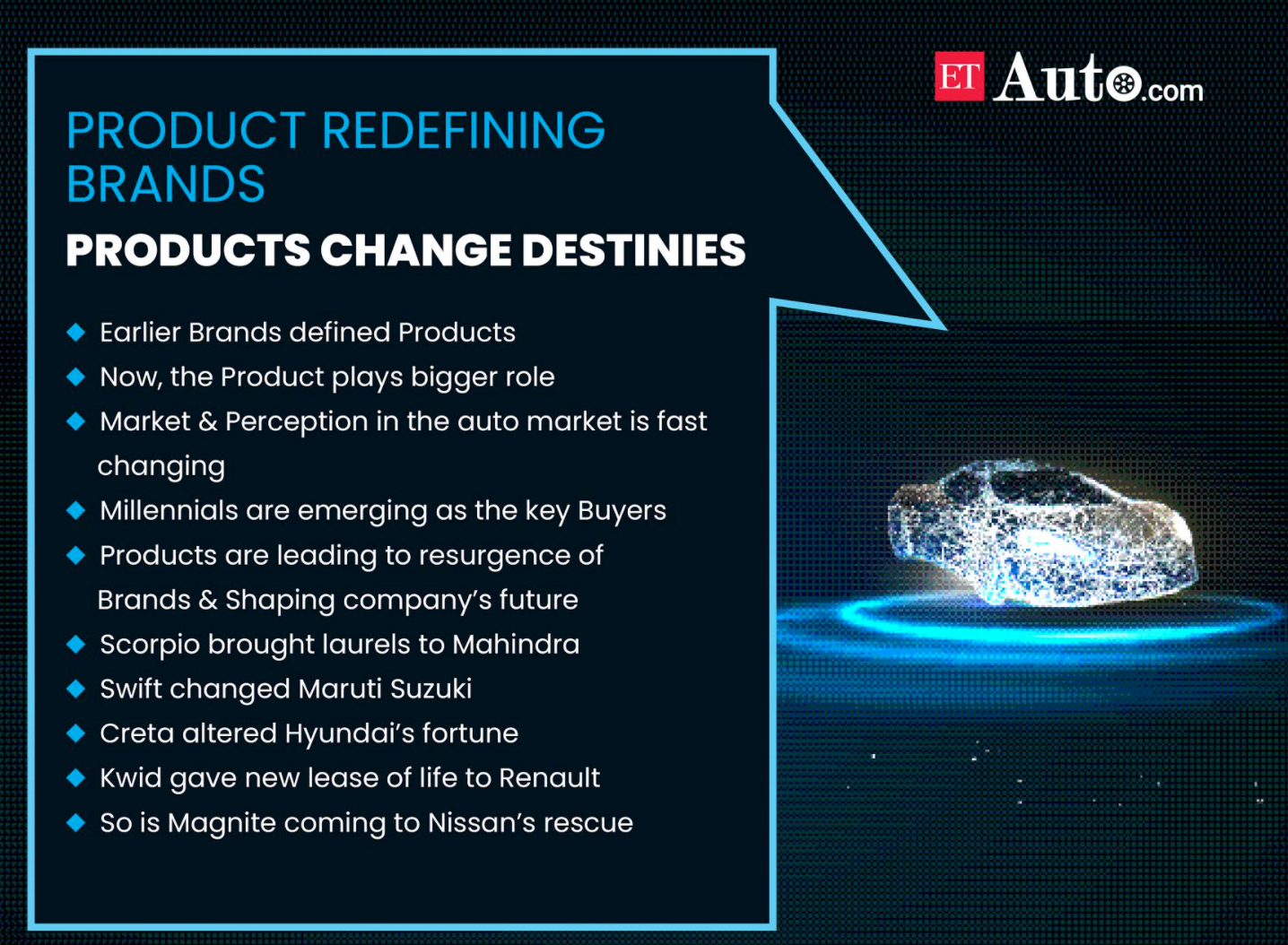

With over 43,000 customer bookings so far, it remains sold-out for most of 2021. Magnite’s success is similar to that of Swift, Scorpio, Creta and the Kwid. They changed the destiny of their parent entities. The products resurrected their brands and strengthened their segments, even at times creating a sub-segment that graduated into a new full-fledged segment in itself. These products brought huge volumes and swelled the automakers’ kitty.

In the given scenario, Nissan’s fully-owned Indian subsidiary was almost on the verge of becoming another General Motors that had to exit the Indian market a few years ago. But Magnite has retrieved Nissan India and steered it to the growth track. Now it is reinvesting in the Indian operations by hiring another 1,000 technicians in its Chennai plant to start a third-shift to meet the surging demand and to limit the waiting period to within two-three months.

“We are working 24×7 to serve the bookings at the earliest. The phenomenal response to the all-new Nissan Magnite is a testimony to the customers’ trust in Nissan brand and love for its huge value proposition. Magnite is exciting and appealing to customers of SUV, sedan and hatchback, and carries forward Nissan’s global SUV DNA,” says Rakesh Srivastava, managing director, Nissan Motor India.

Magnite is in-line with the story of another brand that changed the fortune of its parent forever. It was in 2002 that Mahindra, after leaving no stone unturned to develop a new SUV, unfolded Scorpio. The rest is history. Scorpio was the first indigenous model to carry international traits; it was the highest sold SUV for Mahindra and possibly the best Indian brand to beat many of its international rivals hands down for many years.

Scorpio changed Mahindra forever. Similarly, Swift catapulted Maruti Suzuki to the saddle of a premium car company and helped it shed its small carmaker image forever and redefine its product portfolio with the launch of DZire on the Swift platform. Maruti has sold over two-million Swift cars so far. Swift remains the highest-sold premium hatchback for many years.

Swift changed Maruti’s destiny. From the maker of M-800, Alto, and WagonR, it was Swift, as a premium hatchback, that placed Maruti Suzuki in a different league and helped it to take on the Korean rivals like Hyundai and beat Getz-i20 combo.

“Not many are aware that the response to the Swift launch was lukewarm. In a late-night meeting, Delhi dealers were unanimous in terming the model a failure and almost suggested its withdrawal. Reason – some colourful comments about its rear design. Some from my team were of a similar view. Terming it as a failure was not acceptable. Investment and reputation were at stake. Various counter arguments were given,” Jagdish Khattar, who had introduced Swift in India as the managing director of Maruti Suzuki, recalls.

“On our insistence, a focused campaign in Delhi was agreed upon. I was sure that India would follow if successful in Delhi. We ensured 10,000 units of Swift were put on the road within two months in all colours minus white. Some good comments followed. Increased visibility and novelty factor lead to eventual acceptance. Good feedback, especially on the quality of ride, was received. The rest is history. The country followed Delhi,” he said.

The SUV saga

Creta established Hyundai in the SUV market. From a carmaker of pure hatchbacks and low-priced sedans, Creta transferred it to a premium and modern passenger vehicle player across all major segments breaching the psychological barrier of INR 10 lakh.

Besides resurrecting Hyundai’s image, Creta played a bigger role in changing its fortune by doubling its average realisations to about INR9 lakh – INR 10 lakh, something unimaginable with its smaller car fleet, and dud sedans like Elantra and Sonata.

Creta is the largest selling SUV in India and outnumbers its rivals and has been a trendsetter for the launch of many similar products in the SUV space.

Creta, introduced in 2015 as a product to capture the aspirations of the new age customers with its futuristic design and feature-packed cabin, became an outright success. The latest avatar has further ignited the imagination of customers with its new looks and advanced connected features.

Despite the price touching INR 20 lakh, a recorded 96,989 units of Creta have been sold in the domestic market. It has emerged as the highest-sold SUV in India, capturing 26% market share. “In the calendar year 2015 SUVs contributed to only 13.5% of the overall passenger vehicle sales. This number rose to about 26% in 2019 and touched an all-time high of 29% in CY2020. For us it was even more, from 9% in 2015 to 42.5% in 2020 and changed the entire business plan of Hyundai in the Indian market,” says Tarun Garg, director — marketing and sales, Hyundai Motor India.

The SUV league has also helped its sibling Kia Motors to establish in India as the fastest to scale two-lakh sales and have class leaders like Seltos, and Sonet, both SUVs. It’s their popular body shape that brought laurels to Kia. Their smart designs and innovative tech solutions lured the Indian eyeballs.

The SUV saga started with the Mahindra brand Scorpio embedding some strong DNA strains in the key markets. The Indian customers’ big liking for every such model has created massive waiting periods for them in 2021.

The Indian geography is big and diverse with urban and rural roadscape. SUV with its power-packed performance is a natural fit for the rural terrain and city traffic. Its high seating posture is not extremely comfortable but gives a huge sense of safety in the bumper-to-bumper congested traffic or the fast highway drive.

The innovation by the Indian automakers in providing multiple powertrains with both manual and automatic transmission makes SUV the largest segment with the highest growth rate year after year.

As an aspirational product over hatchbacks and sedans, it has generated the need for an entry-level SUV. Nissan Magnite has been able to target and fulfil that with its aggressive value proposition, appealing to buyers of all body types. That gives a new dynamic to the Indian auto industry and takes a big slice away from hatchbacks and MPVs.

Success begets upgrades

Swift led to the creation of DZire and then came the Sx4 as an option to upgrade to the next level. But it was only the Swift DNA that catapulted DZire into a massive success for Maruti Suzuki. DZire became the largest-sold sedan in India and outpaced almost all other compact sub-four-metre peers.

Upgrades became the norm to every successful product that pushed volumes and profits for carmakers across India. Maruti enjoyed the Swift lineage and also the large base of customers that preferred its bigger vehicles. “It’s a natural upgrade to customers looking for similar DNA products within a brand. A successful vehicle generates huge loyalty that spreads the genre further to generate incremental sales and volumes over competitors,” says Amit Kaushik, managing director, Urban Science, a US-based consultancy.

In the Indian market, it’s the product that defines a brand and brings in the next level of the product line to retain customers and develop a comprehensive ecosystem for volumes and gains in the market.

Product too kills brands

The City sedan redefined the Honda brand in India, and that led to the creation of a premium carmaker in India. But the dismal performance of other Honda products like Brio, BR-V, Mobilio, and Jazz brought down the perception of the brand. Ultimately the market flinched, and that changed the entire narrative of its yesteryears.

Nano comes as a big example of a product changing the future of its creator, Tata Motors. It defined Tata as a brand for long despite being a breakthrough product that failed to generate customer interest. It was not just Nano that bombed. The whole perception of Tata Motors changed – its trajectory went into a different direction and changed its future. Something it is trying to change desperately with better products and designs.

Datsun brought down the plight of the Nissan brand and increased its woes. It created the perception of a cheap brand and frugal company. Datsun still keeps the brands under duress.

Maruti Nexa is another example that faced a backlash from the failure of a weak debut, SCross. It was introduced as a breakthrough with big powertrain and fanfare but turned out to be a mistake. It damaged the image of the entire enterprise. Finally, it was the newly- developed Baleno that rescued Nexa and gave it a fresh lease of life.

The Future

Products bring laurels to companies and will be the guiding light of their future strategies. They cater to buyers’ needs of every segment right from compacts to hatchback to the SUVs with advanced technology and improvised quality and offer them higher value and delightful experiences.

Product is the proving ground of a brand’s promise. Often it defines the future of a company begetting multiple products in diverse styles from the same platforms and powertrains.

Many brands have failed in India when their products have not kept the brand promise, and they sounded the death knell of the companies as in the case of Fiat. Its cars, like Punto and Linea, which were not in tune with the Fiat brand DNA, failed to induce any customer interest and led to its premature demise.

On similar lines, the failure of Beat-Sail products led to the exit of General Motors from India.

Kia is the best example of the product leading the way for the company to debut and drive away with success. A right product strategy steers a company in the right direction and also makes way for its sure success. Auto companies want to remain the preferred brand for customers through product differentiation and technological prowess.