

During the financial year FY22, the company’s profit stood at INR 11,441.47 crore, as against INR 13,451.39 crore in FY21.

Total revenue of operations for the company during the fiscal stood at INR 2,78,453.62 crore, as compared to INR 2,49,794.75 crore in FY21.

The company said its year-on-year margins were impacted by commodity inflation and supply chain issues. For the year, its auto free cash flow negative at INR 9.5 K Cr, primarily due to adverse working capital.

Talking about the outlook for the company, it said that the demand remains strong despite geopolitical and inflation concerns. The supply situation is gradually improving, whereas commodity inflation is likely to remain at elevated levels.

“We expect performance to improve through the year as the China COVID and semiconductor supplies improve and aim to deliver strong EBIT improvement and free cash flows in FY 23 to get to near net auto debt free by FY 2024,” it said.

Tata Motors said it finance costs increased by INR 1, 215Cr to INR 9,312Cr during FY’22 due to higher gross borrowings.

Passenger Vehicles

Tata Motors PV business delivered a comprehensive turnaround in Q4 FY 22 with highest quarterly revenues of INR 10.5 K Cr (+62%), positive EBIT 1.2% and positive free cash flows. EV volumes rose to 9.1K units in Q4 and PV market share improved to 13.4% (+440bps). Robust demand for “New Forever” range and agile supply actions led to this strong performance.

In Passenger Vehicles, the company said it will continue to drive strong sales performance whilst improving profitability and managing supply bottlenecks. In Electric Vehicles, the business will drive up penetration and accelerate sales further. The business is expected to deliver strong improvement in margins and profitability in FY23.

“The business will continue to step-up new product launches and enhance capacities to cater to increasing demand. Despite significant step-up in investments, the PV business is expected to remain self-sustaining whilst the EV business investments are well funded with the capital infusion,” it said.

Shailesh Chandra, Managing Director Tata Motors Passenger Vehicles Ltd & Tata Passenger Electric Mobility Limited said that its demand continues to remain strong even as the semiconductor situation and supply side challenges remain uncertain. “We remain agile and will continue to take prudent actions while enhancing our focus on future-fit initiatives of transforming customer experience digitally and strengthening our established lead in sustainable mobility.”

Commercial Vehicles

The company said its CV business continued to show strong sequential recovery led by MHCV segment. “The business clocked its highest quarterly revenues since Q4’FY19 and grew market shares in all segments. Despite lower margins due to commodity inflation, impact was lower on PBT (bei) of INR 607 Crores in Q4 due to operating leverage from higher revenues.”

Tata said that the CV industry is poised for further growth on the back of increased activity in road construction, mining and improved infrastructure spending. The supply situation continues to show gradual improvement. Despite uncertainties, business sentiments continue to be positive with increasing fleet utilization levels and freight rates. Sharp commodity inflation, however, continues to remain a challenge.

“The Company will continue to step-up its investments in products and new business models to deliver customer value while ensuring profitable growth. Despite near-term supply challenges and inflation concerns, the business aims to deliver strong margins recovery and profitability in FY23,” it said.

Girish Wagh, Executive Director Tata Motors, said, “The Indian Commercial Vehicles sector, deeply impacted for two successive years, showed promising signs of growth in FY22 supported by a steady recovery in the economy, rising industrial activity and reopening of markets. The improvement in consumer sentiment, buoyancy in e-business, firming freight rates, reopening of schools and offices and higher infrastructure spends in road construction and mining helped regenerate demand. We optimized production, introduced new passenger and cargo mobility solutions and accelerated sales to grow every quarter and gain higher market share in every segment of commercial vehicles.”

“Looking ahead, we see significant opportunities to leverage the mega trends shaping the Indian automotive industry. We are keeping a close watch on geopolitical developments, fuel inflation and semiconductor shortage and remain optimistic whilst continuing to work closely with our customers and ecosystem partners to mitigate risks and manage uncertainties,” he said.

JLR Business

For Jaguar and Rover (JLR), the auto maker said that the revenue was £4.8 billion in Q4 FY22, up 1% from Q3 FY22, reflecting the higher wholesales offset partially by the impact of the runout of the previous generation Range Rover, with the New Range Rover still ramping up. The EBIT margin in the quarter was 2.0% with profit before tax about breakeven (£ 9 million) before £ (43) million exceptional charge for our business in Russia. Free Cashflow improved to £340 million, up from £164 million in Q3.

Thierry Bolloré, Chief Executive Officer, JLR said that the environment remains difficult in light of the global chip shortage and other challenges. However, the company is encouraged by strong customer demand.

He also said that they are rapidly progressing plans for a new generation of electric vehicles with its Jaguar strategy and BEV first EMA platform for new Land Rover products.